HTC 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109108

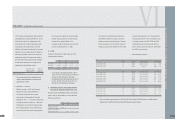

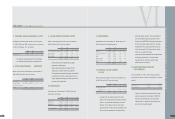

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

CASH

F

LOWS

F

ROM

F

INANCING ACTIVITIES

(Decrease) increase in guarantee deposits received ($ 272,517) $ 79 ($ 12) $ -

Cash dividends ( 1,443,816) ( 4,998,224) ( 11,685,470) ( 360,329)

Bonus to employees ( 210,500) - ( 2,451,000) ( 75,578)

Purchase of treasury stock - ( 243,995) ( 1,747,760) ( 53,893)

Net cash used in financing activities ( 1,926,833) ( 5,242,140) ( 15,884,242) ( 489,800)

NET INCREASE IN CASH 10,048,247 18,200,940 20,638,844 636,412

CASH, BEGINNING OF YEAR 6,148,201 16,196,448 34,397,388 1,060,666

CASH, END OF YEAR $ 16,196,448 $ 34,397,388 $ 55,036,232 $ 1,697,078

SUPPLEMENTAL CASH

F

LOW IN

F

ORMATION

Cash paid during the year

Interest (net of amounts capitalized) $ - $ 298 $ 241 $ 7

Income tax $ 107,456 $ 737,145 $ 2,751,561 $ 84,846

NONCASH INVESTING AND

F

INANCING ACTIVITIES

Transfer of convertible bonds to common stock and

additional paid-in capital $ 1,471,034 $ - $ - -

Transfer of retained earnings and employee bonuses to common stock $ 682,527 $ 794,032 $ 1,403,385 43,274

Retirement of treasury stock $ - $ - $ 1,991,755 61,417

PURCHASE O

F

PROPERTIES

Cost of properties purchased $ 561,712 $ 1,022,430 $ 1,335,029 $ 41,166

Decrease (increase) in payable for purchase of equipment 40,203 ( 21,303) ( 134,842) ( 4,158)

Increase in lease payable - ( 3,894) 876 27

Cash paid for purchase of properties $ 601,915 $ 997,233 $ 1,201,063 $ 37,035

BONUS TO EMPLOYEES

Appropriation of bonus to employees $ 206,000 $ 451,000 $ 2,000,000 $ 61,671

Decrease (increase) in payable for employee bonus 4,500 ( 451,000) 451,000 13,907

Cash paid $ 210,500 $ - $ 2,451,000 $ 75,578

(

Concluded

)

The acco

m

panying notes are an integral part of the financial state

m

ents.

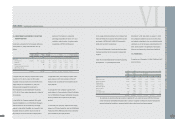

VI

H I G H T E C H C O M P U T E R C O R P.

STATEMENTS O

F

CASH

F

LOWS

YEARS ENDED DECEMBER 31, 2005, 2006 AND 2007

(In Thousands)

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

CASH

F

LOWS

F

ROM OPERATING ACTIVITIES

Net income $ 11,781,944 $ 25,247,327 $ 28,938,862 $ 892,348

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation 582,367 601,382 525,055 16,190

Amortization 35,974 31,178 30,951 954

Gain on disposal of properties, net ( 2,851) ( 37,984) ( 1,458) ( 45)

Losses (gains) on equity-method investments 35,112 12,554 ( 103,997) ( 3,207)

Provision for redemption of convertible bonds 2,042 - - -

Foreign exchange gains on convertible bonds ( 8,179) - - -

Amortization of bond issue costs 17,675 - - -

Deferred income tax assets ( 256,170) ( 168,447) ( 294,803) ( 9,090)

Prepaid pension costs ( 42,097) ( 24,260) ( 21,167) ( 653)

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss ( 58,991) 136,555 19,786 610

Notes receivable ( 27,331) 40,157 55,872 1,723

Accounts receivable ( 5,826,625) ( 4,105,164) ( 625,888) ( 19,299)

Accounts receivable from related parties ( 342,567) ( 891,010) 774,915 23,895

Other current financial assets ( 6,667) ( 313,503) 84,446 2,604

Inventories ( 633,904) ( 146,338) ( 1,135,522) ( 35,014)

Prepayments ( 229,433) ( 1,406,858) 343,792 10,601

Other current assets 17,390 ( 32,776) ( 53,740) ( 1,657)

Notes and accounts payable 5,854,811 3,050,346 5,173,079 159,515

Income tax payable 522,709 1,141,854 755,677 23,302

Accrued expenses 342,540 1,135,322 2,929,700 90,339

Other current liabilities 838,408 605,960 2,385,612 73,562

Net cash provided by operating activities 12,596,157 24,876,295 39,781,172 1,226,678

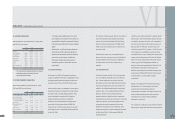

CASH

F

LOWS

F

ROM INVESTING ACTIVITIES

Purchase of properties ( 601,915) ( 997,233) ( 1,201,063) ( 37,035)

Proceeds of the sales of properties 5,882 44,664 5,155 159

Acquisition of investments accounted for by the equity method - ( 478,933) ( 1,472,702) ( 45,412)

Acquisition of financial assets carried at cost - - ( 500,000) ( 15,418)

Acquisition of bond investments with no active market - - ( 33,030) ( 1,019)

Proceeds of the disposal of long-term investments 4,312 - - -

Increase in refundable deposits ( 29,356) ( 1,713) ( 56,446) ( 1,741)

Net cash used in investing activities ( 621,077) ( 1,433,215) ( 3,258,086) ( 100,466)

(

Continue

)