HTC 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121120

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

VI

The Company recategorized its financial assets

and liabilities upon adopting SFAS Nos. 34 and

36. As shown below, the adjustments of the

carrying amounts of the financial instruments

categorized as financial assets or financial

liabilities at fair value through profit or loss were

included in the cumulative effect of changes in

accounting principles. On the other hand, the

adjustments made to the carrying amounts of

financial instruments categorized as available-

for-sale financial assets were recognized as

adjustments to stockholders' equity.

As Cumulative EffectAs Adjustments of

of Change in Accounting Stockholders'

Principles (After Tax) Equity (After Tax)

Available-for-sale financial assets $ - $ 48

•The accounting changes had no

m

aterial effect on the

Co

m

pany

'

s financial state

m

ents as of and for the year

ended

D

ece

m

ber 31, 2006.

c. SFAS Nos. 1, 5 and 25

Effective January 1, 2006, the Company

adopted the newly revised SFAS No. 1 -

"Conceptual Framework for Financial

Accounting and Preparation of Financial

Statements," No. 5 - " Long Term Investments

in Equity Securities" and No. 25 - " Business

Combinations - Accounting Treatment under

the Purchase Method," which prescribe that

investment premiums, representing goodwill,

be assessed for impairment at least annually

instead of being amortized. This accounting

change had no material effect on the

Company's financial statements as of and for

the year ended December 31, 2006.

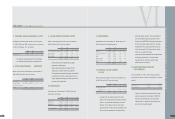

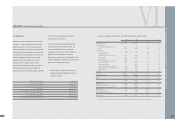

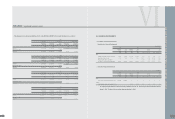

5.CASH

Cash as of December 31, 2005, 2006 and 2007

consisted of the following:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Cash on hand $ 993 $ 1,000 $ 1,000 $ 31

Cash in banks 6,478,555 4,137,988 8,776,552 270,631

Time deposits 9,716,900 30,258,400 46,258,680 1,426,416

$ 16,196,448 $ 34,397,388 $ 55,036,232 $ 1,697,078

•

O

n ti

m

e deposits, interest rates ranged fro

m

1.315% to

1.840%, 1.610% to 2.145% and 1.809% to 4.400%, as of

D

ece

m

ber 31, 2005, 2006 and 2007, respectively.

•

O

n preferential deposits, interest rates ranged fro

m

2.00%

to 4.45%, 2.30% to 5.25% and 3.05% to 4.15% as of

D

ece

m

ber 31, 2005, 2006 and 2007, respectively.

6.

F

INANCIAL ASSETS AND LIABILITIES AT

F

AIR VALUE THROUGH PRO

F

IT OR LOSS

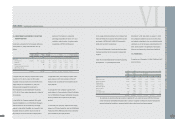

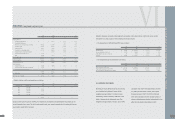

Financial assets and liabilities at fair value through

profit or loss as of December 31, 2005, 2006 and

2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Derivatives - financial assets

Forward exchange contracts $ 60,085 $ - $ - $ -

Derivatives - financial liabilities

Forward exchange contracts $ - $ 76,470 $ 96,256 $ 2,968

The Company had derivative transactions in

2005, 2006 and 2007 to manage exposures

related to exchange rate fluctuations. However,

these transactions did not meet the criteria for

hedge accounting under Statement of Financial

Accounting Standards No. 34 -" Accounting for

Financial Instruments." Thus, the Company had

no hedge accounting in 2005, 2006 and 2007.

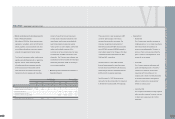

Outstanding forward exchange and currency

option contracts as of December 31, 2005, 2006

and 2007 were as follows:

>

F

orw

a

rd Ex

c

h

a

ng

e

Con

t

r

a

c

t

s

2005

Buy/Sell Currency Settlement Period/ Date Contract Amount

Forward exchange contracts Sell USD/NTD 2006.01.02-2006.01.27 US$ 167,000

Forward exchange contracts Sell EUR/USD 2006.01.02-2006.02.22 EUR 79,000

Forward exchange contracts Sell GBP/USD 2006.01.25 GBP¢G 3,000

2006

Buy/Sell Currency Settlement Period/ Date Contract Amount

Forward exchange contracts Sell USD/NTD 2007.01.05-2007.03.28 US$ 78,000

Forward exchange contracts Sell EUR/USD 2007.01.05-2007.03.09 EUR

C

=108,000

Forward exchange contracts Buy USD/JPY 2007.01.12-2007.03.09 US$ 11,000

Forward exchange contracts Sell GBP/USD 2007.01.05-2007.02.16 GBP£ 6,150

Forward exchange contracts Sell JPY/NTD 2007.01.12-2007.03.28 JP¥ 427,750

Forward exchange contracts Sell JPY/USD 2007.01.17-2007.03.28 JP¥ 810,626

2007

Buy/Sell Currency Settlement Period/ Date Contract Amount

Forward exchange contracts Sell USD/NTD 2008.01.04-2008.01.30 US$ 63,000

Forward exchange contracts Sell EUR/USD 2008.01.09-2008.03.05 EUR

C

=201,500

Forward exchange contracts Buy USD/CAD 2008.01.11-2008.02.22 US$ 5,146

Forward exchange contracts Sell GBP/USD 2008.01.11-2008.01.30 GBP£ 3,725

Forward exchange contracts Sell JPY/NTD 2008.01.09 JP¥ 425,000

•

N

et loss on derivative financial instru

m

ents in 2007 was

N

T$679,996 thousand

(

U

S

$20,968 thousand

)

, consisting of realized

settle

m

ent losses of

N

T$583,740 thousand

(

U

S

$18,000 thousand

)

and valuation losses of

FINANCEI INDEPENDENT AUDITORS' REPORT

l