EasyJet 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 easyJet plc Annual report and accounts 2015

Chief Executive’s review continued

Agreement for 36 additional aircraft

Due to our continued robust trading, high demand for easyJet

flights and the number of profitable opportunities we see in

our markets, we are pleased to have secured an agreement with

Airbus to take delivery of an additional 36 A320 aircraft between

2018 and 2021, all in the 186 seat configuration. These aircraft will

offer increased flexibility in fleet planning, including the faster

replacement of some of our A319 aircraft, lower overall unit costs

and ensure easyJet can continue to grow past 2019 to support

increasing total shareholder return.

easyJet is exercising rights to 30 next generation A320 NEOs

under the existing framework agreement signed in 2013(3). The

additional six aircraft are current generation A320 added to that

agreement. We have secured an additional 30 A320 NEO

purchase rights to replace those we are exercising. Funding is

available. easyJet’s balance sheet and cash generation is strong

with gearing at 30 September at 14%, marginally below the

Board’s target of 15% – 30%.

5CULTURE, PEOPLE AND PLATFORM

easyJet is passionate about its people and we believe that it is

what sets us apart. In particular we believe that our customer-

facing employees are the best in the industry and contribute

significantly to the positive experience that our passengers enjoy,

which in turn drives their loyalty and repeat business.

It is our people who continue to deliver the strategy for the

business and will drive future success. Internally we continue to

focus on recruiting the right people, helping them to understand

the Company’s values and their role in the business and then

giving them the tools to develop a high-performance culture.

Our people are truly exceptional. They are passionate and

driven to achieving a winning strategy. They have responded

to recent tragic events with energy, care for our customers and

unbelievable stamina. We couldn’t achieve these results without

this orange spirit.

In line with the rest of the business we recruited during the year

to help support our growth, adding over 290 pilots and 1,300

cabin crew, as well as 390 people within the management,

administration, engineering and maintenance departments.

Retention rates remain good with employee turnover of

6.6% (2014: 6.7%).

DELIVERING SHAREHOLDER RETURNS

Our high revenue growth and good cost control have driven

strong profit growth and this year we have recorded record

profit for the fifth consecutive year. Our cash generation is also

strong. We generated £895 million in operating cash, before

investing £532 million, principally in the acquisition of 20 aircraft.

easyJet ended the year with net cash of £435 million and

gearing of 14%, marginally below the bottom end of the

Board’s target range.

Return on capital employed increased to 22.2% from 20.5% last

year, as the increase in profit more than made up for the increase

in fleet. As we embark on a new phase of fleet acquisition we

expect this to reduce slightly in the next few years, whilst

remaining among the higher performers in the market.

As we look forward, we expect that our ability to grow revenue

and the renewed focus on cost will deliver strong earnings

momentum and significant returns to shareholders.

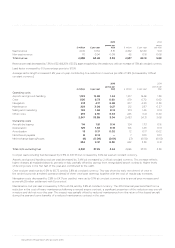

Fleet as at 30 September 2015:

Owned

Operating

leases

Finance

leases Total % of fleet

Changes

in year

Future

committed

deliveries at 16

November

2015

Unexercised

purchase

rights

A319 93 49 6 148 61% (5) – –

A320 70 18 5 93 39% 20 56 –

A320neo – – – –– 130 100

163 67 11 241 15 186 100