EasyJet 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

77

www.easyJet.com

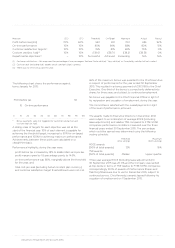

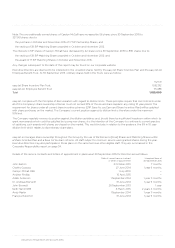

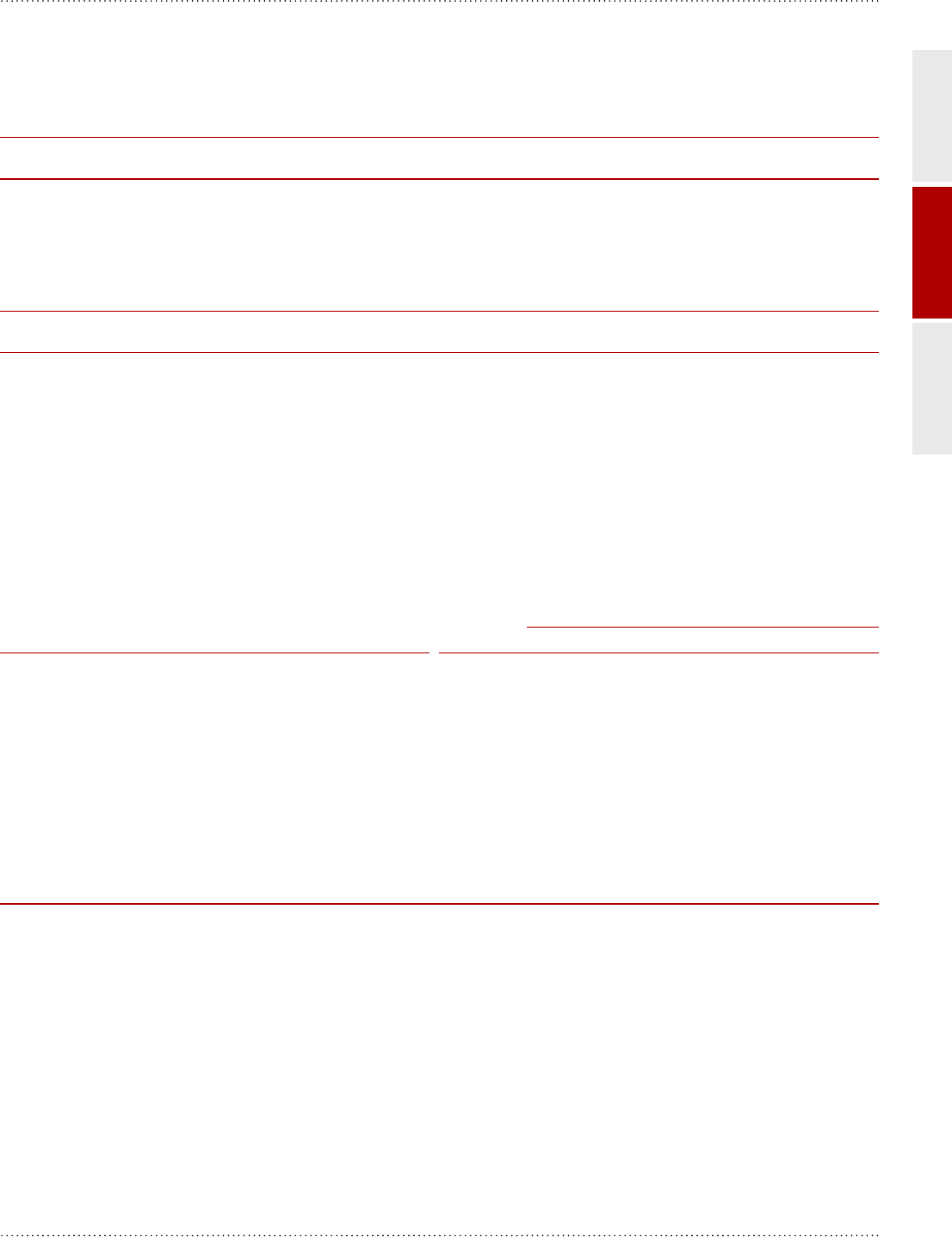

Note 5: For LTIP awards made in December 2013, 50% of vesting is based on three-year average ROCE (including lease adjustment) performance for the three

financial years ending 30 September 2016 and 50% of vesting is based on relative total shareholder return performance compared to companies in the top

decile versus ranked FTSE 51-150. The following targets apply for these awards:

Below

threshold

(0% vesting)

Threshold

(25% vesting)

Target

(40% vesting)

Maximum

(100% vesting)

ROCE awards (50% of total award) < 15.0% 15.0% 18.5% 20.0%

TSR awards (50% of total award) < Median Median n/a Upper quartile

In addition, the TSR awards will not vest unless there has been positive TSR over the performance period.

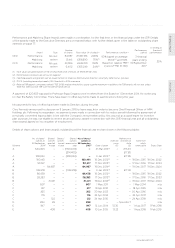

Note 6: For LTIP awards made in December 2014, 50% of vesting is based on three-year average ROCE (including lease adjustment) performance for the three

financial years ending 30 September 2017 and 50% of vesting is based on relative total shareholder return performance compared to companies ranked FTSE

31-130. The following targets apply for these awards:

Below

threshold

(0% vesting)

Threshold

(25% vesting)

Target

(40% vesting)

Maximum

(100% vesting)

ROCE awards (50% of total award) < 15.0% 15.0% 18.2% 20.0%

TSR awards (50% of total award) < Median Median n/a Upper quartile

In addition, the TSR awards will not vest unless there has been positive TSR over the performance period.

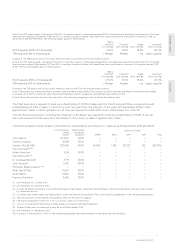

Note 7: Participants buy Partnership Shares monthly under the Share Incentive Plan. The Company provides one Matching Share for each Partnership Share

purchased, up to the first £1,500 per year. These Matching Shares are first available for vesting three years after purchase.

Note 8: These shares/options lapsed in the year due to Chris Kennedy resigning as Director before the maturity date.

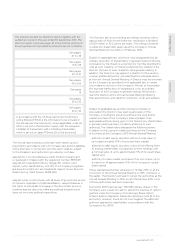

What are the shareholding guidelines for Directors?

The Chief Executive is required to build up a shareholding of 200% of salary and the Chief Financial Officer is required to build

a shareholding of 175% of salary, to be built up over five years from the adoption of the policy (27 September 2012) or their

appointment, if later. Until the guideline is met, they are required to retain 50% of net vested shares from the LTIP.

The Non-Executive Directors, including the Chairman of the Board, are required to build up a shareholding of 100% of annual

fees over a period of three years from the adoption of the policy or date of appointment, if later.

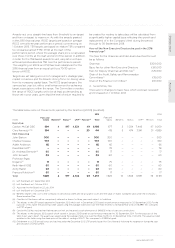

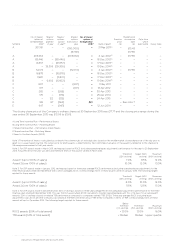

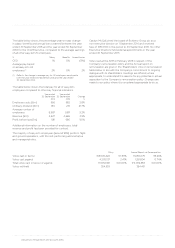

What are the Directors’ current shareholdings and interests in shares?

The following table provides details on the Directors’ shareholdings and interests in shares as at 30 September 2015 (Audited):

Unconditionally

owned

shares(3)

Shareholding

guidelines

achieved(4)

Interests in shares

DABP(5) SAY E LTIP(6) SIP(7) Total

John Barton 24,000 100% – – – – –

Charles Gurassa 18,198 100% – – – – –

Carolyn McCall OBE 327,895 100% 46,482 1,355 512,127 912 560,876

Chris Kennedy(9)(10) – – – – – – –

Adèle Anderson 5,114 100% – – – – –

David Bennett(1)(10) – – – – – – –

Dr. Andreas Bierwirth 3,771 100% – – – – –

John Browett 5,412 100% – – – – –

Professor Rigas Doganis(2)(10) – – – – – – –

Keith Hamill OBE 4,560 100% – – – – –

Andy Martin 7,000 100% – – – – –

François Rubichon 3,465 100% – – – – –

(1) Left the Board on 1 October 2014.

(2) Left the Board on 1 December 2014.

(3) Includes SIP Partnership Shares, vested SIP Performance (Free) Shares, vested SIP Matching Shares, LTIP Investment Shares, and any shares owned

by connected persons.

(4) Unconditionally owned shares and share interests under the Deferred Annual Bonus Plan count towards achievement of the shareholding guidelines.

(5) The principal terms of the Deferred Annual Bonus Plan are described on page 67.

(6) LTIP shares are granted in the form of nil cost options subject to performance.

(7) Consists of unvested SIP Performance (Free) Shares and unvested SIP Matching Shares.

(8) Andrew Findley was not employed by easyJet as at 30 September 2015.

(9) Left the Board on 1 September 2015.

(10) In respect of these Directors, 100% of the shareholding guideline had been achieved on the dates they left the Board.