HTC 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INFORMATION ON CAPITAL RAISING ACTIVITIES

87

(4) L

i

s

t

o

f

Pr

i

n

c

i

p

a

l

Sh

a

r

e

ho

l

d

e

rs

:

04/15/2008

Shares

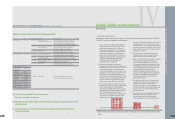

Name of principal shareholders Current Shareholding Percentage

Way-Chih Investment Co., LTD. 29,117,502 5.08%

Way-Lien Technology. 27,997,511 4.88%

Euro Pacific Growth Fund Special Account under custodial administration of Chase Manhattan Bank 25,558,000 4.46%

Hon-Mou Investment Co., Ltd. 18,571,103 3.24%

Cher Wang 18,122,269 3.16%

New Horizon Fund, Company Investment Special Account under custodial administration of Chase Manhattan Bank 14,891,200 2.60%

Wen-Chi Chen 14,878,866 2.60%

Brookside Capital Partners Fund LP under custodial administration of The Hongkong and Shanghai Banking Corporation, Limited

14,564,000 2.54%

HTC Depositary Receipts Special Account under custodial administration of Citibank N.A. 9,848,192 1.72%

Kuan Tseng Investment Co., Ltd. 8,467,785 1.48%

(5) Prov

i

d

e

Sh

a

r

e

Pr

i

c

e

s

f

or Th

e

P

a

s

t

Two

F

i

s

c

a

l

Y

ea

rs, Tog

e

t

h

e

r w

i

t

h Th

e

Comp

a

ny's N

e

t

Wor

t

h P

e

r

Sh

a

r

e

, E

a

rn

i

ngs P

e

r Sh

a

r

e

, D

i

v

i

d

e

nds P

e

r Sh

a

r

e

,

a

nd R

e

l

a

t

e

d In

f

orm

a

t

i

on

:

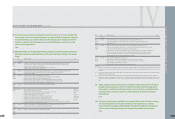

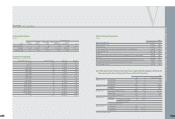

Year

Item 2006 2007 01/01/2008 ~03/31/2008

Market price per share Highest market price 1,220 703 690

Lowest market price 593 390 503

Average market price 825.32 548.64 618.49

Net worth per share(note) Before distribution 97.55 97.84 109.80

After distribution 74.28 (note) (note)

Earnings per share Weighted average shares(thousand shares) 436,409 573,229 573,229

Earnings per share 57.85 50.48 50.48

Retroactively adjusted earnings per share 43.69 (note) (note)

Dividends per share Cash dividends 27 34 (note) -

Stock dividends Dividends from retained earnings 0.3 0.3 (note) -

Dividends from capital surplus - --

Accumulated undistributed dividend - --

Reutrn on investment Price/Earnings ration 14.27 10.87 -

Price/Dividend ratio 30.57 16.14 (note) -

Cash dividend yield 3.27% 6.2% (note) -

N

ote : Pending 2008 shareholders

'

approval

86

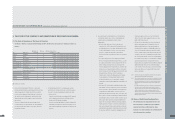

(2) Sh

a

r

e

ho

l

d

e

r S

t

ru

c

t

ur

e

:

04/15/2008

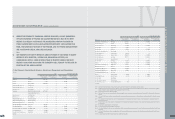

Shareholder structure

Government Financial Other Juridical Foreign Institutions & Domestic

Number Agencies Institutions Persons Natural Persons Natural Persons Total

Number of shareholders 1 35 388 1,013 21,284 22,721

Shareholding 2,975,284 23,242,423 129,457,871 312,141,669 105,316,489 573,133,736

Holding percentage 0.52% 4.06% 22.59% 54.45% 18.38% 100.00%

(3) D

i

ff

us

i

on o

f

Own

e

rsh

i

p

:

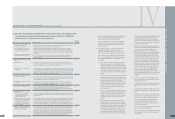

each share having a par value of

N

T$10 04/15/2008

Shareholder Ownership (Unit : share) Number of Shareholders Ownership Ownership

1~999 7,331 2,132,210 0.37%

1,000~5,000 12,014 22,103,114 3.86%

5,001~10,000 1,279 9,381,506 1.64%

10,001~15,000 484 5,976,517 1.04%

15,001~20,000 289 5,173,291 0.90%

20,001~30,000 291 7,187,380 1.25%

30,001~40,000 157 5,587,327 0.97%

40,001~50,000 111 5,080,753 0.89%

50,001~100,000 273 19,771,878 3.45%

100,001~200,000 188 26,518,414 4.63%

200,001~400,000 119 34,221,225 5.97%

400,001~600,000 53 25,733,865 4.49%

600,001~800,000 33 22,223,175 3.88%

800,001~1,000,000 14 12,634,729 2.20%

Over 1,000,001 85 369,408,352 64.46%

Total 22,721 573,133,736 100.00%

V

CAPITAL

l

CAPITAL AND SHARES

l