EasyJet 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

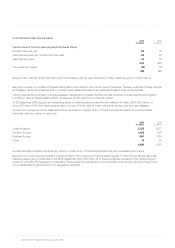

124 easyJet plc Annual report and accounts 2015

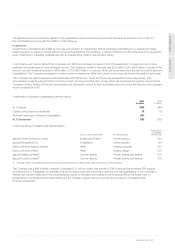

Glossary

Adjusted capital employed Capital employed plus seven times operating lease costs incurred in the year.

Adjusted net cash/debt Net cash/debt less seven times operating lease costs incurred in the year.

Aircraft dry/

wet leasing

Payments to lessors under dry leasing arrangements relate solely to the provision of an aircraft.

Payments to lessors under wet leasing arrangements relate to the provision of aircraft, crew,

maintenance and insurance.

Aircraft owned/leased

at end of year

Number of aircraft owned or on lease arrangements of over one month’s duration at the end

of the period.

Available seat kilometres (ASK) Seats flown multiplied by the number of kilometres flown.

Average adjusted

capital employed

The average of opening and closing adjusted capital employed.

Block hours Hours of service for aircraft, measured from the time that the aircraft leaves the terminal at

the departure airport to the time that it arrives at the terminal at the destination airport.

Capital employed Shareholders’ equity less net cash/debt.

Cost per ASK Revenue less profit before tax, divided by available seat kilometres.

Cost per seat Revenue less profit before tax, divided by seats flown.

Cost per seat, excluding fuel Revenue, less profit before tax, plus fuel costs, divided by seats flown.

EBITDAR Earnings before interest, taxes, depreciation, amortisation, aircraft dry leasing costs, and profit

or loss on disposal of aircraft held for sale.

Gearing Adjusted net cash/debt divided by the sum of shareholders’ equity and adjusted net cash/debt.

Load factor Number of passengers as a percentage of number of seats flown. The load factor is not weighted

for the effect of varying sector lengths.

Net cash/debt Total cash less borrowings. (Cash includes money market deposits but excludes restricted cash).

Normalised operating

profit after tax

Reported operating profit adjusted for one-third of operating lease costs incurred in the year, less

tax at the prevailing UK corporation tax rate at the end of the financial year.

Operated aircraft utilisation Average number of block hours per day per aircraft operated.

Other costs Administrative and operational costs not reported elsewhere, including some employee costs,

compensation paid to passengers, exchange gains and losses and the profit or loss on the

disposal of property plant and equipment.

Passengers Number of earned seats flown. Earned seats comprises seats sold to passengers (including no-

shows), seats provided for promotional purposes and seats provided to staff for business travel.

Profit before tax per seat Profit before tax divided by seats flown.

Revenue The sum of seat revenue and non-seat revenue.

Revenue passenger

kilometres (RPK)

Number of passengers multiplied by the number of kilometres those passengers were flown.

Revenue per ASK Revenue divided by available seat kilometres.

Revenue per seat Revenue divided by seats flown.

ROCE Return on capital employed.

ROCE (excluding

lease adjustments)

Operating profit, less tax at the prevailing UK corporation tax rate at the end of the financial year,

divided by average capital employed.

ROCE (including

lease adjustments)

Normalised operating profit after tax divided by average adjusted capital employed.

Seats flown Seats available for passengers.

Sector A one-way revenue flight.