EasyJet 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 easyJet plc Annual report and accounts 2015

Notes to the accounts continued

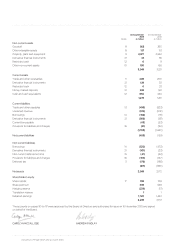

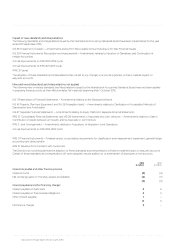

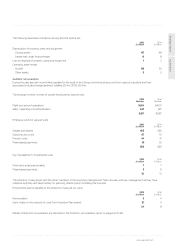

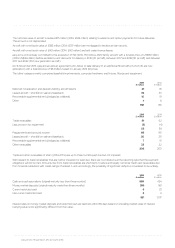

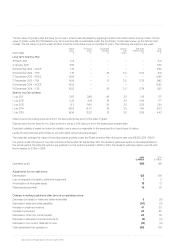

5. Tax charge

Tax on profit on ordinary activities

2015

£ million 2014

£ million

Current tax

United Kingdom corporation tax 109 99

Foreign tax 6 6

Prior year adjustments (14) (7)

Total current tax charge 101 98

Deferred tax

Temporary differences relating to property, plant and equipment 28 25

Other temporary differences 2 3

Prior year adjustments 8 8

Change in tax rate (1) (3)

Total deferred tax charge 37 33

138 131

Effective tax rate 20.1% 22.5%

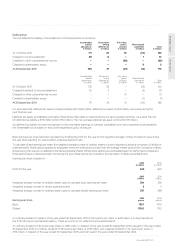

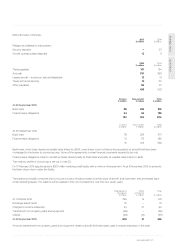

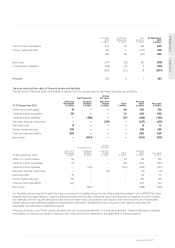

Reconciliation of the total tax charge

The tax for the year is lower than (2014: higher than) the standard rate of corporation tax in the UK as set out below:

2015

£ million 2014

£ million

Profit before tax 686 581

Tax charge at 20.5% (2014: 22.0%) 141 128

Expenses not deductible for tax purposes 3 3

Share-based payments 1 2

Adjustments in respect of prior years – current tax (14) (7)

Adjustments in respect of prior years – deferred tax 8 8

Change in tax rate (1) (3)

138 131

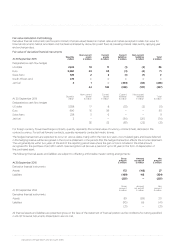

Current tax payable at 30 September 2015 amounted to £43 million (2014: £53 million). The current tax payable at 30 September 2015

of £43 million entirely related to tax payable in the UK. The current tax payable at 30 September 2014 of £53 million related to £45 million

of tax payable in the UK and £8 million related to tax due in other European countries.

During the year ended 30 September 2015, net cash tax paid amounted to £98 million (2014: £96 million).

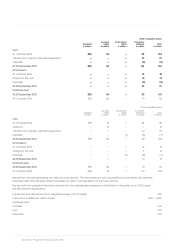

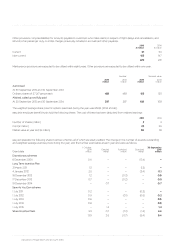

Tax on items recognised directly in other comprehensive income or shareholders’ equity

2015

£ million 2014

£ million

Credit/(charge) to other comprehensive income

Deferred tax on change in fair value of cash flow hedges 56 (10)

Credit/(charge) to shareholders’ equity

Current tax credit on share-based payments 13 7

Deferred tax (charge)/credit on share-based payments (9) 1

4 8