EasyJet 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

9

www.easyJet.com

Chief Executive’s review

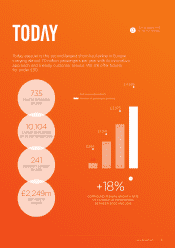

This has been another year of record profits

and delivering our strategy for easyJet. We

carried an additional four million passengers

to reach 68.6 million passengers; we grew

revenue to £4,686 million; and we increased

profit before tax for the fifth successive year

to a record £686 million. Return on capital

employed increased to 22.2%(1), another

record for the Company.

OVERVIEW

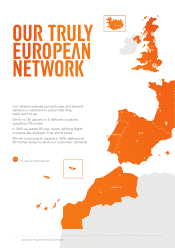

Our markets are strong, with favourable economic and consumer

trends. Our core leisure customer is part of a market that is

growing strongly every year as people take more holidays and

city breaks, complemented by a business travel market that

prizes both flexibility and value.

easyJet has positioned its network and product to capitalise on

these trends and has delivered again during the year. Our business

model and strategy are continuing to deliver profitable growth

and increasing annual returns to shareholders.

In particular:

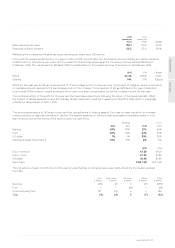

• Revenue increased by 3.5% to £4,686 million, with passenger

volumes increasing by 6.0% and revenue per seat by 1.5% on a

constant currency basis to £64.28, offset by currency headwinds.

• Our passengers continue to be attracted by our model of having

convenient airports and flights, available at good value. We

finished the year strongly with record load factors in both July

and August driving revenue per seat up by 3.2% in constant

currency in the fourth quarter.

• Load factor for the full year grew by 0.9 percentage

points to 91.5%, demonstrating strong demand in a

competitive environment.

• We increased yield and revenue throughout the year with our

market leading digital platform driving and fulfilling demand,

supported by our best-in-class Revenue Management System.

• Our confidence, both in the demand environment and our

structural growth opportunities within our markets has led us

to secure an additional 36 aircraft between 2018 and 2021,

comprising 30 Next Generation A320s and 6 Current Generation

A320s, all in the 186 seat configuration. This will bring flexibility

and secure further cost savings of £27 million.

• Cost per seat decreased by 3.4%, with benefits from both fuel

and currency. Cost per seat at constant currency excluding fuel

increased by 3.6%. We have experienced cost pressures that

include regulated airport price increases, increased de-icing costs

and significant disruption costs. We have mitigated this through

£46 million of sustainable savings and we have a pipeline of

structural cost improvement to deliver future savings.

• Profit before tax grew by £105 million to £686 million and we

increased the profit before tax margin to 14.6% from 12.8%.

• Return on capital employed(1) increased by 1.7 percentage

points to a record 22.2% (2014: 20.5%), with some benefits

from our hedge positions, maintaining our strong market

returns. We continue to drive capital efficiency with rigour and

discipline, reallocating aircraft around the network to maximise

return on capital employed.

• We generated £895 million of operating cash flow, reducing

our gearing to 14%, thus further strengthening our balance sheet.

• Reflecting the strong financial performance during 2015, the

Board has recommended a dividend of 55.2 pence per share,

an increase of 21.6% from the prior year, in line with its policy

of paying 40% of annual profit after tax to shareholders.

CAROLYN MCCALL OBE, CHIEF EXECUTIVE

A year of strong performance

£686m

PROFIT BEFORE TAX (2014: £581M)

22.2%

ROCE (2014: 20.5%)

(1) Return on Capital Employed shown adjusted for leases capitalised at 7 times.