HTC 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

181180

Under their respective local government regulations,

other subsidiaries have defined contribution pension

plans covering all eligible employees. The pension

fund contributions were NT$846 thousand in 2005,

NT$3,006 thousand in 2006 and NT$15,728

thousand (US$485 thousand) in 2007.

Based on the Statement of Financial Accounting

Standards No. 18 - "Accounting for Pensions" issued

by the Accounting Research and Development

Foundation of the ROC, pension cost under a

defined benefit pension plan should be calculated by

the actuarial method.

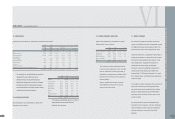

The Company's net pension costs under the defined

benefit plan in 2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Service cost $ 44,766 $ 5,259 $ 4,930 $ 152

Interest cost 10,042 9,400 8,629 266

Projected return on plan assets (5,782) (10,320) (8,988 ) (277)

Amortization of unrecognized

net transition obligation, net - - 74 3

Amortization of net

pension benefit 6,154 1,708 2,182 67

Net pension cost $ 55,180 $ 6,047 $ 6,827 $ 211

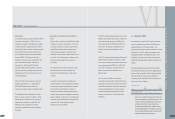

The reconciliation between pension fund status and

prepaid pension cost as of December 31, 2005,

2006 and 2007 is as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Present actuarial value of benefit obligation

Vested benefits $ 792 $ - $ - $ -

Non-vested benefits 127,313 153,371 172,092 5,307

Accumulated benefit obligation 128,105 153,371 172,092 5,307

Additional benefits on future salaries 161,127 159,023 145,809 4,496

Projected benefit obligation 289,232 312,394 317,901 9,803

Plan assets at fair value ( 274,197) (311,532) (348,853 ) ( 10,757)

Funded status 15,035 862 ( 30,952 ) ( 954)

Unrecognized net transitional obligation - - ( 1,032 ) ( 32)

Unrecognized pension loss ( 64,795) ( 74,882) ( 63,229 ) ( 1,950)

Additional minimum pension liability - - 953 29

Prepaid pension cost $( 49,760) $( 74,020) $( 94,260) $( 2,907)

Assumptions used in actuarially determining the

present value of the projected benefit obligation

were as follows:

2005 2006 2007

Weighted-average discount rate 3.25% 2.75% 2.75%

Assumed rate of increase in future compensation 4.75% 4.25% 2%-4%

Expected long-term rate of return on plan assets 3.25% 2.75% 2.75%

•The vested benefits as of

D

ece

m

ber 31, 2005, 2006 and

2007 a

m

ounted to

N

T$962 thousand,

N

T$0 thousand and

N

T$0 thousand, respectively.

VI

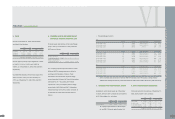

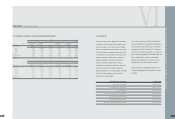

18. LONG-TERM BANK LOANS

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Secured loans (Notes 9 and 27)

NT$50,000 thousand, repayable

from July 2006 in 16 quarterly

installments; 1% annual interest $ - $ - $ 31,250 $ 964

NT$65,000 thousand, repayable in

quarterly installments from the

completion date of the loan plan; 1%

annual interest; the loan plan had not

been completed as of

December 31, 2007 - - 65,000 2,004

Less current portion - - (20,625) (636)

$ - $ - $ 75,625 $ 2,332

19. PENSION PLAN

The Labor Pension Act (the "Act"), which provides

for a new defined contribution plan, took effect on

July 1, 2005. Employees covered by the Labor

Standards Law (the "Law") before the enforcement

of the Act were allowed to choose to remain to be

subject to the defined benefit pension mechanism

under the Law or to be subject instead to the Act.

Based on the Act, the rate of the Company's

required monthly contributions to the employees'

individual pension accounts is at least 6% of monthly

wages and salaries, and these contributions are

recognized as pension expense in the income

statement. The pension fund contributions were

NT$40,152 thousand in 2005, NT$90,488 thousand

in 2006 and NT$113,985 thousand (US$3,515

thousand) in 2007.

Under the Law, which provides for a defined benefit

pension plan, retirement payments should be made

according to the years of service, with a payment of

two units for each year of service but only one unit

per year after the 15th year; however, total units

should not exceed 45. The rate of the Company's

contributions to a pension fund is 2%. These

contributions are deposited in the Central Trust of

China (which merged with the Bank of Taiwan in July

2007, with the Bank of Taiwan as the survivor entity,)

a government-designated custodian of pension

funds, and managed by the Pension Fund

Administration Committee. The pension fund

balances were NT$274,197 thousand, NT$311,532

thousand and NT$348,853 thousand (US$10,757

thousand) as of December 31, 2005, 2006 and

2007, respectively.

The related pension benefit obligation for those

employees that elected to join the defined

contribution plan were not settled, therefore, no

settlement or curtailment charge was recorded.

H.T.C. (B.V.I.) Corp., HTC HK, Limited, and HTC

Asia Pacific Pte. Ltd. have no pension plans.

FINANCEI CONSOLIDATED REPORT

l