EasyJet 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 easyJet plc Annual report and accounts 2015

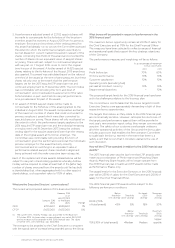

How was pay linked to performance in the 2015 financial year?

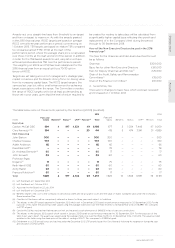

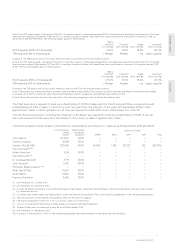

Measure CEO CFO Threshold On-Target Maximum Actual Payout

Profit before tax (£m) 70% 60% 550 610 700 686 92%

On-time performance 10% 10% 80% 84% 88% 80% 15%

Customer satisfaction targets(1) 10% 10% 76% 81% 84% 75% 0%

Cost per seat (ex. fuel)(2) 10% 10% £39.01 £38.74 £38.21 £39.38 0%

Departmental objectives(3) – 10% Successful Achieved Exceeding N/A N/A

(1) Customer satisfaction – this measures the percentage of our passengers that are ‘Quite satisfied’, ‘Very satisfied’ or ‘Completely satisfied’ at last contact.

(2) Cost per seat (excluding fuel) targets are at constant (plan) currency.

(3) There was no CFO bonus paid this year.

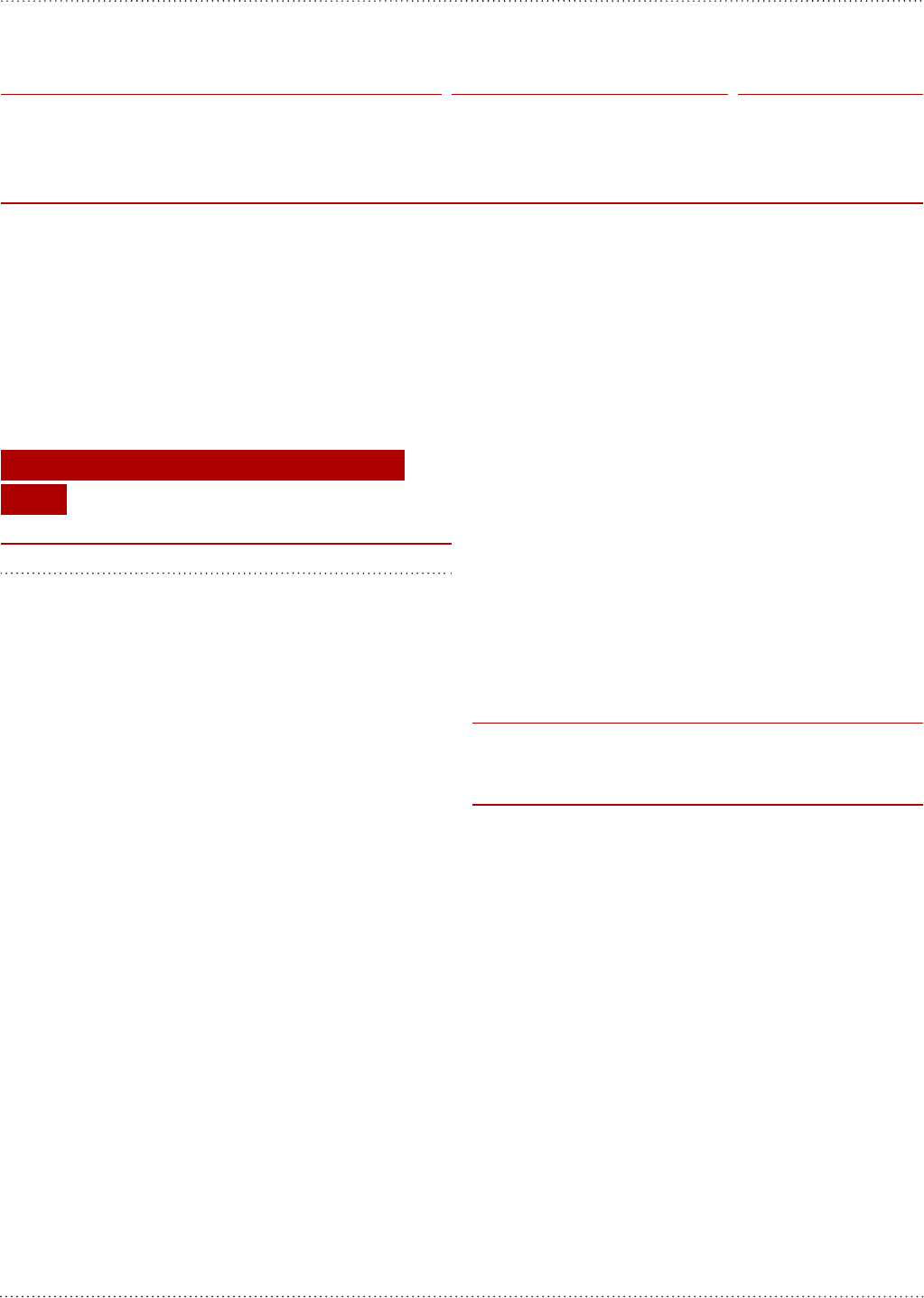

Annual bonus

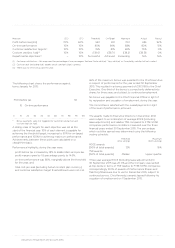

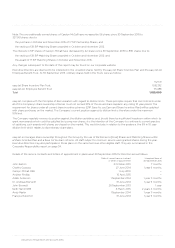

The following chart shows the performance against

bonus targets for 2015:

ANNUAL BONUS

(%)

Profit before tax

On-time performance

0 10 20 30 40 50 60 70 80 90 100

92

15

* Bonus payments were not triggered for customer satisfaction and

cost per seat (ex fuel).

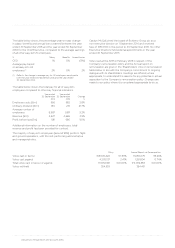

A sliding scale of targets for each objective was set at the

start of the financial year. 10% of each element is payable for

achieving the threshold target, increasing to 50% for on-target

performance and 100% for achieving maximum performance.

Achievements between these points are calculated on a

straight-line basis.

Performance highlights during the year were:

• profit before tax increased by 18% to £686 million and pre-tax

profit margins grew by 1.8 percentage points to 14.6%;

• on-time performance was 80%, marginally above the threshold

for the year; and

• total cost per seat (excluding fuel at constant plan currency)

and customer satisfaction target threshold levels were not met.

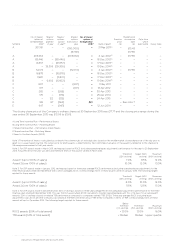

66% of the maximum bonus was awarded to the Chief Executive

in respect of performance for the year ended 30 September

2015. This resulted in a bonus payment of £917,098 to the Chief

Executive. One-third of the bonus is compulsorily deferred into

shares for three years and subject to continued employment.

No bonus was payable to the Chief Financial Officer in light of

his resignation and cessation of employment during the year.

The Committee is satisfied with the overall payments in light

of the level of performance achieved.

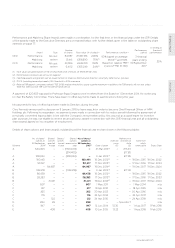

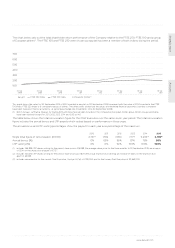

LTIP

The awards made to Executive Directors in December 2012

were subject to a combination of average ROCE (including

lease adjustments) and relative TSR compared to FTSE 51-150

companies performance conditions measured over the three

financial years ended 30 September 2015. The percentage

which could be earned was determined using the following

vesting schedule:

Threshold

(25% vesting)

Maximum

(100% vesting)

ROCE awards

(50% of total awards) 12% 16%

TSR awards

(50% of total awards) Median Upper quartile

Three-year average ROCE (including lease adjustments) to

30 September 2015 was 20.0% and the Company was ranked

at top decile in terms of TSR relative to FTSE 51-150 companies;

correspondingly 100% of awards of Performance Shares and

Matching Shares are due to vest in December 2015, subject to

continued service. Chris Kennedy’s awards lapsed following his

cessation of employment on 1 September 2015.

Directors’ remuneration report continued