HTC 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131130

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

and the outstanding GDRs represented 10,707

thousand common shares or 1.87% of the

Company's common shares.

> C

a

p

i

t

a

l

Surp

l

us

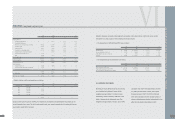

The additional paid-in capital was NT$3,064,356

thousand as of January 1, 2005. Then, two

transactions resulted in the following increases

in additional paid-in capital: (a) NT$1,346,515

thousand from the conversion of bonds payable

into 12,452 thousand shares in the first and

second quarters of 2005; and (b) NT$36,627

thousand (US$1,129 thousand) from the

retirement of treasury stock in April 2007. As a

result, the additional paid-in capital as of

December 31, 2007 was NT$4,374,244

thousand (US$134,883 thousand). Under the

Company Law, the Company may transfer the

capital surplus to common stock if there is no

accumulated deficit.

When the Company did not subscribe for the

new shares issued by BandRich Inc., an

adjustment of NT$15,845 thousand was made

to the investment's carrying value and capital

surplus.

The additional paid-in capital from a merger

(Note 1), which took effect on March 1, 2004,

was NT$25,972 thousand. Then, because of

treasury stock retirement in April 2007, the

additional paid-in capital from a merger

decreased to NT$25,756 thousand (US$794

thousand).

> Appropr

i

a

t

i

on o

f

R

e

t

a

i

n

e

d E

a

rn

i

ngs

a

nd D

i

v

i

d

e

nd

Po

li

c

y

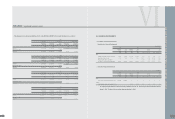

Based on the Company Law of the ROC and the

Company's Articles of Incorporation, 10% of the

Company's annual net income less any deficit

should first be appropriated as legal reserve

until this reserve equals its capital. From the

remainder, there should be appropriations of not

more than 1% as remuneration to directors and

supervisors and at least 5% as bonuses to

employees.

The appropriation of retained earnings should

be proposed by the board of directors and

approved by the stockholders in their annual

meeting.

As part of a high-technology industry and a

growing enterprise, the Company considers its

operating environment, industry developments,

and long-term interests of stockholders as well

as its programs to maintain operating efficiency

and meet its capital expenditure budget and

financial goals in determining the stock or cash

dividends to be paid. The Company's dividend

VI

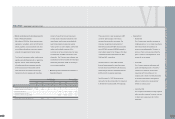

the holders can exercise their right for at up to

70% of the granted option units. After four years

from the grant date, the option holders are

eligible to exercise their rights on all the options

owned. The exercise period is five years. As of

December 31, 2007, the Company had issued

to employees 3,000 thousand units of stock

options, which were increased to 7,011

thousand units by taking into account the effect

of stock dividends and the issuance of additional

common stocks. After the employees' choosing

to give up the stock options in 2007, there were

no employee stock options outstanding. The

remaining employee stock options which were

not issued, amounting to 4,000 thousand units,

expired on December 25, 2003.

> G

l

ob

a

l

D

e

pos

i

t

a

ry R

e

c

e

i

p

t

s

The Company issued 14,400 thousand common

shares corresponding to 3,600 thousand units of

Global Depositary Receipts (GDRs). For this

GDR issuance, the Company's stockholders,

including Via Technologies, Inc., also issued

12,878.4 thousand common shares,

corresponding to 3,219.6 thousand GDR units.

Thus, the entire offering consisted of 6,819.6

thousand GDR units. Each GDR represents four

common shares, with par value of NT$131.1.

For this common share issuance, net of related

expenses, NT$1,696,855 thousand was

accounted for as capital surplus. This share

issuance for cash was completed and registered

on November 19, 2003.

The holders of these GDRs have the same

rights and obligations as the stockholders of the

Company. However, the distribution of the

offering and sales of GDRs and the shares

represented thereby in certain jurisdictions may

be restricted by law. In addition, the GDRs

offered and the shares represented are not

transferable, except in accordance with the

restrictions described in the GDR offering

circular and related laws applied in Taiwan.

Through the depositary custodian in Taiwan,

GDR holders are entitled to exercise these

rights:

a. To vote; and

b. To receive dividends and participate in new

share issuance for cash subscription.

Taking into account the effect of stock dividends,

the GDRs increased to 7,833.3 thousand units

(31,333.2 thousand shares). The holders of

these GDRs requested the Company to redeem

the GDRs to get the Company's common

shares. As of December 31, 2007, there were

5,156.6 thousand units of GDRs redeemed,

representing 20,627 thousand common shares,

FINANCEI INDEPENDENT AUDITORS' REPORT

l