EasyJet 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 easyJet plc Annual report and accounts 2015

Risk

Risk management framework

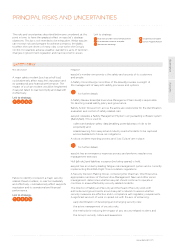

The Group faces a number of risks which, if they arise, could affect its ability to achieve

its strategic objectives. The Board is responsible for determining the nature of these risks

and ensuring appropriate mitigating actions are in place to manage them effectively.

Risk appetite

The level of risk it is considered appropriate to accept in

achieving easyJet's strategic objectives is reviewed and validated

by the Board on an annual basis. The appropriateness of the

mitigating actions is determined in accordance with the Board

approved risk appetite for the relevant area.

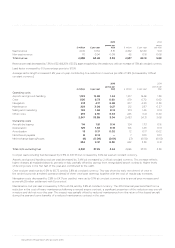

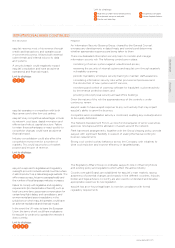

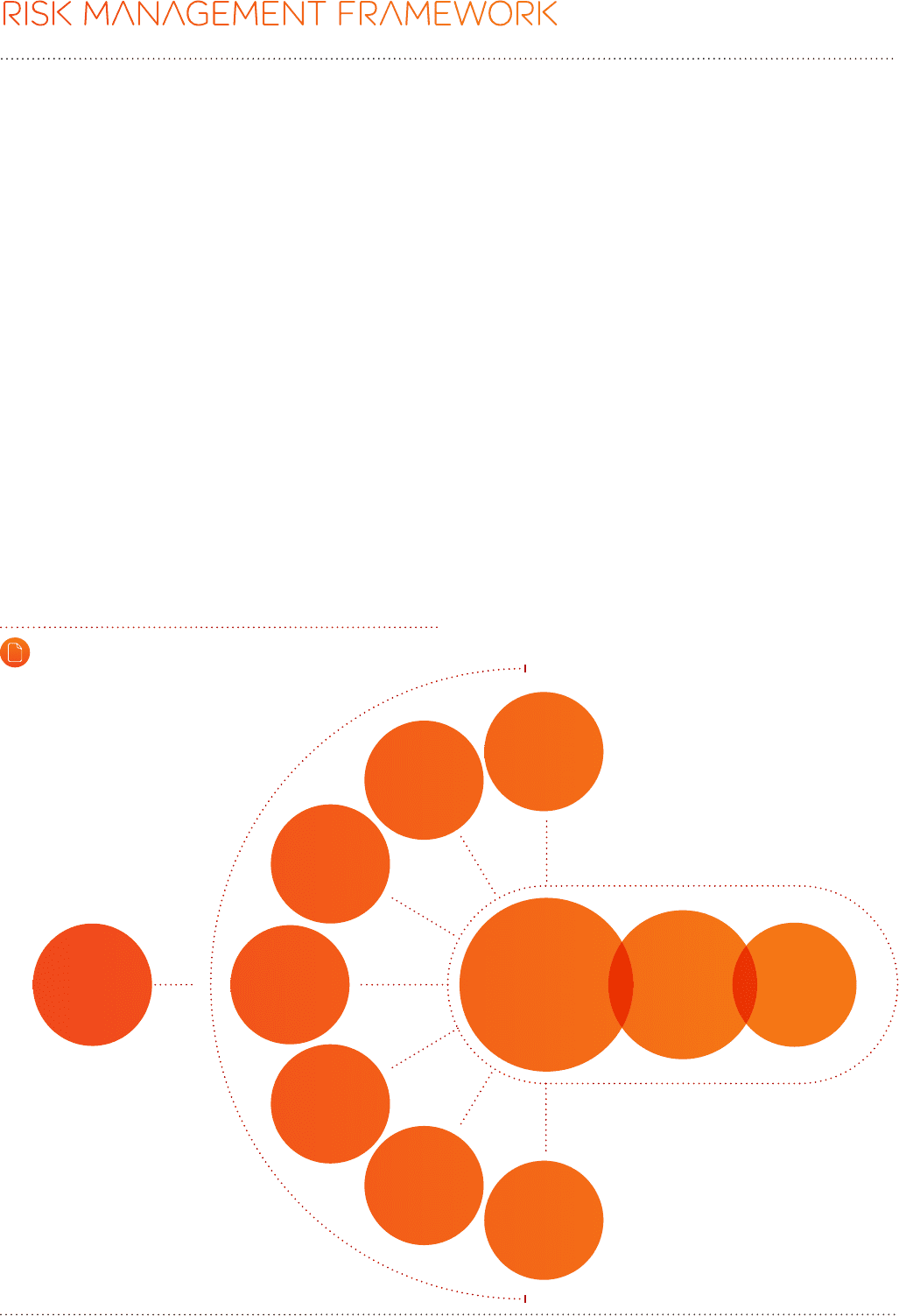

Risk management process

The diagram below sets out easyJet's risk management process.

This is co-ordinated by the risk team, which reports to the

Chief Financial Officer. The key elements of the process are:

• The risk management process begins with the identification of

significant risks by each function. Risk identification workshops

are run to identify matters which could materially impact on

the functions or the wider business. These are attended by

Executive Management Team members and senior managers.

• Risks are assessed taking into account the potential impact

and likelihood of the risks occurring and the key mitigations

identified. The current level of risk is compared to the Board's

risk appetite to determine whether further mitigations are

required. Risks specific to the function's activities are managed

within the function on an ongoing basis with regular follow-up

by the risk team.

• The most significant risks from each function (based on

materiality, cross-functional impact and/or those which have

common themes across the business) are reviewed by the

Risk Evaluation Group, which consists of members of senior

management from each function. This Group's role is to

debate, agree and prioritise the principal business risks.

• These risks, which form the basis for the principal risks and

uncertainties detailed in this section, are challenged and

validated by the Executive Management Team and the Board.

• The principal business risks are monitored and managed

throughout the year by the Executive Management Team

and the Board with the risk team. Risk reports are provided

to the Board on a quarterly basis as a minimum.

• In addition to supporting the Board, the risk team supports the

business in its management of risks relating to key projects,

third parties, countries and bases.

PLC

BOARD

FEEDBACK FROM THE BOARD

FEEDBACK FROM THE BOARD

EXECUTIVE

MANAGEMENT

TEAM

Challenge & ownership

Risk identification & assessment

Risk identification & assessment

* A separate management system monitors

flight safety risks (easyJet's safety process is

described in more detail on pages 31 to 32).

RISK MANAGEMENT

PROCESS

SPONSORSHIP

AND RISK

APPETITE

ASSESSMENT

RISK

EVALUATION

GROUP

PRIORITISES AND

FILTERS PRINCIPAL

BUSINESS RISKS

REPUTATIONAL

RISKS

THIRD PARTY

RISKS

COUNTRY/

BASE RISKS

FINANCIAL

RISKS

OPERATIONAL

RISKS

PROJECT/

PROGRAMME

RISKS

SAFETY

RISKS*

Turn to page: 56

for further details on Risk Management and Internal control