HTC 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139138

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

25.

F

INANCIAL INSTRUMENTS

>

Fa

i

r V

a

l

u

e

o

f

F

i

n

a

n

c

i

a

l

Ins

t

rum

e

n

t

s

Nond

e

r

i

v

a

t

i

v

e

F

i

n

a

n

c

i

a

l

Ins

t

rum

e

n

t

s

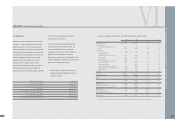

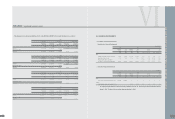

December 31

2005 2006 2007

Carrying Fair Carrying Fair Carrying Fair

Amount Value Amount Value Amount Value

NT$ NT$ NT$ NT$ NT$ US$(Note 3) NT$ US$(Note 3)

Assets

Available-for-sale financial assets - noncurrent $ 836 $ 836 $ 1,733 $ 1,733 $ 784 $ 24 $ 784 $ 24

Financial assets carried at cost 1,192 1,192 1,192 1,192 501,192 15,455 501,192 15,455

Bond investments with no active market - - - - 33,030 1,019 33,030 1,019

Investments accounted for using equity method 323,505 323,505 821,556 821,556 2,397,133 73,917 2,397,133 73,917

> D

e

r

i

v

a

t

i

v

e

F

i

n

a

n

c

i

a

l

Ins

t

rum

e

n

t

s

December 31

2005 2006 2007

Carrying Fair Carrying Fair Carrying Fair

Amount Value Amount Value Amount Value

NT$ NT$ NT$ NT$ NT$ US$(Note 3) NT$ US$(Note 3)

Assets

Financial assets at fair value through profit or loss $ 60,085 $ 60,085 $ - $ - $ - $ - $ - $ -

Liabilities

Financial liabilities at fair value through profit or loss - - 76,470 76,470 96,256 2,968 96,256 2,968

•The Co

m

pany adopted

S

tate

m

ent of Financial Accounting

S

tandards

(

S

FA

S

)

N

o. 34 -

"

Accounting for Financial Instru

m

ents

"

effective

January 1, 2006. The effects of this accounting change are described in

N

ote 4.

VI

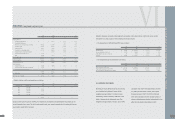

> Th

e

e

mp

l

oy

ee

s

t

o

ck

op

t

i

ons h

a

d d

il

u

t

i

v

e

e

ff

e

c

t

s on

t

h

e

2005

a

nd 2006 EPS. Th

e

r

e

l

a

t

e

d

i

n

f

orm

a

t

i

on

i

s

a

s

f

o

ll

ows

:

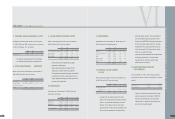

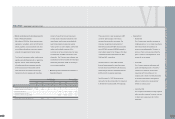

2005

Numerators Denominator EPS (In Dollars)

Income before Income after Shares Income before Income after

Income Tax Income Tax (Thousands) Income Tax Income Tax

NT$ NT$ NT$ NT$

Basic EPS $ 12,155,939 $ 11,781,944 573,414 $ 21.20 $ 20.55

Employee stock options - - 4,846

Diluted EPS $ 12,155,939 $ 11,781,944 578,260 $ 21.02 $ 20.37

2006

Numerators Denominator EPS (In Dollars)

Income before Income after Shares Income before Income after

Income Tax Income Tax (Thousands) Income Tax Income Tax

NT$ NT$ NT$ NT$

Basic EPS $ 26,957,878 $ 25,247,327 577,919 $ 46.65 $ 43.69

Employee stock options - - 6,763

Diluted EPS $ 26,957,878 $ 25,247,327 584,682 $ 46.11 $ 43.18

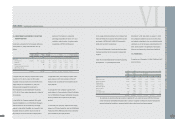

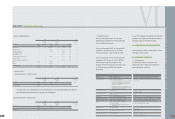

2007

Numerators Denominator EPS (In Dollars)

Income before Income after Shares Income before Income after

Income Tax Income Tax (Thousands) Income Tax Income Tax

NT$ NT$ NT$ NT$

Basic EPS $ 32,151,297 $ 28,938,862 573,299 $ 56.08 $ 50.48

Employee stock options - - -

Diluted EPS $ 32,151,297 $ 28,938,862 573,299 $ 56.08 $ 50.48

2007

Numerators Denominator EPS (In Dollars)

Income before Income after Shares Income before Income after

Income Tax Income Tax (Thousands) Income Tax Income Tax

US$ (Note 3) US$ (Note 3) US$ (Note 3) US$ (Note 3)

Basic EPS $ 991,406 $ 892,348 573,299 $ 1.73 $ 1.56

Employee stock options - - -

Diluted EPS $ 991,406 $ 892,348 573,299 $ 1.73 $ 1.56

FINANCEI INDEPENDENT AUDITORS' REPORT

l