HTC 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147146

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

> Prop

e

r

t

y Tr

a

ns

a

c

t

i

on

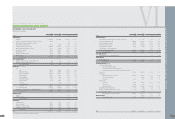

In the second quarter of 2005, the Company

acquired land and building from VIA Technologies,

Inc. for NT$304,630 thousand.

In the second quarter of 2005, the Company sold

equipment to HTC Europe Co., Ltd. for NT$2

thousand, resulting in a gain of NT$2 thousand.

In the second quarter of 2006, the Company sold

equipment to HTC Europe Co., Ltd. for NT$141

thousand and to High Tech Computer Corp.

(Suzhou) for NT$3,914 thousand, resulting in gains

of NT$81 thousand and NT$2,169 thousand,

respectively.

In 2007, the Company sold equipment to High Tech

Computer Corp. (Suzhou) for NT$5,080 thousand,

resulting in a gain of NT$2,046 thousand.

27. COMMITMENTS AND CONTINGENCIES

As of December 31, 2007, unused letters of credit

amounted to £47 thousand.

28. SIGNI

F

ICANT CONTRACTS

> P

a

t

e

n

t

Agr

ee

m

e

n

t

s

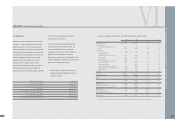

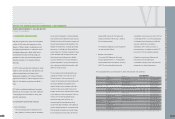

To enhance the quality of its products and

manufacturing technologies, the Company has

patent agreements, as follows:

D

e

s

c

r

i

p

t

i

on

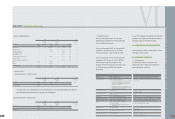

Authorization to use embedded operating system; royalty payment based on agreement.

Authorization to use GSM system software; royalty payment based on agreement.

Authorization to use CDMA technology to manufacture and sell units; royalty payment

based on agreement.

Authorization to use EDGE reference design license and support agreement; royalty

payment based on agreement.

Authorization to use platform patent license agreement; royalty payment based on

agreement.

Authorization to use wireless technology, like GSM; royalty payment based on agreement.

Authorization to use TDMA and CDMA technology; royalty payment based on agreement.

GSM/DCS 1800/1900 Patent License; royalty payment based on agreement.

TDMA, NARROWBAND CDMA, WIDEBAND CDMA or TD/CDMA Standards patent license

or technology; royalty payment based on agreement.

Authorization to use GSM, GPRS or EDGE patent license or technology; royalty payment

based on agreement.

Authorization to use GSM, GPRS or EDGE patent license or technology; royalty payment

based on agreement.

Authorization to use GSM, GPRS, EDGE, CDMA or WCDMA patent license or technology;

royalty payment based on agreement.

Con

t

r

a

c

t

or Con

t

r

a

c

t

T

e

rm

Microsoft January 1, 2007-January 31, 2009

Texas Instruments France January 14, 2000-January 13, 2010

Qualcomm Incorporated December 20, 2000 to the following dates:

(a) If the Company materially breaches any covenant and fails to take

remedial action within 30 days after Qualcomm s issuance of a

written notice, the Company will be prohibited from using

Qualcomm s property or patents.

(b) Any time when the Company is not using any of Qualcomm s

intellectual property, the Company may terminate this agreement

upon 60 days prior written notice to Qualcomm.

Ericsson Mobile Platform AB April 2003-March 2011

Telefonaktiebolaget LM Ericsson December 15, 2003 to the expiry dates of these patents, and no longer

than December 14, 2008

Nokia Corporation January 1, 2003 to the expiry dates of these patents.

InterDigital Technology Corporation. December 31, 2003 to the expiry dates of these patents.

KONINKLIJKE PHILIPS ELECTRONICS N.V.

January 5, 2004 to the expiry dates of these patents

Motorola, Inc. December 23, 2003 to the latest of the following dates:

(a) Expiry dates of patents

(b) Any time when the Company is not using any of Motorola's

intellectual property,

ALCATEL/TCL & Alcatel July 1, 2004-June 30, 2009

Siemens Aktiengesellschaft July 1, 2004 to the expiry dates of these patents.

Lucent Technologies GRL LLC July 1, 2004-June 30, 2009

VI

> S

e

rv

i

c

e

a

nd M

a

r

k

e

t

i

ng

Fee

s

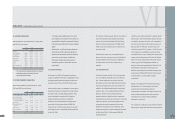

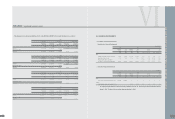

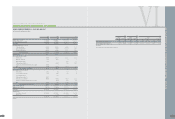

2005 2006 2007

% to Total % to Total % to Total

Service Service Service

Related Party Amount Expenses Amount Expenses Amount Expenses

NT$ NT$ NT$ US$(Note 3)

HTC America Inc. $ - - $ 464,321 32 $ 1,336,085 $ 41,199 30

HTC Europe Co., Ltd. - - 302,919 21 1,327,623 40,938 30

HTC Nippon Corporation - - 31,478 2 247,967 7,646 7

HTC Belgium BVBA/SPRL - - - - 232,447 7,168 5

HTC Singapore Pte. Ltd. - - - - 150,017 4,626 3

Communication Global Certification Inc. - - 34,814 2 115,253 3,554 3

HTC (H.K.) Limited - - - - 75,792 2,337 2

HTC (Australia and New Zealand) Pty. Ltd. - - - - 60,314 1,860 1

HTEK 21,983 14 21,685 1 - -

Exedea Inc. - - 15,567 1 - - -

VIA Technologies Inc. 3,600 3 2,400 - 2,400 74 -

$ 25,583 17 $ 873,184 59 $ 3,547,898 $ 109,402 81

> L

ea

s

i

ng - L

e

ss

ee

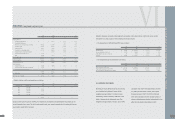

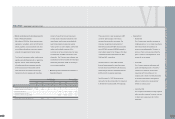

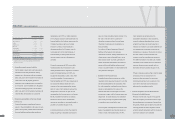

Operating Expense - Rental Expense

2005 2006 2007

% to Total % to Total % to Total

Rental Rental Rental

Related Party Amount Expenses Amount Expenses Amount Expenses

NT$ NT$ NT$ US$(Note 3)

VIA Technologies Inc. $ 7,663 37 $ - - $ - $ - -

•The Co

m

pany leased offices and parking space owned by VIA Technologies, Inc. at one-year renewable operating lease agree

m

ents,

and the rental pay

m

ent was deter

m

ined at the rates prevailing in the surrounding area.

> Nonop

e

r

a

t

i

ng In

c

om

e

- R

e

n

t

a

l

R

e

v

e

nu

e

2005 2006 2007

% to Total % to Total % to Total

Rental Rental Rental

Related Party Amount Revenue Amount Revenue Amount Revenue

NT$ NT$ NT$ US$(Note 3)

VIA Technologies Inc. $ 339 100 $ - - $ - $ - -

FINANCEI INDEPENDENT AUDITORS' REPORT

l