HTC 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133132

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

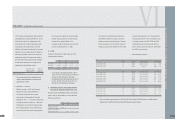

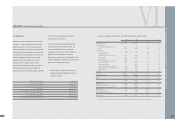

22.PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

2005 2006

NT$ NT$

Function Classified as Classified as Classified as Classified as

Expense Item Operating Costs Operating Expenses Total Operating Costs Operating Expenses Total

Personnel expenses 1,253,363 1,460,432 2,713,795 1,399,381 1,980,666 3,380,047

Salary 1,077,001 1,266,704 2,343,705 1,167,170 1,736,364 2,903,534

Insurance 62,775 74,798 137,573 70,395 86,345 156,740

Pension 40,987 54,345 95,332 32,485 63,285 95,770

Others 72,600 64,585 137,185 129,331 94,672 224,003

Depreciation expense 361,055 221,312 582,367 367,879 233,503 601,382

Amortization 660 35,314 35,974 - 31,178 31,178

2007

NT$ US$(Note 3)

Function Classified as Classified as Classified as Classified as

Expense Item Operating Costs Operating Expenses Total Operating Costs Operating Expenses Total

Personnel expenses 1,511,827 2,357,008 3,868,835 46,618 72,680 119,298

Salary 1,261,420 2,029,616 3,291,036 38,896 62,585 101,481

Insurance 79,743 114,041 193,784 2,459 3,516 5,975

Pension 36,610 80,837 117,447 1,129 2,493 3,622

Others 134,054 132,514 266,568 4,134 4,086 8,220

Depreciation expense 279,752 245,303 525,055 8,626 7,564 16,190

Amortization - 30,951 30,951 - 954 954

VI

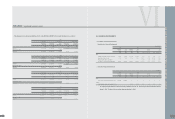

policy stipulates that only up to 95% of total

dividends may be distributed as cash dividends.

Had the Company recognized the employees'

bonuses of NT$531,000 thousand as expenses

in 2005, the pro forma earnings per share in

2005 would have decreased from NT$33.26 to

NT$31.76, which were not adjusted retroactively

for the effect of stock dividend distribution in

later years.

Had the Company recognized the employees'

bonuses of NT$2,105,000 thousand as

expenses in 2006, the pro forma earnings per

share in 2006 would have decreased from

NT$57.85 to NT$53.03, which were not adjusted

retroactively for the effect of stock dividend

distribution in the following year.

As of January 18, 2008, the date of the

accompanying independent auditors' report, the

appropriation of the 2007 earnings had not been

proposed by the Board of Directors. Information

on earnings appropriation can be accessed

online through the Market Observation Post

System on the Web site of the Taiwan Stock

Exchange.

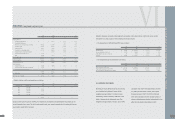

21.TREASURY STOCK

On December 12, 2006, the Company's board of

directors passed a resolution to buy back 5,000

thousand Company shares from the open market. The

repurchase period was between December 13, 2006

and January 19, 2007, and the repurchase price

ranged from NT$601 to NT$800 per share. If the

Company's share price was lower than this price range,

the Company might continue to buy back its shares.

During the repurchase period, the Company bought

back 3,624 thousand shares, which were approved to

be retired by the Company's board of directors in April

2007, for NT$1,991,755 thousand (US$61,417

thousand). Other information on the treasury stock

transactions was as follows:

(

In thousands of shares

)

As of As of

January December

Purpose 1, 2007 Increase Decrease 31, 2007

For maintaining the Company's

credit and stockholders' equity 374 3,250 3,624 -

Based on the Securities and Exchange Act of the ROC,

the number of reacquired shares should not exceed

10% of the Company's issued and outstanding stocks,

and the total purchase amount should not exceed the

sum of the retained earnings, additional paid-in capital

in excess of par, and realized capital reserve. In

addition, the Company should not pledge it treasury

shares nor exercise voting rights on the shares before

their reissuance.

FINANCEI INDEPENDENT AUDITORS' REPORT

l