EasyJet 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

71

www.easyJet.com

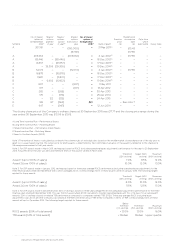

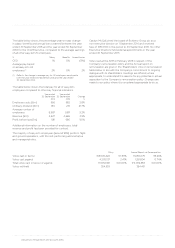

Element Purpose and link to strategy Operation (including maximum levels where applicable)

Fees To attract and retain a high-

calibre Chairman, Deputy

Chairman and Non-Executive

Directors by offering market-

competitive fee levels.

The Chairman is paid an all-inclusive fee for all Board responsibilities.

The other Non-Executive Directors receive a basic Board fee, with

supplementary fees payable for additional Board Committee responsibilities.

The Chairman and Non-Executive Directors do not participate in any of the

Company’s incentive arrangements.

Fee levels are reviewed on a periodic basis, and may be increased, taking into

account factors such as the time commitment of the role and market levels

in companies of comparable size and complexity.

Flexibility is retained to exceed current fee levels if it is necessary to do so

in order to appoint a new Chairman or Non-Executive Director of an

appropriate calibre.

Necessary expenses incurred undertaking Company business will be

reimbursed so that the Chairman and Non-Executive Directors are not

worse off, on a net of tax basis, for fulfilling Company duties.

No other benefits or remuneration are provided to the Chairman or

Non-Executive Directors.

Fee levels for current incumbents for the 2016 financial year are as follows:

• Non-Executive Chairman: £300,000;

• Non-Executive Director base fee: £60,000;

• supplementary fee for Deputy Chairman and Senior Independent Director

(SID) role: £25,000; and

• supplementary fee for Chair of the Audit, Remuneration and Safety

Committees: £15,000, and Finance Committee Chair: £10,000.

ANNUAL REPORT ON REMUNERATION

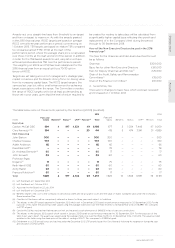

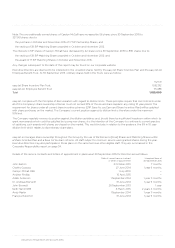

Who is on the Company’s Remuneration Committee?

As at 30 September 2015, the members of the Committee were:

Charles Gurassa (Chair), François Rubichon and John Browett.

David Bennett stepped down from the Committee on 1 October

2014 and Professor Rigas Doganis stepped down from the

Committee on 1 December 2014 following their retirement from

the Board. The responsibilities of the Committee are set out in

the Corporate Governance section of the Annual Report on

page 53.

The Chief Executive attends meetings by invitation and assists

the Committee in its deliberations as appropriate. The

Committee also receives assistance from the Group People

Director and the Group Head of Reward. The Group Company

Secretary acts as secretary to the Committee. No Directors are

involved in deciding their own remuneration.

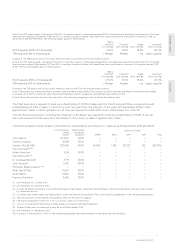

The Remuneration Committee is advised by Hewitt New

Bridge Street (HNBS), (an AON company). A sister company

in the AON Group also provides pension and flexible benefits

administration services to the company. HNBS was appointed

by the Committee in 2004. HNBS advises the Committee on

developments in executive pay and on the operation of easyJet’s

incentive plans. Total fees paid to HNBS in respect of services to

the Committee during the 2015 financial year were £133,000.

HNBS is a signatory to the Remuneration Consultants’ Group

Code of Conduct. The Committee has reviewed the operating

processes in place at HNBS and is satisfied that the advice it

receives is independent and objective.

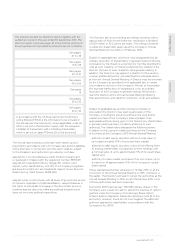

How has the new CFO’s package been set?

Andrew Findlay’s package is in line with that applicable to the

previous CFO, and is in line with our policy, other than salary on

appointment which has been set at £425,000 (with the previous

CFO’s salary set at £430,800 at the time of his departure).

In addition, certain performance related buy-out arrangements

have been agreed to compensate Andrew Findlay for bonus and

long-term incentive awards forfeited from his previous employer.

The approach to the buy-out is in line with the Company’s policy

on buy-out arrangements (and the expectations of institutional

investors where a buy-out takes place). The payment was

performance related in that it has been calculated so as to

replicate the likely value and time horizons associated with

the awards at the previous employer.

The buy-out comprised:

1. A cash payment of equivalent value to the bonus he would

have been eligible to receive from his previous employer in

relation to the year of his departure. The payment was

performance related in that the amount of the bonus was

determined based on his former company’s reported

disclosures of how the company performed against its bonus

targets. The cash payment, amounting to £311,837, was paid in

October 2015. The Committee was comfortable with providing

this form and level of compensation since it replicated the

amount of value forfeit in connection with joining easyJet.