EasyJet 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

13

www.easyJet.com

3MAINTAIN COST ADVANTAGE

easyJet has a strong cost-focused culture, with a number of

structural advantages in key areas that enable it to combine

the offering of a primary airport network with good value fares.

Every year easyJet delivers substantial cost savings against

underlying cost inflation, whilst in the longer term we have

a pipeline of opportunities that will further improve our

structural competitiveness.

In 2015 cost per seat decreased by 3.4%, primarily reflecting

benefits from fuel and foreign currency. On a constant currency,

ex-fuel basis cost per seat rose 3.6%. Part of this is the cost of

doing business within our successful business model; part was

due to one-off factors during the year. We have generated

sustainable savings during the year of £46 million.

easyJet’s structural advantages are an integral part of our

business model, with established benefits in fleet, airports

and handling, engineering, pensions and overheads:

• We operate an exclusively Airbus A320-family fleet. This

delivers operational flexibility as well as efficiencies in

engineering and maintenance, crew, ownership and fuel. As

the second-largest operator of Airbus aircraft in the world we

also benefit from significant economies of scale on acquisition.

Between 2016 and 2021 we will derive a major benefit from

up-gauging of our fleet, from a majority 156-seat A319

composition to a fleet that is over 70% 186-seat A320s.

This is expected to have a 13-14% cost per seat benefit,

which translates into over £110 million of comparable savings.

• With significant positions in our airports, we are able to drive

economies of scale from long term deals with the airport

owners and operators, as well as with ground handling agents

at those airports. We are now in our second year of a seven

year contract with Gatwick airport, as the largest operator at

the airport, and likewise at London Luton airport, where we

have signed a 10 year contract. In Ground Handling we signed

an arrangement with GH Italia covering all of the nine airports

where we operate in Italy. We expect to agree a number of

new contracts in both areas in 2016 and 2017.

• During 2015 we completed our new component support

arrangement with AJW Group, consolidating previous

arrangements and again leveraging our increasing scale.

This has been successfully implemented in October 2016

and we expect to drive significant maintenance savings

over the term of the contract.

• easyJet is not encumbered with significant historic costs

that legacy carriers have. Our crew are more productive. We

maintain a lean and efficient head office and we do not have

expensive pension arrangements for current and previous

employees. We believe we can leverage this position to drive

incrementally profitable growth in the medium term.

We will relentlessly focus on delivering these initiatives in the next

few years. Our experiences in 2015 have given us the impetus to

increase our cost saving efforts. We plan to re-invigorate what

has already been a hugely successful cost saving programme,

leveraging our increasing scale and reviewing our cost

management down to the lowest level.

4DISCIPLINED USE OF CAPITAL

easyJet has a clear capital structure framework and a strategy

which is intended to maximise shareholder returns. The Company

maintains a strong balance sheet with low gearing, which gives

us a strong competitive advantage through access to a lower

cost of funding as well as operational flexibility.

Our objective is always to optimise our return on capital

employed through the allocation of aircraft and capacity across

the network, regularly moving them to airports and routes with

better opportunities. In line with this strategy, we took the

decision in June to close our base at Rome Fiumicino and will

redistribute those eight based aircraft to other bases in Italy,

including the opening of a new base in Venice. These actions

reiterate our focus on returns and will increase the return on

capital employed of the Company as a whole, as we have done

regularly in the past and will do so in the future.

As we continue to add frequencies and commit to basing

aircraft around the network in scale, we are able to maintain

the very high fleet utilisation that sets us apart. In 2015 we

maintained our asset utilisation across the network, at an

average of 11 block hours per day (2014: 11 hours).

Fleet

We manage our fleet to provide flexibility in our planning

arrangements, so that on the one hand we can maximise

opportunities in a strong demand environment, whilst being able

to manage our capacity as necessary. easyJet’s total fleet as at

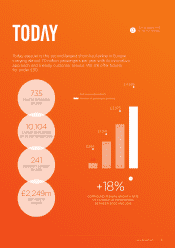

30 September 2015 comprised 241 aircraft and increased by a

net 15 from 30 September 2014.

Over the next five years we will reduce cost by changing the

fleet mix and ownership structure. We took delivery of 20 A320

aircraft in the 12 months to 30 September 2015, which provide

a per seat cost saving of 7% to 8% over the A319, through

up-gauging. Five A319 aircraft were retired and the average

age of the fleet increased to 6.2 years (2014: 5.8 years).