EasyJet 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 easyJet plc Annual report and accounts 2015

Financial review continued

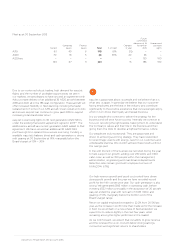

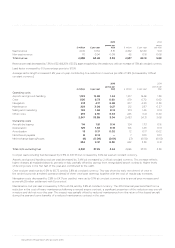

Summary consolidated statement of financial position

2015

£ million

2014

£ million

Change

£ million

Goodwill 365 365 –

Property, plant and equipment 2,877 2,542 335

Derivative financial instruments (297) (21) (276)

Unearned revenue (619) (572) (47)

Net working capital (350) (417) 67

Restricted cash 12 32 (20)

Net cash 435 422 13

Current and deferred taxation (219) (239) 20

Other non-current assets and liabilities 45 60 (15)

2,249 2,172 77

Opening shareholders’ equity 2,172 2,017

Profit for the year 548 450

Ordinary dividend paid (180) (133)

Special dividend paid –(175)

Movement in hedging reserve (222) 38

Other movements (69) (25)

2,249 2,172

Net assets increased by £77 million, with the adverse movement on the hedging reserve and the payment of the ordinary dividend more

than off set by the profit and cash generated in the period. The movement on the hedging reserve was due to the adverse mark-to-

market movement on Jet fuel forward contracts offset to an extent by favourable movements on foreign currency forward contracts.

The net book value of property, plant and equipment increased by £335 million, driven principally by the acquisition of 20 A320

family aircraft, and pre-delivery payments relating to other aircraft purchases.

ANDREW FINDLAY

Chief Financial Officer

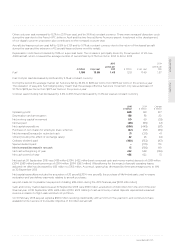

GOING CONCERN

easyJet’s business activities, together with factors likely to affect its future

development and performance, are described in the strategic report on

pages 1 to 45. Principal risks and uncertainties are described on pages 24

to 29. Note 22 to the accounts sets out the Group’s objectives, policies and

procedures for managing its capital and gives details of the risks related to

financial instruments held by the Group.

The Group holds cash and cash equivalents of £650 million and money

market deposits of £289 million as at 30 September 2015. Total debt of

£504 million is free from financial covenants, with £182 million due for

repayment in the year to 30 September 2016.

Net current liabilities at 30 September 2015 were £489 million but included

unearned revenue (payments made by customers for flights scheduled

post year end) of £619 million.

The business is exposed to fluctuations in jet fuel prices and US dollar and

euro exchange rates. The Group’s policy is to hedge between 65% and 85%

of estimated exposures 12 months in advance, and 45% and 65% of

estimated exposures from 13 up to 24 months in advance. The Group was

compliant with this policy at the date of this Annual report and accounts.

After making enquiries, the Directors have a reasonable expectation that the

Company and the Group will be able to operate within the level of available

facilities and cash and deposits for the foreseeable future. Accordingly,

they continue to adopt the going concern basis in preparing the accounts.

VIABILITY STATEMENT

The Directors have assessed easyJet’s viability over a three-year period to

September 2018. This is based on three years of the strategic plan, which

gives greater certainty over the forecasting assumptions used.

In making their assessment, the Directors took account of easyJet’s current

financial and operational positions and contracted capital expenditure. They

also assessed the potential financial and operational impacts, in severe but

plausible scenarios, of the principal risks and uncertainties set out on pages

24 to 29 and the likely degree of effectiveness of current and available

mitigating actions.

Based on this assessment, the Directors have a reasonable expectation that

the Company and the Group will be able to continue in operation and meet

all their liabilities as they fall due up to September 2018.

In making this statement, the Directors have also made the following key

assumptions:

• funding for capital expenditure in the form of capital markets debt, bank

debt or aircraft leases will be available in all plausible market conditions;

• there will not be a prolonged grounding of a substantial portion of

the fleet; and

• in the event that the UK votes to leave the European Union, the terms

of exit are such that easyJet would be able to continue to operate

over broadly the same network as at present.