EasyJet 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

15

www.easyJet.com

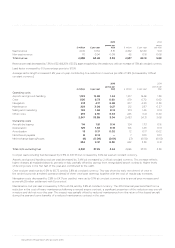

Sensitivities

• A $10 movement per metric tonne impacts the 2016 financial

year fuel bill by $3.5 million.

• A one cent movement in £/$ impacts the 2016 financial year

profit before tax by £1.5 million.

• A one cent movement in £/€ impacts the 2016 financial year

profit before tax by £0.7 million.

• A one cent movement in £/CHF impacts the 2016 financial

year profit before tax by £0.4 million.

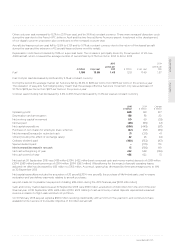

OUTLOOK

We remain confident in our ability to deliver growth and returns

for shareholders as we continue to execute our strategy. For the

year to 30 September 2016 we plan to increase capacity by c.7%

and by c.8% in the first half of the year as we invest in profitable

growth. We will continue to expand in our new bases of

Hamburg, Amsterdam and Oporto as well as consolidating our

strong market positions in the UK, Switzerland, France and Italy.

Demand remains resilient and with forward bookings in line with

last year, we view the future with confidence.

Based on current market fuel prices we expect the unit fuel(4) bill

to decline by between £140 million and £160 million during the

year to 30 September 2016. As you would expect, passengers

will continue to benefit from the lower fuel cost and therefore

we expect a slight decline in revenue per seat at constant

currency during the first half of the year.

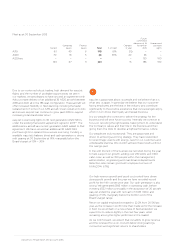

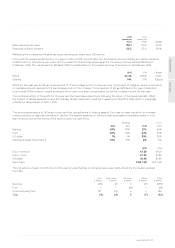

HEDGING POSITIONS

easyJet operates under a clear set of treasury policies agreed by the Board. The aim of easyJet’s hedging policy is to reduce short

term earnings volatility. Therefore, easyJet hedges forward, on a rolling basis, between 65% and 85% of the next 12 months

anticipated fuel and currency requirements and between 45% and 65% of the following 12 months anticipated requirements.

Details of current hedging arrangements are set out below:

Percentage of anticipated requirement hedged

Fuel

requirement

US Dollar

requirement

Euro

surplus

CHF

surplus

Six months to 31 March 2016 85% 89% 75% 69%

Average rate $852 /metric tonne $1.62 €1.20 CHF 1.46

Full year ending 30 September 2016 83% 81% 80% 67%

Average rate $830 /metric tonne $1.63 €1.22 CHF 1.46

Full year ending 30 September 2017 60% 61% 54% 51%

Average rate $664 /metric tonne $1.55 €1.33 CHF 1.43

We expect a slight decline in total cost per seat at constant

currency including fuel for the full year of approximately 1%, based

on jet fuel prices within a range of $450 per metric tonne to $556

per metric tonne. Cost per seat excluding fuel and currency is

expected to increase by approximately 2% for the full year. This

will be weighted towards the first six months to 31 March 2016,

primarily reflecting further increases in regulated airports costs and

navigation charges, disruption costs and an expected cold winter.

Exchange rate movements(5) are likely to have an adverse impact

of approximately £15 million in the first half year compared to the

six months to 31 March 2015 and £40 million for the 12 months

to 30 September 2016 compared to the 12 months to

30 September 2015. Consequently market expectations are

in line within the Board’s expectations for the full year.

We continue to see significant longer term opportunities to

grow revenue, profit and shareholder returns. We expect market

demand to remain strong and easyJet’s unique model and

strategy are well-positioned to capture significant value from

favourable trends in both leisure and business markets.

CAROLYN MCCALL OBE

Chief Executive

(3) The aircraft list prices based on the relevant price catalogue in January 2012, is US$76,260,569 for the current generation A320 aircraft and US$92,346,946

for the new generation A320 NEO aircraft (being the sum of the airframe list price, engine option list price and the price of certain assumed specification

change notices). Therefore the total list price for the 36 aircraft is approximately US$3,227,971,794.

(4) Unit fuel calculated as the difference between latest estimate of the 2016 financial year fuel costs less the 2015 financial year fuel cost per seat multiplied

by 2016 financial year seat capacity.

(5) US $ to £ sterling 1.522, euro to £ sterling 1.4106. Currency and fuel increases are shown net of hedging impact.