HTC 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135134

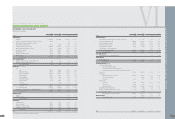

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

> In

c

om

e

t

a

x

e

s p

a

y

a

b

l

e

a

s o

f

D

e

c

e

mb

e

r 31, 2005, 2006

a

nd 2007 w

e

r

e

c

ompu

t

e

d

a

s

f

o

ll

ows

:

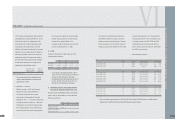

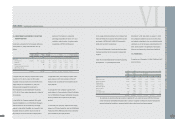

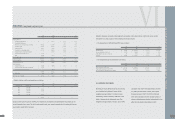

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Income before income tax $ 12,155,939 $ 26,957,878 $ 32,151,297 $ 991,406

Permanent differences

Losses (gains) on equity-method investments 35,112 12,554 ( 103,997) ( 3,207)

Other 31,012 36,625 45,745 1,411

Temporary differences

Realized pension cost ( 42,098) ( 24,260) ( 21,166) ( 653)

Unrealized bad debt expenses - - 64,603 1,992

Unrealized loss on decline in value of inventory 239,955 304,936 24,625 759

Unrealized royalties 1,183,995 1,930,164 271,000 8,356

Realized depreciation ( 12,058) - - -

Unrealized foreign exchange losses (gains), net 217,995 ( 177,812) ( 94,291) ( 2,908)

Unrealized warranty expense 639,801 429,492 2,075,962 64,014

Unrealized marketing expenses - 983,087 2,023,933 62,409

Unrealized profit from intercompany transactions 8,788 148,934 11,064 342

Unrealized valuation (gain) loss on financial instruments ( 60,085) 76,470 96,256 2,968

Capitalized expense 2,698 ( 19,414) 30,767 949

Other 30,877 ( 1,292) 43,593 1,344

Total income 14,431,931 30,657,362 36,619,391 1,129,182

Less tax-exempt income tax ( 8,734,397) ( 20,914,039) ( 22,787,534) ( 702,668)

Taxable income 5,697,534 9,743,323 13,831,857 426,514

Tax rate 25% 25% 25% 25%

1,424,384 2,435,831 3,457,964 106,628

Income tax credit ( 10) ( 10) ( 10) -

Estimated income tax provision 1,424,374 2,435,821 3,457,954 106,628

Unappropriated earnings (additional 10% income tax) 144,006 436,049 571,507 17,623

Less investment research and development tax credits ( 938,425) ( 1,024,576) ( 648,134) ( 19,986)

Current income tax 629,955 1,847,294 3,381,327 104,265

Less prepaid and withheld income tax ( 13,092) ( 156,308) ( 1,060,575) ( 32,703)

Tax shortage stated in the tax assessment notice - 67,731 193,642 5,971

Income tax payable $ 616,863 $ 1,758,717 $ 2,514,394 $ 77,533

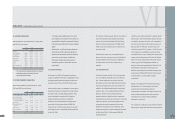

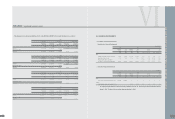

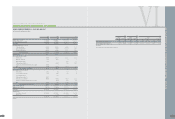

•The tax effects of deductible te

m

porary differences and tax credit carryforwards that gave rise to deferred tax assets as of

D

ece

m

ber 31, 2005, 2006 and 2007 were as follows:

VI

23.INCOME TAX

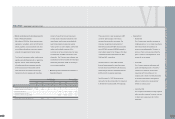

The Basic Income Tax Act (BITA), which took effect

on January 1, 2006, requires that the basic income

tax (BIT) should be 10% of the sum of the taxable

income as calculated in accordance with the Income

Tax Act (ITA) plus tax-exempt income under the ITA

or relevant laws. The tax payable of the current year

would be the higher of the BIT or the income tax

payable calculated in accordance with the ITA.

However, if the BIT is higher than the ITA tax,

investment tax credits granted under the provisions

of other laws should not be used to deduct the

difference between the two taxes payable. The effect

of the BIT had been taken into account by the

Company in its tax calculation.

The income tax returns through 2003 had been

examined by the tax authorities. However, the

Company disagreed with the tax authorities'

assessment on its returns for 2002 to 2003 and

applied for the reexamination of its returns.

Nevertheless, under the conservatism guideline, the

Company adjusted its income tax for the tax shortfall

stated in the tax assessment notices.

> Und

e

r

t

h

e

S

t

a

t

u

t

e

f

or Upgr

a

d

i

ng Indus

t

r

i

e

s,

t

h

e

Comp

a

ny w

a

s gr

a

n

t

e

d

e

x

e

mp

t

i

on

f

rom

c

orpor

a

t

e

i

n

c

om

e

t

a

x

a

s

f

o

ll

ows

:

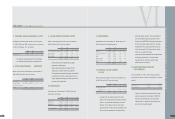

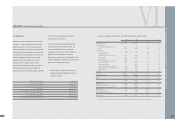

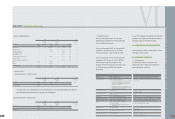

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs and Smartphones 2001.04.26~2006.04.25

Sales of pocket PCs (wireless) and Smartphones 2002.01.01~2006.12.31

Sales of Win CE products 2003.01.01~2007.12.31

Sales of pocket PCs, pocket PCs (wireless) and Smartphones 2004.09.15~2009.09.14

Sales of pocket PCs (wireless) and Smartphones 2004.11.30~2009.11.29

Sales of pocket PCs (wireless) and Smartphones 2005.12.20~2010.12.19

sales of wireless or smartphone whichhas 3G or GPS function 2006.12.20-2011.12.19

FINANCEI INDEPENDENT AUDITORS' REPORT

l