EasyJet 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

121

www.easyJet.com

Notes to the company accounts

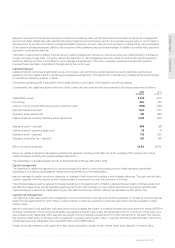

a) Significant accounting policies

The significant accounting policies applied in the preparation of these Company accounts are the same as those set out in note 1 to

the consolidated accounts with the addition of the following.

Investments

Investments in subsidiaries are stated at cost, less any provision for impairment. Where subsidiary undertakings incur charges for share-

based payments in respect of share options and awards granted by the Company, a capital contribution in the same amount is recognised

as an investment in subsidiary undertakings with a corresponding credit to shareholders’ equity.

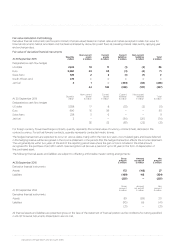

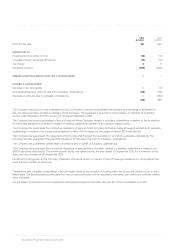

b) Income statement and statement of total comprehensive income

In accordance with Section 408 of the Companies Act 2006, the Company is exempt from the requirement to present its own income

statement and statement of comprehensive income. The Company’s profit for the year was £221 million (2014: £667 million). Included in this

amount are cash dividends received of £199 million (2014: £650 million – in-specie), which are recognised when the right to receive payment

is established. The Company recognised no other income or expenses in either the current or prior year, other than the profit for each year.

The Company has eight employees at 30 September 2015 (2014: ten). These are the Non-Executive Directors of easyJet plc; their

remuneration is paid by easyJet Airline Company Limited. The Executive Directors of easyJet plc are employed and paid by easyJet Airline

Company Limited. Details of Directors’ remuneration are disclosed in note 4 to the consolidated accounts and in the Directors’ remuneration

report on pages 64 to 80.

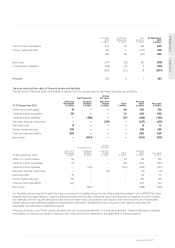

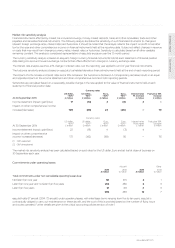

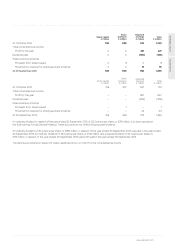

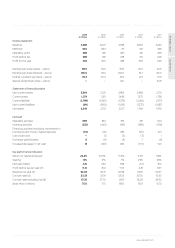

c) Investments in subsidiary undertakings

Investments in subsidiary undertakings were as follows:

2015

£ million 2014

£ million

At 1 October 309 286

Capital contributions to subsidiaries 18 23

Allotment and issue of shares by subsidiaries 551 –

At 30 September 878 309

A full list of Group companies are detailed below.

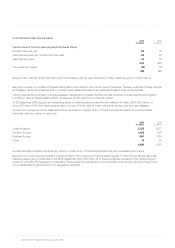

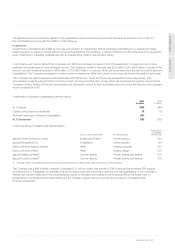

Country of incorporation Principal activity

Percentage

of ordinary

shares held

easyJet Airline Company Limited England and Wales Airline operator 100

easyJet Switzerland S.A. Switzerland Airline operator 49

Dawn Licensing Holdings Limited Malta Holding company 100

Dawn Licensing Limited Malta Graphic design 100

easyJet Sterling Limited(1) Cayman Islands Aircraft trading and leasing 100

easyJet Leasing Limited(1) Cayman Islands Aircraft trading and leasing 100

(1) Although these companies are Cayman Islands incorporated they have always been, and continue to be, UK tax resident.

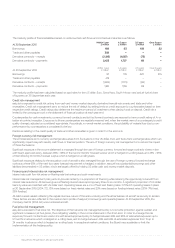

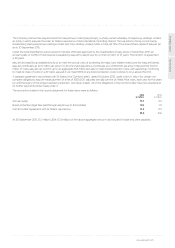

The Company has a 49% interest in easyJet Switzerland S.A. with an option that expires in 2016 to acquire the remaining 51%. easyJet

Switzerland S.A. is a subsidiary on the basis that the Company exercises a dominant influence over the undertaking. A non-controlling

interest has not been reflected in the consolidated accounts on the basis that holders of the remaining 51% of the shares have no

entitlement to any dividends from that holding and the Company has an option to acquire those shares for a predetermined

minimal consideration.