HTC 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

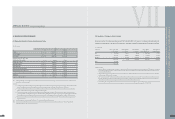

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

189188

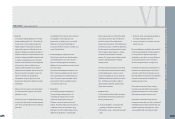

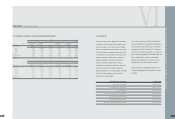

The tax effects of deductible temporary differences and loss and tax credit carryforwards that gave rise to

deferred tax assets as of December 31, 2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

Temporary differences

Unrealized marketing expenses $ - $ 245,772 $ 757,691 $ 23,364

Provision for loss on decline in value of inventory 146,682 222,916 229,072 7,064

Unrealized royalties 459,556 942,097 1,009,848 31,139

Unrealized bad debt expense - - 16,072 496

Capitalized expense 39,571 31,936 39,628 1,222

Unrealized reserve for warranty expense 241,126 348,499 867,489 26,750

Unrealized valuation loss on financial instruments - 19,117 24,064 742

Unrealized foreign exchange loss, net 21,220 - - -

Other 16,348 27,770 40,296 1,242

Loss carryforwards - 7,868 25,293 780

Tax credit carryforwards 378,236 9,574 47,484 1,464

Total deferred tax assets 1,302,739 1,855,549 3,056,937 94,263

Less valuation allowance ( 796,976) ( 1,147,549) ( 2,026,939) ( 62,502)

Total deferred tax assets, net 505,763 708,000 1,029,998 31,761

Deferred tax liabilities

Unrealized pension cost ( 11,882) ( 18,505) ( 23,797) ( 734)

Unrealized valuation gain on financial instruments ( 15,021) - - -

Unrealized foreign exchange gain, net - ( 38,254) (43,035) ( 1,327)

478,860 651,241 963,166 29,700

Less current portion ( 229,826) ( 428,077) ( 570,992) ( 17,607)

Deferred tax assets - noncurrent $ 249,034 $ 223,164 $ 392,174 $ 12,093

VI

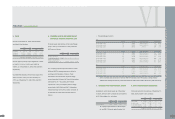

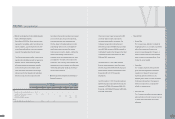

Provision for income tax for 2005, 2006 and 2007; and income tax payable, income tax refund receivables and

deferred tax assets as of December 31, 2005, 2006 and 2007 were as follows:

2005 2006

Income Tax Income Tax Deferred Tax Income Tax Income Tax Deferred Tax

Expense Payable Assets Expense (before) Payable Assets

NT$ NT$ NT$ NT$ NT$ NT$

High Tech Computer Corp. $ 373,995 $ 616,863 $ 478,860 $ 1,710,551 $ 1,758,717 $ 647,307

BandRich Inc - - - ( 3,934) - 3,934

HTEK 49 - - - - -

HTC America Inc. 2,112 - - 294 - -

Exedea Inc. - - - 1,464 - -

HTC EUROPE CO., LTD. 45 - - - - -

$ 376,201 $ 616,863 $ 478,860 $ 1,708,375 $ 1,758,717 $ 651,241

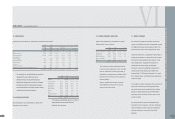

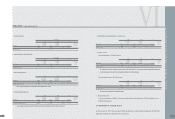

2007

Income Tax Income Tax Deferred Tax

Expense (Benefit) Payable Assets

NT$ US$ NT$ US$ NT$ US$

(Note 3) (Note 3) (Note 3)

High Tech Computer Corp. $ 3,212,435 $ 99,058 $ 2,514,394 $ 77,533 $ 942,110 $ 29,051

BandRich Inc. ( 5,892) ( 181) - - 9,826 303

Communication Global Certification Inc. 292 9 - - 2,286 71

HTC America Inc. 61,401 1,893 - - - -

Exedea Inc. 7,948 245 - - - -

HTC EUROPE CO., LTD. 31,082 959 29,705 916 - -

HTC NIPPON Corporation 489 15 90 3 - -

HTC BRASIL - - - - - -

HTC Belgium BAVA/SPRL 4,231 130 3,361 104 - -

HTC Singapore Pte. Ltd. 526 16 519 16 - -

HTC (H.K.) Limited 661 20 3,682 113 3,029 93

HTC (Australia and New Zealand) Pty. Ltd. 1,051 32 6,952 214 5,915 182

$ 3,314,224 $ 102,196 $ 2,558,703 $ 78,899 $ 963,166 $ 29,700

FINANCEI CONSOLIDATED REPORT

l