HTC 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127126

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

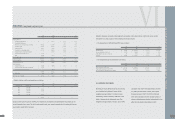

The number of shares issued upon the conversion of

any bond is determined by dividing the principal

amount of the bonds (translated into New Taiwan

dollars at a fixed exchange rate of NT$34.658 to

US$1.00) by the conversion price in effect on the

conversion date.

The initial conversion price was NT$205.32 per

share at the time of issuance. Upon the distribution

of stock dividends and the issuance of additional

common shares, the conversion price will be

adjusted.

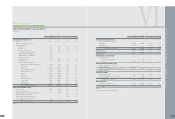

19.PENSION PLAN

The Labor Pension Act (the "Act"), which provides

for a new defined contribution plan, took effect on

July 1, 2005. Employees covered by the Labor

Standards Law (the "Law") before the enforcement

of the Act were allowed to choose to remain to be

subject to the defined benefit pension mechanism

under the Law or to be subject instead to the Act.

Based on the Act, the rate of the Company's

required monthly contributions to the employees'

individual pension accounts is at least 6% of monthly

wages and salaries, and these contributions are

recognized as pension expense in the income

statement. The pension fund contributions were

NT$40,152 thousand in 2005, NT$89,723 thousand

in 2006 and NT$110,723 thousand (US$3,415

thousand) in 2007.

Under the Law, which provides for a defined benefit

pension plan, retirement payments should be made

according to the years of service, with a payment of

two units for each year of service but only one unit

per year after the 15th year; however, total units

should not exceed 45. On January 1, 2004, the rate

of the Company's contributions to a pension fund

increased from 2% to 8% of employees' salaries and

wages and then decreased to 2% after the Act took

effect. The fund is deposited in the Central Trust of

China, a government-designated custodian of

pension funds, and managed by the Pension Fund

Administration Committee. The pension fund

balances were NT$274,197 thousand, NT$311,532

thousand and NT$348,439 (US$10,744 thousand)

as of December 31, 2005, 2006 and 2007,

respectively.

Based on the Statement of Financial Accounting

Standards No. 18 - "Accounting for Pensions,"

issued by the Accounting Research and

Development Foundation of the ROC, pension cost

under a defined benefit pension plan should be

calculated by the actuarial method. Related

disclosure is as follows:

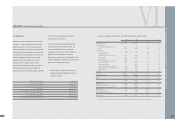

The Company's net pension costs under the defined

benefit plan in 2005, 2006 and 2007 were as follows:

VI

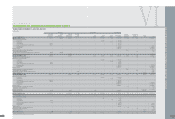

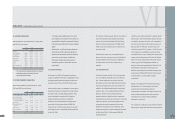

16.ACCRUED EXPENSES

Accrued expenses as of December 31, 2005, 2006

and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Marketing $ - $ 983,088 $ 3,007,021 $ 92,723

Salaries and bonuses 698,818 762,942 914,062 28,186

Professional fees 39,445 49,221 615,365 18,975

Research materials 48,013 119,075 189,469 5,843

Export expenses 183,060 162,221 127,867 3,943

Meals and welfare 36,978 57,436 58,287 1,797

Insurance 45,307 40,398 46,967 1,448

Travel 23,689 58,027 40,777 1,257

Repairs and maintenance 23,690 23,759 32,564 1,004

Others 105,807 83,962 237,450 7,322

$ 1,204,807 $ 2,340,129 $ 5,269,829 $ 162,498

•The Co

m

pany accrued

m

arketing expenses on the basis of

related agree

m

ents and other factors that would

significantly affect the accruals.

17.OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2005,

2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Reserve for warranty expenses $ 964,503 $1,393,995 $3,469,957 $106,998

Employee bonus payable - 451,000 - -

Deferred credits - profit from

intercompany transactions 15,077 164,011 175,075 5,399

Agency receipts 86,467 122,897 107,618 3,318

Other payables to related

parties (Note 26) 89,777 110,617 244,094 7,527

Advance receipts 112,641 37,340 105,424 3,251

Directors' remuneration 21,842 21,842 21,842 674

Others 12,461 61,920 173,348 5,345

$1,302,768 $2,363,622 $4,297,358 $132,512

•The Co

m

pany provides warranty service for one to two

years, depending on the contracts with our custo

m

ers. The

warranty liability is esti

m

ated on

m

anage

m

ent

'

s evaluation

of the products under warranty and recognized as warranty

liability.

•

D

eferred credits - profit fro

m

interco

m

pany transactions

were unrealized profit fro

m

interco

m

pany transactions.

•Agency receipts were pri

m

arily overseas value-added tax,

e

m

ployees

'

inco

m

e tax, insurance, and other ite

m

s.

•

O

ther payables to related parties were pay

m

ents for

m

iscellaneous expenses of overseas sales offices and

repair

m

aterials.

18.BONDS PAYABLE

On January 29, 2003, the Company issued zero

coupon convertible bonds with an aggregate amount

of US$66,000 thousand and maturity in 2008. The

issue price was 100% of the US$1,000 par value.

Under the bond terms, a bondholder has the right to

request the Company to redeem the bonds on April

29, 2004 at their accreted principal amount. Thus,

some bondholders requested the Company to

redeem the bonds amounting to US$2,000

thousand, and other bondholders requested the

conversion of bonds amounting to US$64,000

thousand into 17,336 thousand shares. As a result,

the Company had no outstanding bonds payable as

of April 30, 2005.

FINANCEI INDEPENDENT AUDITORS' REPORT

l