HTC 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE CORPORATE GOVERNANCE REPORT

7776

3. IN

F

ORMATION ON CPA PRO

F

ESSIONAL

F

EES

:

(1) Wh

e

n non-

a

ud

i

t

f

ee

s p

a

i

d

t

o

t

h

e

c

e

r

t

i

f

i

e

d pub

li

c

a

cc

oun

t

a

n

t

,

t

o

t

h

e

a

cc

oun

t

i

ng

f

i

rm o

f

t

h

e

c

e

r

t

i

f

i

e

d pub

li

c

a

cc

oun

t

a

n

t

,

a

nd/or

t

o

a

ny

a

ff

ili

a

t

e

d

e

n

t

e

rpr

i

s

e

o

f

su

c

h

a

cc

oun

t

i

ng

f

i

rm

a

r

e

e

qu

i

v

a

l

e

n

t

t

o on

e

qu

a

r

t

e

r or mor

e

o

f

t

h

e

a

ud

i

t

f

ee

s p

a

i

d

t

h

e

r

e

t

o,

t

h

e

a

moun

t

s o

f

bo

t

h

a

ud

i

t

a

nd

non-

a

ud

i

t

f

ee

s

a

s w

e

ll

a

s d

e

t

a

il

s o

f

non-

a

ud

i

t

s

e

rv

i

c

e

s sh

a

ll

b

e

d

i

s

c

l

os

e

d

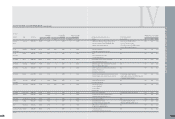

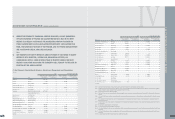

Whether the CPA's Audit Period

Non-Audit Fee Covers an Entire Fiscal Year

System Company Human Others Subtotal Yes No Audit Peilod

Accounting Firm Name of CPA Audit Fee Design Registration Resource (note 1) Note

Deloitte & Touche Ming-Hsien Yang 6,220,000 - 123,000 10,000 1,480,000 7,833,000

Kwan-Chung Lai

N

ote 1: Please record non-audit fees separately according to service ite

m

. If non-audit fees indicated under

"

O

ther

"

constitute 25 percent of total non-audit fees, the nature of those service ite

m

s shall

be indicated in the

R

e

m

arks colu

m

n.

(2) Wh

e

n

t

h

e

c

omp

a

ny

c

h

a

ng

e

s

i

t

s

a

cc

oun

t

i

ng

f

i

rm

a

nd

t

h

e

a

ud

i

t

f

ee

s p

a

i

d

f

or

t

h

e

f

i

s

c

a

l

y

ea

r

i

n

wh

i

c

h su

c

h

c

h

a

ng

e

t

oo

k

p

l

a

c

e

a

r

e

l

ow

e

r

t

h

a

n

t

hos

e

f

or

t

h

e

pr

e

v

i

ous y

ea

r,

t

h

e

r

e

du

c

t

i

on

i

n

t

h

e

a

moun

t

o

f

a

ud

i

t

f

ee

s, r

e

du

c

t

i

on p

e

r

c

e

n

t

a

g

e

,

a

nd r

ea

son(s)

t

h

e

r

e

f

or sh

a

ll

b

e

d

i

s

c

l

os

e

d.

HTC did not change its accounting firm.

(3) Wh

e

n

t

h

e

a

ud

i

t

f

ee

s p

a

i

d

f

or

t

h

e

c

urr

e

n

t

y

ea

r

a

r

e

l

ow

e

r

t

h

a

n

t

hos

e

f

or

t

h

e

pr

e

v

i

ous

f

i

s

c

a

l

y

ea

r by

15 p

e

r

c

e

n

t

or mor

e

,

t

h

e

r

e

du

c

t

i

on

i

n

t

h

e

a

moun

t

o

f

a

ud

i

t

f

ee

s, r

e

du

c

t

i

on p

e

r

c

e

n

t

a

g

e

,

a

nd

r

ea

son(s)

t

h

e

r

e

f

or sh

a

ll

b

e

d

i

s

c

l

os

e

d.

Audit fee of year 2007 is higher than previous year.

4. IN

F

ORMATION ON REPLACEMENT O

F

CERTI

F

IED PUBLIC ACCOUNTANT

:

I

f

t

h

e

c

omp

a

ny h

a

s r

e

p

l

a

c

e

d

i

t

s

c

e

r

t

i

f

i

e

d pub

li

c

a

cc

oun

t

a

n

t

w

i

t

h

i

n

t

h

e

l

a

s

t

t

wo

f

i

s

c

a

l

y

ea

rs or

a

ny subs

e

qu

e

n

t

i

n

t

e

r

i

m

p

e

r

i

od,

i

t

sh

a

ll

d

i

s

c

l

os

e

t

h

e

f

o

ll

ow

i

ng

i

n

f

orm

a

t

i

on

(1) R

e

g

a

rd

i

ng Th

e

F

orm

e

r C

e

r

t

i

f

i

e

d Pub

li

c

A

cc

oun

t

a

n

t

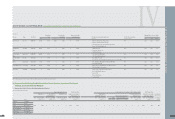

Date of replacement 10/29/2007

Reason and specifying of replacement Due to adjustments in the managerial organization at Deloitte & Touche,

the certifying CPAs have been changed from Tze-Chun Wang, CPA and

Kwan-Chung Lai, CPA to Ming-Hsien Yang, CPA and Kwan-Chung Lai, CPA.

Specifying whether it was the certified public accountant that Concerned Person

voluntarily ended the engagement or declined further engagement Condition Accountant Appointer

voluntarily ended the engagement

discontinued the engagement.

Issued an audit report expressing other than an unqualified opinion during None

the two most recent years, furnish the opinion and reason.

Indicate whether there was any disagreement between the company Affirmative Accounting principles or practices

and the former certified public accountant Financial report disclosure

Auditing scope or procedure

Other

Negative

Description

Disclose the information (Other matters required for disclosure under None

Article 10, subparagraph 5, item 1, point 4 of the Regulations Governing

Information to be Published in Annual Reports of Public Companies).

(2) R

e

g

a

rd

i

ng Th

e

Su

cc

e

ssor C

e

r

t

i

f

i

e

d Pub

li

c

A

cc

oun

t

a

n

t

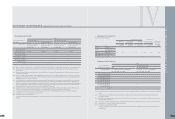

Name of the accounting firm Deloitte & Touche

Name of the certified public accountant Ming-Hsien Yang, Kwan-Chung Lai

Date of engagement 10/29/2007

If prior to the formal engagement of the successor certified public accountant, the company consulted the newly None

engaged accountant regarding the accounting treatment of or application of accounting principles to a specified

transaction, or the type of audit opinion that might be rendered on the company's financial report, the company shall

state and identify the subjects discussed during those consultations and the consultation results.

The company shall consult and obtain written views from the successor certified public accountant regarding the matters None

on which the company did not agree with the former certified public accountant, and shall make disclosure thereof.

(3) R

e

p

l

y L

e

tt

e

r

f

rom Th

e

F

orm

e

r CPA R

e

g

a

rd

i

ng Th

e

M

a

tt

e

rs Und

e

r Ar

t

i

c

l

e

10, Subp

a

r

a

gr

a

ph 5,

I

t

e

m 1,

a

nd Ar

t

i

c

l

e

10, Subp

a

r

a

gr

a

ph 5, I

t

e

m 2, Po

i

n

t

3 o

f

Th

e

s

e

Th

e

R

e

gu

l

a

t

i

ons Gov

e

rn

i

ng

In

f

orm

a

t

i

on

t

o B

e

Pub

li

sh

e

d

i

n Annu

a

l

R

e

por

t

s o

f

Pub

li

c

Comp

a

n

i

e

s

None

CORPORATE G OVERNA NCE

l

CPA PRO

F

ESSIONAL

F

EES

l

REPLACEMENT O

F

CPA

l

IV

Transfer pricing report,

international tax

consultation,review of

shareholders

'

m

eeting annual

report, and CPA opinion on

earnings capitalization.