HSBC 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

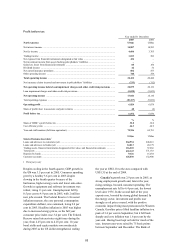

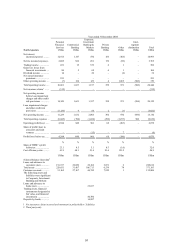

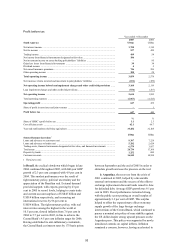

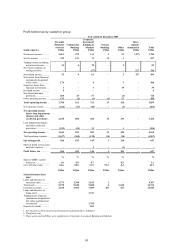

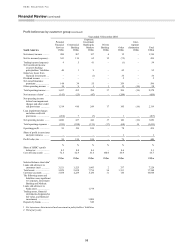

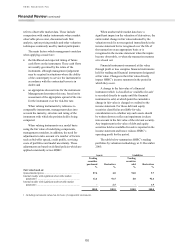

Profit before tax

Year ended 31 December

2005 2004

South America US$m US$m

Net interest income ......................................................................................................................... 1,750 1,310

Net fee income ............................................................................................................................... 537 459

Trading income .............................................................................................................................. 409 54

Net income from financial instruments designated at fair value ..................................................... 186 –

Net investment income on assets backing policyholders’ liabilities ............................................... –95

Gains less losses from financial investments .................................................................................. 39 34

Dividend income ............................................................................................................................ 42

Net earned insurance premiums ...................................................................................................... 746 596

Other operating income .................................................................................................................. 188 28

Total operating income ................................................................................................................ 3,859 2,578

Net insurance claims incurred and movement in policyholders’ liabilities ..................................... (691) (459)

Net operating income before loan impairment charges and other credit risk provisions ....... 3,168 2,119

Loan impairment charges and other credit risk provisions .............................................................. (554) (267)

Net operating income ................................................................................................................... 2,614 1,852

Total operating expenses ................................................................................................................ (1,967) (1,413)

Operating profit ............................................................................................................................ 647 439

Share of profit in associates and joint ventures ...............................................................................–1

Profit before tax ............................................................................................................................ 647 440

%%

Share of HSBC’s profit before tax .................................................................................................. 3.1 2.3

Cost efficiency ratio ....................................................................................................................... 62.1 66.7

Year-end staff numbers (full-time equivalent) ................................................................................ 33,282 32,108

US$m US$m

Selected balance sheet data1

Loans and advances to customers (net) ........................................................................................... 9,307 7,228

Loans and advances to banks (net) ................................................................................................. 5,282 2,624

Trading assets, financial instruments designated at fair value, and financial investments .............. 6,579 3,857

Total assets ..................................................................................................................................... 24,734 17,368

Deposits by banks ........................................................................................................................... 1,252 680

Customer accounts ......................................................................................................................... 16,545 10,958

1Third party only.

In Brazil, the cyclical slowdown which began in late

2004 continued throughout 2005, with full-year GDP

growth of 2.3 per cent compared with 4.9 per cent in

2004. This modest performance was the result of

tight monetary policy, political uncertainty and the

appreciation of the Brazilian real. External demand

provided support, with exports growing by 23 per

cent in 2005 to record levels, helping to create trade

and current account surpluses of US$45 billion and

US$14 billion respectively, and increasing net

international reserves by 96 per cent to

US$54 billion. The tight monetary policy, with real

interest rates among the highest in the world at

10.5 per cent, slowed inflation from 7.6 per cent in

2004 to 5.7 per cent in 2005, in line to achieve the

Central Bank’s 4.5 per cent inflation target for 2006.

Having established its anti-inflationary credentials,

the Central Bank cut interest rates by 175 basis points

between September and the end of 2005 in order to

stimulate growth and ease the pressure on the real.

In Argentina, the recovery from the crisis of

2001 continued in 2005, helped by a favourable

external environment and the success of the offer to

exchange replacement discount bonds issued in June

for defaulted debt. Average GDP growth was 9.1 per

cent in 2005. Fiscal performance remained strong,

with the public sector posting an overall surplus of

approximately 3.3 per cent of GDP. This surplus

helped to offset the expansionary effect on money

supply growth of the large foreign exchange

interventions of the Central Bank, which continued to

pursue a nominal rate policy of near stability against

the US dollar despite strong upward pressure on the

Argentine peso. This policy was supported by newly

introduced controls on capital inflows. Inflation

remained a concern, however, having accelerated to