HTC 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

179178

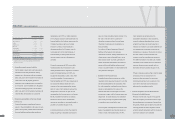

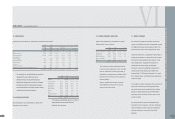

16. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2005,

2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Reserve for warranty expenses

$ 964,503 $1,393,995 $3,469,957 $106,998

Agency receipts 86,845 145,373 226,124 6,973

Advance receipts 113,471 57,426 163,135 5,030

Directors' remuneration 21,842 21,842 21,842 674

Employee bonus payable - 451,000 - -

Others 11,692 43,367 88,974 2,744

$1,198,353 $2,113,003 $3,970,032 $122,419

The Company provides warranty service for

one to two years, depending on the contracts

with our customers. The warranty liability is

estimated on management's evaluation of the

products under warranty and recognized as

warranty liability.

Agency receipts were primarily overseas

value-added tax, employees' income tax,

insurance, and other items.

17. BONDS PAYABLE

On January 29, 2003, the Company issued zero

coupon convertible bonds with an aggregate amount

of US$66,000 thousand and maturity in 2008. The

issue price was 100% of the US$1,000 par value.

Under the bond terms, a bondholder has the right to

request the Company to redeem the bonds on April

29, 2004 at their accreted principal amount. Thus,

some bondholders requested the Company to

redeem the bonds amounting to US$2,000

thousand, and other bondholders requested the

conversion of bonds amounting to US$64,000

thousand into 17,336 thousand shares. As a result,

the Company had no outstanding bonds payable as

of April 30, 2005.

The number of shares issued upon the conversion of

any bond is determined by dividing the principal

amount of the bonds (translated into New Taiwan

dollars at a fixed exchange rate of NT$34.658 to

US$1.00) by the conversion price in effect on the

conversion date.

The initial conversion price was NT$205.32 per

share at the time of issuance. Upon the distribution

of stock dividends and the issuance of additional

common shares, the conversion price will be

adjusted.

VI

•The construction of a new office building was co

m

pleted in

S

epte

m

ber 2007, and a construction a

m

ount of

N

T$933,546 thousand

(

U

S

$28,786 thousand

)

was

transferred fro

m

prepay

m

ents for construction in progress

to buildings and structures. Prepay

m

ents for equip

m

ent-

in-transit and construction-in-progress referred to building

construction and

m

iscellaneous equip

m

ent.

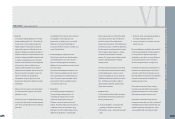

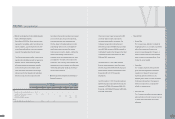

15. ACCRUED EXPENSES

Accrued expenses as of December 31, 2005, 2006

and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Marketing $ - $ 983,088 $3,190,918 $ 98,394

Salaries and bonuses 724,267 828,071 989,143 30,501

Research materials 48,013 128,505 193,859 5,978

Professional fees 40,595 53,074 148,815 4,589

Export expenses 187,324 200,083 139,512 4,302

Meals and welfare 36,978 57,598 58,287 1,797

Insurance 45,307 42,403 47,460 1,463

Travel 23,689 58,027 40,777 1,257

Repairs and maintenance 23,690 23,759 33,686 1,039

Others 112,399 109,470 283,952 8,756

$1,242,262 $2,484,078 $5,126,409 $158,076

•The Co

m

pany accrued

m

arketing expenses on the basis of

related agree

m

ents and other factors that would

significantly affect the accruals.

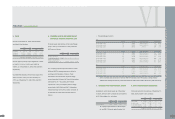

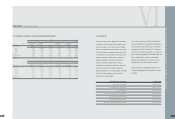

14. PROPERTIES

Properties as of December 31, 2005, 2006 and 2007 were as follows:

2005 2006 2007

Carrying Carrying Accumulated

Value Value Cost Depreciation Carrying Value

NT$ NT$ NT$ NT$ NT$ US$(Note 3)

Land $ 610,293 $ 610,293 $ 610,293 $ - $ 610,293 $ 18,819

Buildings and structures 797,981 735,785 2,254,855 423,090 1,831,765 56,484

Machinery and equipment 1,063,205 1,170,572 3,966,723 2,626,773 1,339,950 41,318

Molding equipment - - 212,360 201,247 11,113 343

Computer equipment 49,202 73,830 284,260 186,886 97,374 3,002

Transportation equipment 1,334 1,167 3,195 2,492 703 22

Furniture and fixtures 46,039 51,056 213,934 115,842 98,092 3,025

Leased assets - 3,927 4,712 1,571 3,141 97

Leasehold improvements 14,688 49,797 119,672 40,366 79,306 2,445

Prepayments for construction-in-progress and equipment-in-transit 27,467 473,971 149,225 - 149,225 4,601

$ 2,610,209 $ 3,170,398 $ 7,819,229 $ 3,598,267 $ 4,220,962 $ 130,156

FINANCEI CONSOLIDATED REPORT

l