HTC 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

187186

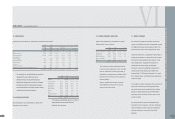

23. INCOME TAX

The Basic Income Tax Act (BITA), which took effect

on January 1, 2006, requires that the basic income

tax (BIT) should be 10% of the sum of the taxable

income as calculated in accordance with the Income

Tax Act (ITA) plus tax-exempt income under the ITA

or relevant laws. The tax payable of the current year

would be the higher of the BIT or the income tax

payable calculated in accordance with the ITA.

However, if the BIT is higher than the ITA tax,

investment tax credits granted under the provisions

of other laws should not be used to deduct the

difference between the two taxes payable. The effect

of the BIT had been taken into account by the

Company in its tax calculation.

The income tax returns of HTC through 2003 had

been examined by the tax authorities while those of

Communication Global Certification Inc. had been

examined through 2005. However, HTC disagreed

with the tax authorities' assessment on its returns for

2002 to 2003 and applied for the reexamination of its

returns. Nevertheless, under the conservatism

guideline, HTC adjusted its income tax for the tax

shortfall stated in the tax assessment notices.

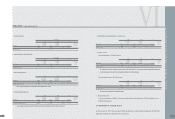

Under the Statute for Upgrading Industries, HTC

was granted exemption from corporate income tax,

as follows

I

t

e

m Ex

e

mp

t

f

rom Corpor

a

t

e

In

c

om

e

T

a

x Ex

e

mp

t

i

on P

e

r

i

od

Sales of pocket PCs and Smartphones 2001.04.26~2006.04.25

Sales of pocket PCs (wireless) and Smartphones 2002.01.01~2006.12.31

Sales of Win CE products 2003.01.01~2007.12.31

Sales of pocket PCs, pocket PCs (wireless) and Smartphones 2004.09.15~2009.09.14

Sales of pocket PCs (wireless) and Smartphones 2004.11.30~2009.11.29

Sales of pocket PCs (wireless) and Smartphones 2005.12.20~2010.12.19

sales of wireless or smartp hone whichhas 3G or GPS function 2006.12.20-2011.12.19

VI

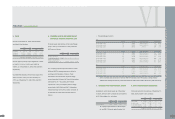

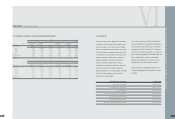

22. PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

2005 2006

NT$ NT$

Function Classified as Classified as Classified as Classified as

Expense Item Operating Costs Operating Expenses Total Operating Costs Operating Expenses Total

Personnel expenses 1,340,366 1,541,507 2,881,873 1,747,869 2,195,829 3,943,698

Salary 1,162,139 1,345,393 2,507,532 1,503,540 1,942,094 3,445,634

Insurance 62,798 74,800 137,598 70,395 87,463 157,858

Pension 41,624 54,554 96,178 35,036 64,505 99,541

Others 73,805 66,760 140,565 138,898 101,767 240,665

Depreciation expense 369,120 231,356 600,476 384,241 254,112 638,353

Amortization 7,830 36,268 44,098 7,319 33,197 40,516

2007

Function NT$ US$(Note 3)

Classified as Classified as Classified as Classified as

Expense Item Operating Costs Operating Expenses Total Operating Costs Operating Expenses Total

Personnel expenses 2,026,408 3,254,586 5,280,994 62,487 100,357 162,844

Salary 1,740,812 2,848,099 4,588,911 53,679 87,823 141,502

Insurance 80,707 163,098 243,805 2,489 5,029 7,518

Pension 45,258 91,282 136,540 1,396 2,815 4,211

Others 159,631 152,107 311,738 4,923 4,690 9,613

Depreciation expense 393,581 287,676 681,257 12,136 8,871 21,007

Amortization 14,006 37,856 51,862 432 1,167 1,599

FINANCEI CONSOLIDATED REPORT

l