EasyJet 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

107

www.easyJet.com

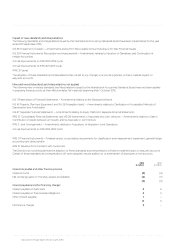

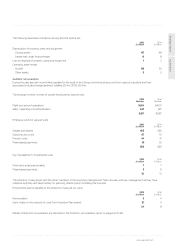

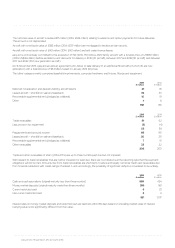

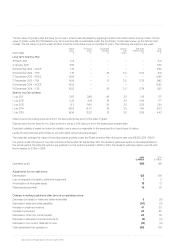

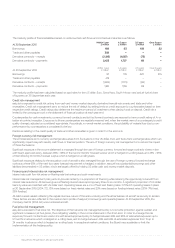

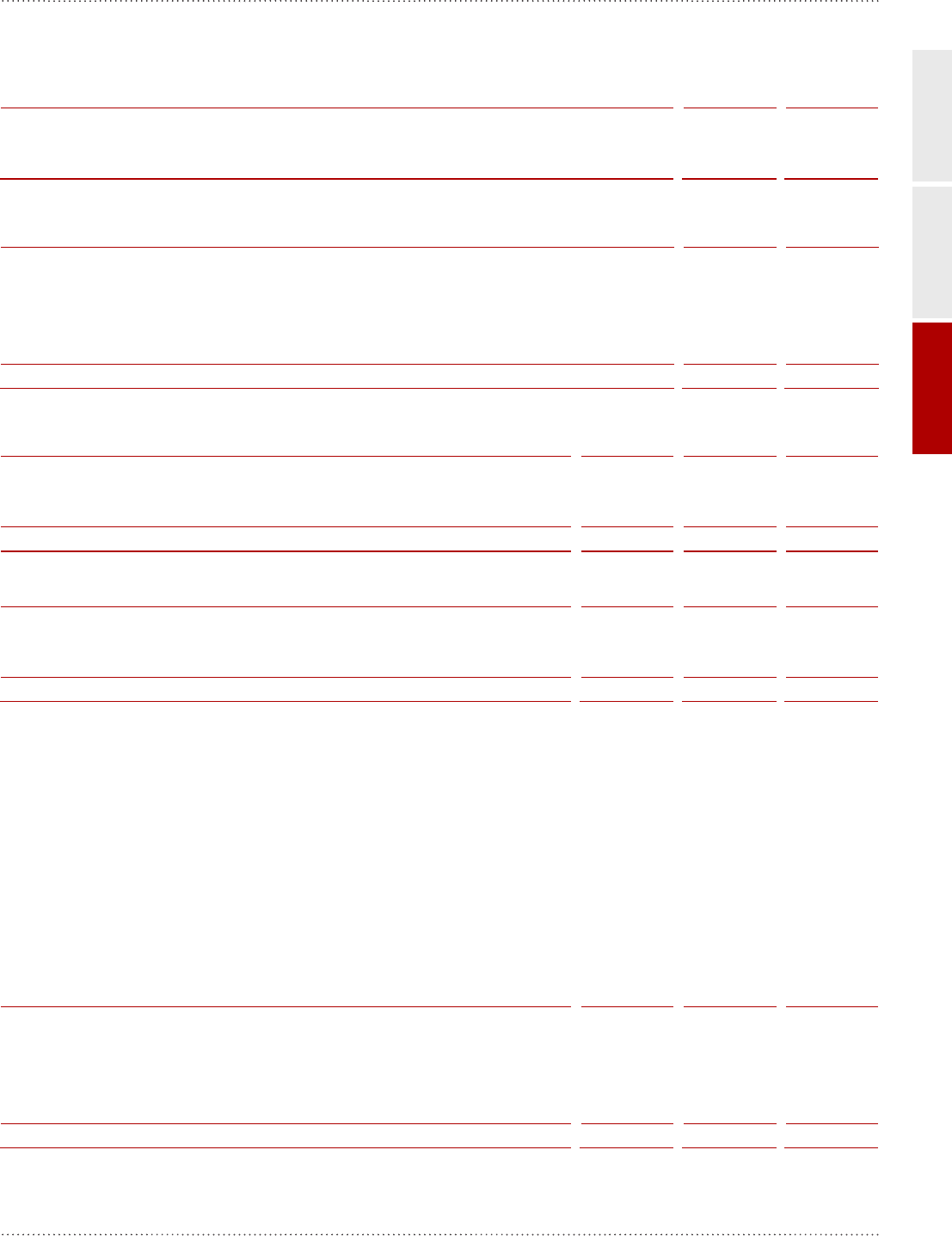

Restricted cash comprises:

2015

£ million 2014

£ million

Pledged as collateral to third parties:

Security deposits – 23

Aircraft operating lease deposits 12 9

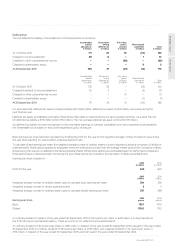

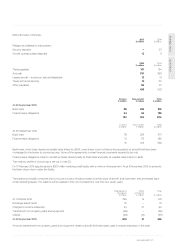

13. Trade and other payables

2015

£ million

2014

£ million

Trade payables 101 134

Accruals 310 299

Leased aircraft – surplus on sale and leaseback 12 13

Taxes and social security 16 20

Other payables 56 57

495 523

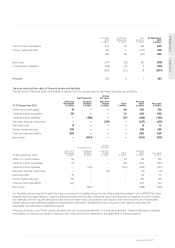

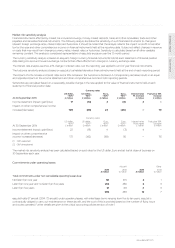

14. Borrowings

Current

£ million

Non-current

£ million

Total

£ million

At 30 September 2015

Bank loans 88 228 316

Finance lease obligations 94 94 188

182 322 504

Current

£ million

Non-current

£ million

Total

£ million

At 30 September 2014

Bank loans 78 299 377

Finance lease obligations 13 173 186

91 472 563

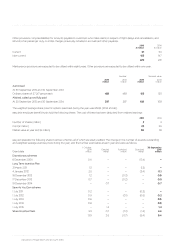

Bank loans, which bear interest at variable rates linked to LIBOR, were drawn down to finance the acquisition of aircraft that have been

mortgaged to the lender to provide security. None of the agreements contain financial covenants required to be met.

Finance lease obligations relate to aircraft and bear interest partly at fixed rates and partly at variable rates linked to LIBOR.

The maturity profile of borrowings is set out in note 22.

On 10 February 2015 easyJet signed a $500 million revolving credit facility with a minimum five-year term. As at 16 November 2015 no amounts

had been drawn down under this facility.

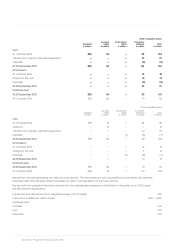

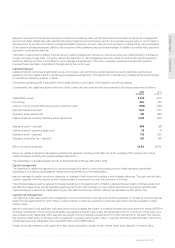

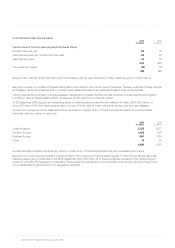

15. Non-current deferred income

The balance principally comprises the non-current surplus of sale proceeds over fair value of aircraft that have been sold and leased back

under operating leases. This balance will be realised in the income statement over the next seven years.

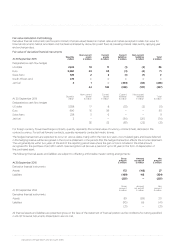

16. Provisions for liabilities and charges

Maintenance

provisions

£ million

Other

provisions

£ million

Total

£ million

At 1 October 2014 226 15 241

Exchange adjustments 10 – 10

Charged to income statement 45 37 82

Transferred from property, plant and equipment (48) – (48)

Utilised (28) (31) (59)

At 30 September 2015 205 21 226

Amounts transferred from property, plant and equipment relate to aircraft life-limited parts used in engine restoration in the year.