HTC 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

177176

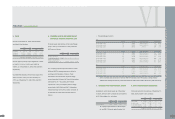

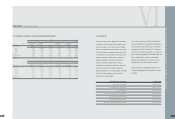

12.

F

INANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31,

2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Hua-Chuang Automobile Information

Technical Center Co., Ltd. $ - $ - $500,000 $15,418

Answer Online, Inc. 1,192 1,192 1,192 37

$ 1,192 $ 1,192 $501,192 $15,455

In January 2007, the Company acquired 10% equity

interest in Hua-Chuang Automobile Information

Technical Center Co., Ltd. for NT$500,000 thousand

(US$15,418 thousand). The Company also signed a

joint venture agreement with Yulon Group, the main

stockholder of Hua-Chuang. Under the agreement,

the Company and Yulon Group may, between

January 1, 2010 and December 31, 2011, submit

written requests to each other for Yulon Group to

buy back NT$300,000 thousand at original price,

some of Hua-Chuang's shares bought by the

Company.

In March 2004, the Company merged with IA Style,

Inc. (Note 1) and acquired 1.82% equity interest in

Answer Online, Inc. as a result of the merger.

These unquoted equity instruments were not carried

at fair value because their fair value could not be

reliably measured; thus, the Company accounted for

these investments by the cost method.

13. BOND INVESTMENTS WITH NO ACTIVE

MARKET

As of December 31, 2007, the Company had the

following investment in bonds not quoted in an active

market:

NT$ US$(Note 3)

Bond investment $ 33,030 $ 1,019

Less current portion ( 33,030) ( 1,019)

$ - $ -

The above 12-month bond investment, with 6%

annual interest, was acquired by the Company for

NT$33,030 thousand (US$1,000 thousand). The

unquoted debt instrument was not carried at fair

value because its fair value could not be reliably

measured.

VI

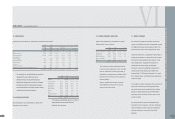

9. OTHER CURRENT

F

INANCIAL ASSETS

Other current financial assets as of December 31,

2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Restricted current assets $ - $ - $ 34,500 $ 1,064

Agency payments 31,816 210,077 23,540 726

Other receivables 20,319 25,297 102,344 3,156

Interest receivables 15,566 24,854 50,444 1,555

$ 67,701 $260,228 $210,828 $ 6,501

Restricted current assets were time deposits

provided as collaterals for long-term loans.

Agency payments were primarily royalty and other

prepayments on behalf of vendors and customers.

Other receivables were primarily overseas value-

added tax receivables from customers,

compensation from service charges, prepayment for

employees' travel expenses and proceeds of sales

of properties.

10. INVENTORIES

Inventories as of December 31, 2005, 2006 and

2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Finished goods $ 703,834 $1,217,864 $ 582,455 $ 17,960

Work-in-process 1,868,373 1,274,719 2,034,715 62,742

Raw materials 3,332,551 4,445,963 5,741,329 177,037

5,904,758 6,938,546 8,358,499 257,739

Less valuation allowance (586,727) (975,033) (1,121,797) (34,591)

$5,318,031 $5,963,513 $7,236,702 $223,148

11. PREPAYMENTS

Prepayments as of December 31, 2005, 2006 and

2007 referred to the following items:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Royalty (Note 29) $ 274,489 $1,631,513 $1,232,901 $ 38,017

Software and hardware maintenance

22,984 81,322 76,732 2,366

Travel 16,034 47,153 7,390 228

Molding equipment 57,700 40,088 158,280 4,881

Service 18,224 10,039 28,513 879

Others 28,533 57,705 63,945 1,972

$ 417,964 $1,867,820 $1,567,761 $ 48,343

FINANCEI CONSOLIDATED REPORT

l