HTC 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125124

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

On its equity-method investments, the Company had

losses of NT$35,112 thousand, NT$12,554 thousand

and a gain of NT$103,997 (US$3,207 thousand) in

2005, 2006 and 2007, respectively.

The financial statements of equity-method investees

had been examined by the Company's independent

auditors.

Under the revised Statement of Financial Accounting

Standards No. 7, "Consolidated Financial

Statements," which took effect on January 1, 2005,

the Company included the accounts of all its direct

and indirect subsidiaries in the consolidated financial

statements as of and for years ended December 31,

2005, 2006 and 2007. All significant intercompany

balances and transactions have been eliminated.

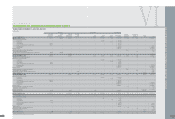

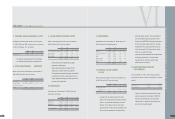

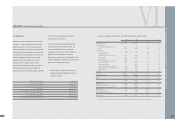

15.PROPERTIES

Properties as of December 31, 2005, 2006 and 2007

were as follows:

2005 2006 2007

Carrying Carrying Accumulated

Value Value Cost Depreciation Carrying Value

NT$ NT$ NT$ NT$ NT$ US$(Note 3)

Land $ 610,293 $ 610,293 $ 610,293 $ - $ 610,293 $ 18,818

Buildings and structures 797,981 735,785 2,239,919 423,030 1,816,889 56,025

Machinery and equipment 987,009 1,020,799 3,336,489 2,298,998 1,037,491 31,992

Molding equipment - - 201,247 201,247 - -

Computer equipment 35,397 41,304 212,623 161,355 51,268 1,581

Transportation equipment 626 706 1,335 851 484 15

Furniture and fixtures 30,640 23,824 115,696 86,641 29,055 896

Leased assets - 3,927 4,712 1,571 3,141 97

Leasehold improvements 5,843 2,656 44,487 23,151 21,336 658

Prepayments for construction-in-progress and equipment-in-transit 27,467 470,330 145,944 - 145,944 4,500

$ 2,495,256 $ 2,909,624 $ 6,912,745 $ 3,196,844 $3,715,901 $ 114,582

•The construction of a new office building was co

m

pleted in

S

epte

m

ber 2007, and a construction a

m

ount of

N

T$933,546 thousand

(

U

S

$28,786 thousand

)

was transferred fro

m

prepay

m

ents for construction in progress to buildings and structures. Prepay

m

ents for

equip

m

ent-in-transit and construction-in-progress referred to building construction and

m

iscellaneous equip

m

ent.

VI

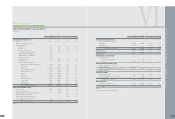

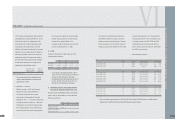

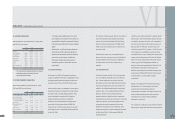

14.INVESTMENTS ACCOUNTED

F

OR BY THE

EQUITY METHOD

Investments accounted for by the equity method as

of December 31, 2005, 2006 and 2007 were as

follows:

2005 2006 2007

Carrying Ownership Carrying Ownership Original Carrying Ownership

Value Percentage Value Percentage Cost Value Percentage

NT$ NT$ NT$ US$(Note 3) NT$ US$(Note 3)

Equity method

H.T.C. (B.V.I.) Corp. $ 323,505 100 $ 422,788 100 $ 1,402,835 $ 43,257 $ 1,427,492 $ 44,017 100

BandRich Inc. - 136,200 51 135,000 4,163 114,487 3,530 51

HTC HK, Limited - - 889 100 1,277 40 8,034 248 100

Communication Global Certification Inc. - - - 100 280,000 8,634 281,621 8,684 100

HTC Asia Pacific Pte. Ltd. - - - 100 560,660 17,288 565,499 17,438 100

Prepayments for long-term investments - - 261,679 - - - - - -

$ 323,505 $ 821,556 $ 2,379,772 $ 73,382 $ 2,397,133 $ 73,917

In August 2000, the Company acquired 100% equity

interest in H.T.C. (B.V.I.) Corp. for NT$12,834

thousand and accounted for this investment by the

equity method. As of December 31, 2007, the

Company had increased this investment to

NT$1,402,835 thousand (US$43,257 thousand).

H.T.C. (B.V.I.) Corp. makes investments on behalf of

the Company.

In April 2006, the Company acquired 92% equity

interest in BandRich Inc. for NT$135,000 thousand

and accounted for this investment by the equity

method. In May 2006, BandRich Inc. issued 12,000

thousand shares of common stock at a price of

NT$12.50 per share of which the Company didn't

purchase. The Company's ownership

percentage declined from 92% to 51% and

resulted in capital surplus - long term equity

investments of NT$15,845 thousand.

In September 2006, the Company acquired 100%

equity interest in HTC HK, Limited for NT$1,277

thousand and accounted for this investment by the

equity method.

In January 2007, the Company acquired 100%

equity interest in Communication Global Certification

Inc. for NT$280,000 thousand (US$8,634 thousand)

and accounted for this investment by the equity

method.

In June 2007, the Company acquired 100% equity

interest in HTC Asia Pacific Pte. Ltd. for NT$560,660

thousand (US$17,288 thousand) and accounted for

this investment by the equity method.

FINANCEI INDEPENDENT AUDITORS' REPORT

l