EasyJet 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

73

www.easyJet.com

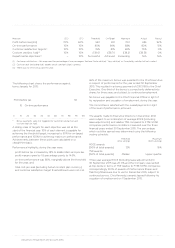

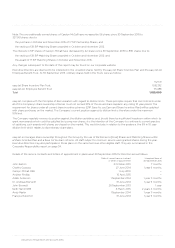

Awards vest on a straight-line basis from threshold to on-target

and from on-target to maximum. As with the awards granted

in the 2015 financial year, ROCE targets are based on average

ROCE over a three-year performance period, commencing on

1 October 2015. TSR targets are based on relative TSR compared

to companies ranked FTSE 31-130 at the start of the

performance period, where the average share price is calculated

over three months at the start and end of the period. In addition,

in order for the TSR-based awards to vest, easyJet must have

achieved positive absolute TSR over the performance period.

The weighting on ROCE and TSR has been rebalanced for the

2016 financial year from an equal split to a 70/30 split in

favour of ROCE.

Targets are set taking account of management’s strategic plan,

market consensus and the Board’s strong focus on driving value

from its increasing capital base. The ROCE target range is the

same as last year but with a small enhancement for achieving

target expectations within the range. The Committee considers

the range of ROCE targets set to be at least as demanding as

those set in prior years, given that the level of return required to

be created for vesting to take place will be calculated from

a significantly higher capital base reflecting the growth and

replacement of in the Company’s fleet during the period

through to 30 September 2018.

How will the Non-Executive Directors be paid in the 2016

financial year?

The fees for the Chairman and Non-Executive Directors will

be as follows:

Chairman £300,000

Basic fee for other Non-Executive Directors £60,000

Fees for Deputy Chairman and SID role(1) £25,000

Chair of the Audit, Safety and Remuneration

Committees(1) £15,000

Chair of the Finance Committee(1) £10,000

(1) Supplementary fees.

There are no changes to basic fees, which were last reviewed

and increased on 1 October 2013.

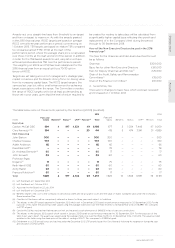

What did the Directors earn in relation to the 2015 financial year?

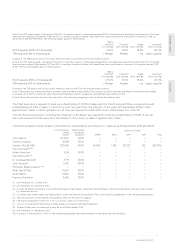

The table below sets out the amounts earned by the Directors (£’000) (Audited):

2015 2014

£’000

Fees and

Salary Benefits(5) Bonus(6) LTIP(7) Pension(8) Total

Fees and

Salary Benefits Bonus LTIP(9) Pension Total

Executive

Carolyn McCall OBE 694 4 917 4,534 49 6,198 677 5 1,034 7,446 47 9,209

Chris Kennedy(1)(10) 394 – – – 20 414 418 5 474 3,941 31 4,869

Non-Executive

John Barton 300 – – – – 300 300 – – – – 300

Charles Gurassa 100 – – – – 100 100 – – – – 100

Adèle Anderson 85 – – – – 85 66 – – – – 66

David Bennett(2) – – – – – – 78 – – – – 78

Dr. Andreas Bierwirth(3) 60 – – – – 60 17 – – – – 17

John Browett 60 – – – – 60 60 – – – – 60

Professor Rigas

Doganis(4) 13 – – – – 13 75 – – – – 75

Keith Hamill OBE 60 – – – – 60 60 – – – – 60

Andy Martin 60 – – – – 60 60 – – – – 60

François Rubichon(3) 60 – – – – 60 17 – – – – 17

Total 1,886 4 917 4,534 69 7,410 1,928 10 1,508 11,387 78 14,911

(1) Left the Board on 1 September 2015.

(2) Left the Board on 1 October 2014.

(3) Appointed to the Board on 22 July 2014.

(4) Left the Board on 1 December 2014.

(5) Benefits relate to the cost to the Company of personal accident and life assurance cover and the value of shares during the year under the Company’s

Share Incentive Plan.

(6) One-third of the bonus will be compulsorily deferred in shares for three years and subject to forfeiture.

(7) This relates to the LTIP awards granted in December 2012 which vest in December 2015 based on performance measured to 30 September 2015. For the

purposes of this table, the award has been valued using the average share price over the three months to 30 September 2015 of £16.988. This compares

to £7.37 at grant.

(8) Carolyn McCall has reached her lifetime pension limit and received a cash alternative of £48,605 in lieu of pension contributions.

(9) This relates to the January 2012 awards which vested in January 2015 based on performance measured to 30 September 2014. For the purposes of the

table in last year’s report, the award was valued using the average share price over the three months to 30 September 2014 of £13.275. The value has been

updated in this table using the share price at the date of vesting of £16.71. This compares to £3.928 at grant.

(10) Entitlement to a 2015 annual bonus and vesting under the December 2012 LTIP awards lapsed for Chris Kennedy following his resignation during the year

and cessation of employment.