EasyJet 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 easyJet plc Annual report and accounts 2015

Notes to the accounts continued

22. Financial risk and capital management continued

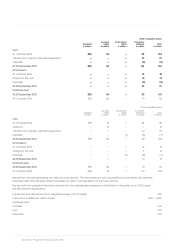

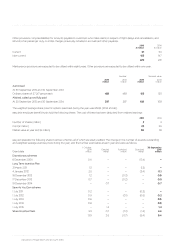

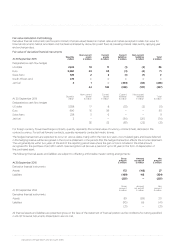

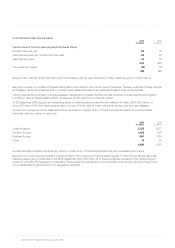

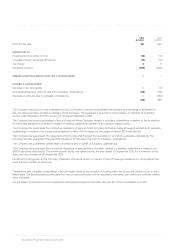

The maturity profile of financial liabilities based on undiscounted cash flows and contractual maturities is as follows:

At 30 September 2015 Within 1 year

£ million

1-2 years

£ million

2-5 years

£ million

Over 5 years

£ million

Borrowings 190 93 199 52

Trade and other payables 398 – – –

Derivative contracts – receipts (2,193) (1,667) (73) –

Derivative contracts – payments 2,433 1,727 69 –

At 30 September 2014 Within 1 year

£ million

1-2 years

£ million

2-5 years

£ million

Over 5 years

£ million

Borrowings 97 178 220 105

Trade and other payables 419 – – –

Derivative contracts – receipts (1,826) (1,173) (69) –

Derivative contracts – payments 1,861 1,159 69 –

The maturity profile has been calculated based on spot rates for the US dollar, Euro, Swiss franc, South African rand and jet fuel at close

of business on 30 September each year.

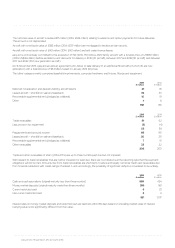

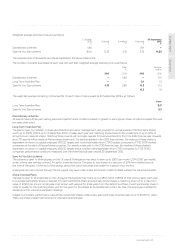

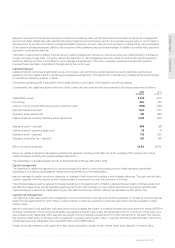

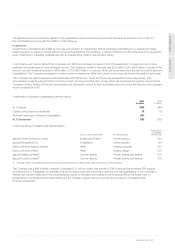

Credit risk management

easyJet is exposed to credit risk arising from cash and money market deposits, derivative financial instruments and trade and other

receivables. Credit risk management aims to reduce the risk of default by setting limits on credit exposure to counterparties based on their

respective credit ratings. Credit ratings also determine the maximum period of investment when placing funds on deposit. Credit risk is

limited to the carrying amount in the statement of financial position at each year end.

Counterparties for cash investments, currency forward contracts and jet fuel forward contracts are required to have a credit rating of A- or

better at contract inception. Exposures to those counterparties are regularly reviewed and, when the market view of a counterparty’s credit

quality changes, adjusted as considered appropriate. Accordingly, in normal market conditions, the probability of material loss due to non-

performance by counterparties is considered to be low.

Disclosure relating to the credit quality of trade and other receivables is given in note 11 to the accounts.

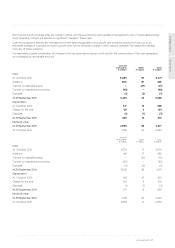

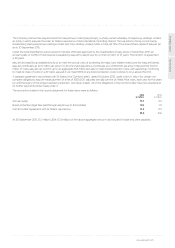

Foreign currency risk management

The principal exposure to currency exchange rates arises from fluctuations in the US dollar, Euro and Swiss franc exchange rates which can

significantly impact easyJet’s results, cash flows or financial position. The aim of foreign currency risk management is to reduce the impact

of these fluctuations.

Significant exposure in the income statement is managed through the use of foreign currency forward exchange contracts where, in line

with board approved policy, between 65% – 85% of the next 12 months’ forecast surplus which is hedged on a rolling basis, and 45% – 65%

of the following 12 months forecast surplus which is hedged on a rolling basis.

Significant exposure relating to the acquisition cost of aircraft is also managed through the use of foreign currency forward exchange

contracts where 90% of the next two years forecast requirement is hedged. In addition, easyJet has substantial borrowings and other

liabilities denominated in US dollars, which are largely offset by holding US dollar cash and money market deposits.

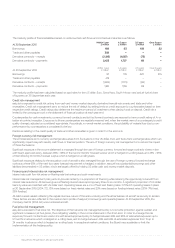

Financing and interest rate risk management

Interest rate cash flow risk arises on floating rate borrowings and cash investments.

Interest rate risk management policy aims to provide certainty in a proportion of financing while retaining the opportunity to benefit from

interest rate reductions. All borrowings are at floating interest rates repricing every three to six months. A significant proportion of US dollar

loans by value are matched with US dollar cash. Operating leases are a mix of fixed and floating rates. Of the 67 operating leases in place

at 30 September 2015 (2014: 72), 75% were based on fixed interest rates and 25% were based on floating interest rates (2014: 71% fixed,

29% floating).

All debt is asset related, reflecting the capital intensive nature of the airline industry and the attractiveness of aircraft as security to lenders.

These factors are also reflected in the medium-term profile of easyJet’s borrowings and operating leases. At 30 September 2015, the

Company had 114 (2014: 94) unencumbered aircraft.

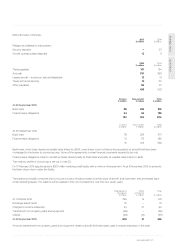

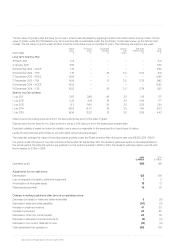

Fuel price risk management

easyJet is exposed to fuel price risk. The objective of the fuel price risk management policy is to provide protection against sudden and

significant increases in jet fuel prices, thus mitigating volatility in the income statement in the short-term. In order to manage the risk

exposure, forward contracts are used in line with Board approved policy to hedge between 65% and 85% of estimated exposures up to

12 months in advance which is hedged on a rolling basis, and to hedge between 45% and 65% of estimated exposures from 13 up to

24 months in advance which is hedged on a rolling basis. In exceptional market conditions, the Board may accelerate or limit the

implementation of the hedging policy.