EasyJet 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

95

www.easyJet.com

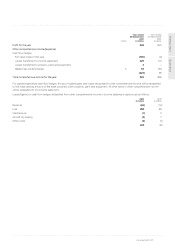

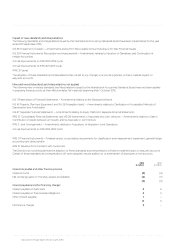

Notes to the accounts

1. Significant accounting policies

Statement of compliance

easyJet plc (the ‘Company’) and its subsidiaries (‘easyJet’ or the ‘Group’ as applicable) is a low-cost airline carrier operating principally in

Europe. The Company is a public limited company whose shares are listed on the London Stock Exchange under the ticker symbol EZJ

and is incorporated and domiciled in the United Kingdom. The address of its registered office is Hangar 89, London Luton Airport, Luton,

Bedfordshire, LU2 9PF.

The accounts are prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union,

taking into account IFRS Interpretations Committee (IFRSIC) interpretations and those parts of the Companies Act 2006 applicable

to companies reporting under IFRS.

Basis of preparation

The accounts are prepared based on the historical cost convention except for certain financial assets and liabilities including derivative

financial instruments that are measured at fair value.

The accounting policies set out below have been applied consistently to all years presented in these accounts.

easyJet’s business activities, together with factors likely to affect its future development and performance, are described in the strategic

report on pages 1 to 45. Principal risks and uncertainties are described on pages 24 to 29. Note 22 to the accounts sets out the Group’s

objectives, policies and procedures for managing its capital and gives details of the risks related to financial instruments held by the Group.

The accounts have been prepared on a going concern basis. Details on going concern are provided on page 22.

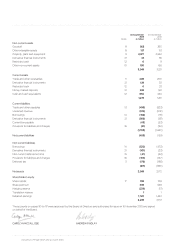

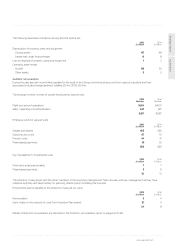

Significant judgements, estimates and critical accounting policies

The preparation of accounts in conformity with generally accepted accounting principles requires the use of estimates and assumptions

that affect the reported amounts of assets and liabilities at the date of the accounts and the reported amounts of income and expenses

during the reporting period. Although these amounts are based on management’s best estimates of the amount, events or actions may

mean that actual results ultimately differ from those estimates, and these differences may be material. The estimates and the underlying

assumptions are reviewed regularly.

The following three accounting policies are considered critical accounting policies as they require a significant amount of management

judgement and the results are material to easyJet’s accounts.

Aircraft maintenance provisions (Note 16)

easyJet incurs liabilities for maintenance costs in respect of aircraft leased under operating leases during the term of the lease. These arise

from legal and constructive contractual obligations relating to the condition of the aircraft when it is returned to the lessor. To discharge

these obligations, easyJet will also normally need to carry out one heavy maintenance check on each of the engines and the airframe

during the lease term.

A charge is made in the income statement, based on hours or cycles flown, to provide for the cost of these obligations. Estimates required

include the likely utilisation of the aircraft, the expected cost of the heavy maintenance check at the time it is expected to occur, the

condition of the aircraft and the lifespan of life-limited parts.

The bases of all estimates are reviewed annually, and also when information becomes available that is capable of causing a material change

to an estimate, such as renegotiation of end of lease return conditions, increased or decreased utilisation, or changes in the cost of heavy

maintenance services.

Other provisions (Note 16)

easyJet incurs liabilities for amounts payable to customers who make claims in respect of flight delays and cancellations, and refunds of

air passenger duty or similar charges. Estimates required include passenger claim history, level of claims made and period of time over

which claims are made. The bases of all estimates are reviewed at least annually and also when information becomes available that is

capable of causing a material change to the estimate.

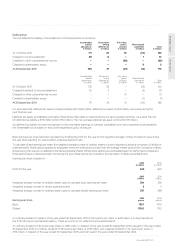

Goodwill and landing rights (Note 8)

Goodwill and landing rights are tested for impairment at least annually. easyJet has one cash-generating unit, being its route network.

In making this assessment, easyJet has considered the manner in which the business is managed including the centralised nature of

its operations and the ability to open or close routes and redeploy aircraft and crew across the whole route network.

The value in use of the cash-generating unit is determined by discounting future cashflows to their present value. When applying this

method, easyJet relies on a number of estimates including its strategic plans, fuel prices, exchange rates, long-term economic growth

rates for the principal countries in which it operates, and its pre-tax weighted average cost of capital.