EasyJet 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

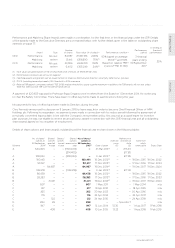

72 easyJet plc Annual report and accounts 2015

2. A performance adjusted award of 22,762 easyJet shares will

be made to compensate for the forfeiture of the long-term

incentive award he received in August 2013 from his previous

employer. Since around two-thirds of the vesting period for

this award had already run its course, the Committee assessed

the extent to which the performance targets were likely to

be met (based on current market forecasts) in respect of the

shares comprising two-thirds of the award and converted this

number of shares into an equivalent value of easyJet shares

on joining. These will vest, subject to continued employment

with easyJet, on 7 August 2016, so as to mirror the original

time horizon of the award. A further award of 14,625 easyJet

shares relating to the forfeiture of the August 2013 award was

also granted. This award was calculated based on the value of

one-third of the award at the time of joining easyJet, but these

shares will only vest to the extent that the performance

targets set for the 2013 easyJet LTIP award are met and

continued employment to 17 December 2016. The Committee

was comfortable with providing this form and level of

compensation since it replicated its assessment of the value

forfeit and also, in part, switched into easyJet performance

on a pro-rata basis for part of the award.

3. An award of 39,923 easyJet shares will be made to

compensate for the forfeiture of the award granted to the

individual in August 2014. This award comprised an exchange

of the maximum number of shares that could vest under his

previous employers’ award which were then converted to

easyJet shares on joining. These shares will only vest based on

the extent to which the performance targets applying to the

2014 easyJet LTIP award are met and the individual remaining

in employment until 19 December 2017, being the ordinary

vesting date for the easyJet award and later than the vesting

date of the original award at his former employer. The

Committee was comfortable with providing this form of

compensation given the performance period at the individual’s

previous employer for this award had only recently

commenced and so switching to an equivalent value in

performance related easyJet shares resulted in alignment

being achieved with the wider executive team at easyJet.

Each of the replacement share awards detailed above will be

subject to easyJet’s shareholding guidelines whereby Andrew

Findlay will be required to retain at least half of the (after tax)

number of shares exercised from the awards until he has built

a shareholding that, when aggregated with his other easyJet

shareholdings, is of equivalent value to 175% of salary.

How will the remuneration policy be applied for the 2016

financial year?

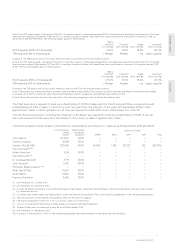

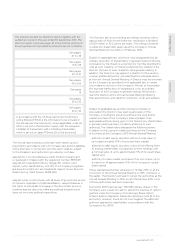

What are the Executive Directors’ current salaries?

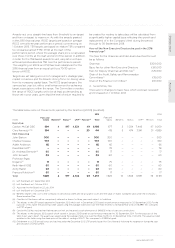

The current and proposed salaries of the Executive Directors are:

1 January 2016

salary

1 January 2015

or on

appointment

to the Board

salary Change

CEO £705,600 £698,600 1%

CFO(1) £425,000 £425,000 0%

(1) The current CFO, Andrew Findlay, was appointed to the Board on

2 October 2015. His base salary on appointment was set at £425,000

and no increase will be awarded in the 2016 financial year. The salary

of former CFO, Chris Kennedy, was £430,800.

The increase to be awarded to the Chief Executive is consistent

with the typical rate of increase being awarded across the Group.

What bonus will be awarded in respect of performance in the

2016 financial year?

The maximum bonus opportunity remains at 200% of salary for

the Chief Executive and at 175% for the Chief Financial Officer.

The measures have been selected to reflect a range of financial

and operational goals that support the key strategic objectives

of the Company.

The performance measures and weightings will be as follows:

As a percentage of maximum

bonus opportunity

Measure CEO CFO

Profit before tax 70% 60%

On-time performance 10% 10%

Customer satisfaction 10% 10%

Operating costs (excluding fuel)

per seat at constant currency 10% 10%

Departmental objectives – 10%

The proposed target levels for the 2016 financial year have been

set to be challenging relative to the business plan.

The Committee is comfortable that the bonus targets for both

Executive Directors are appropriately demanding in light of their

respective bonus opportunities.

The targets themselves, as they relate to the 2016 financial year,

are commercially sensitive. However, retrospective disclosure of

the targets and performance against them will be provided in

next year’s remuneration report unless they remain commercially

sensitive. The safety of our customers and people underpins

all of the operational activities of the Group and the bonus plan

includes a provision that enables the Remuneration Committee

to scale back the bonus earned in the event that there is a

safety event that occurs that it considers warrants the use of

such discretion.

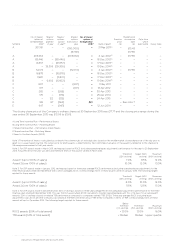

How will the LTIP be operated in relation to the 2016 financial year

awards?

The 2015 financial year was the last time that LTIP awards were

made via a combination of Performance and Matching Share

Awards. Matching Share Awards will no longer operate from

the 2016 financial year onwards and LTIP awards will be made

as Performance Shares only.

The award levels for the Executive Directors in the 2016 financial

year will be 250% of salary for the Chief Executive and 200% of

salary for the Chief Financial Officer.

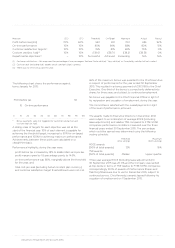

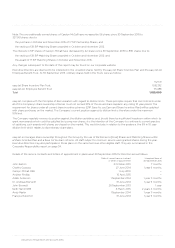

The 2016 financial year LTIP awards will be subject to the

following performance conditions:

Below

threshold

(0% vesting)

Threshold

(25% vesting)

On-target

(50%

vesting)

Maximum

(100%

vesting)

ROCE (70%

of total award) <15% 15% 18% 20%

Below

threshold

(0% vesting)

Threshold

(25% vesting)

Maximum

(100%

vesting)

TSR (30% of total award) <Median Median

Upper

quartile

Directors’ remuneration report continued