EasyJet 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

75

www.easyJet.com

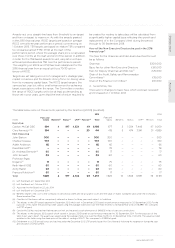

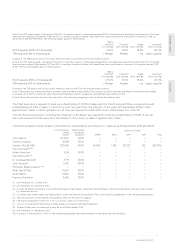

What LTIP awards were granted to Directors in the financial year?

Performance and Matching Share Awards were made in combination, for the final time, in the financial year under the LTIP. Details

of the awards made to the Executive Directors are summarised below, with further details given in the table on outstanding share

interests on page 77.

Award Type

Number

of shares Face value (% of salary)(1) Performance condition(2)

Performance

period

% vesting at

threshold

performance

CEO Performance Nil cost

option

84,987 £1,397,186 200% 50% based on average

ROCE(4) and 50%

Based on relative TSR(5)

(versus FTSE 31-130)

3 financial

years ending

30 September

2017

25%

Matching 31,441 £516,890 75%(3)

CFO Performance Nil cost

option

39,306 £646,190 150%

Matching 6,402 £105,249 24%(3)

(1) Face value calculated based on the closing share price of £16.44 on 18 December 2014.

(2) Performance conditions are set out on page 67.

(3) Matching awards are granted over an equal number of shares as the Executive Directors voluntarily defer bonus (pre-tax).

(4) ROCE (including lease adjustments) 15% threshold to 20% maximum.

(5) Relative TSR against companies ranked FTSE 31-130 median threshold to upper quartile maximum. In addition, the TSR awards will not vest unless

there has been positive TSR over the performance period.

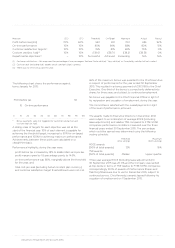

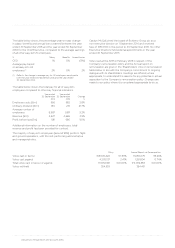

Have there been any payments to past Directors? (Audited)

A payment of £20,833 was paid to Professor Rigas Doganis since he retired from the Board on 1 December 2014, for continuing

to chair the Safety Committee. There have been no other payments made to past Directors during the year.

Have there been any payments for loss of office? (Audited)

No payments for loss of office have been made to Directors during the year.

Chris Kennedy announced his decision on 8 January 2015 to leave easyJet in order to become Chief Financial Officer of ARM

Holdings plc. Following his resignation, no payments were made in connection with his notice period following the agreement of

a mutually convenient leaving date. In line with the Company’s remuneration policy, this was not as a good leaver for incentive

plan purposes, he was not eligible to receive an annual bonus award in connection with the 2015 financial year and all outstanding

share awards lapsed on his cessation of employment.

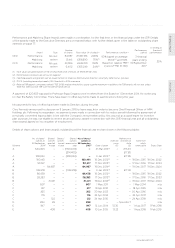

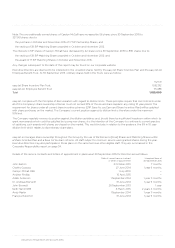

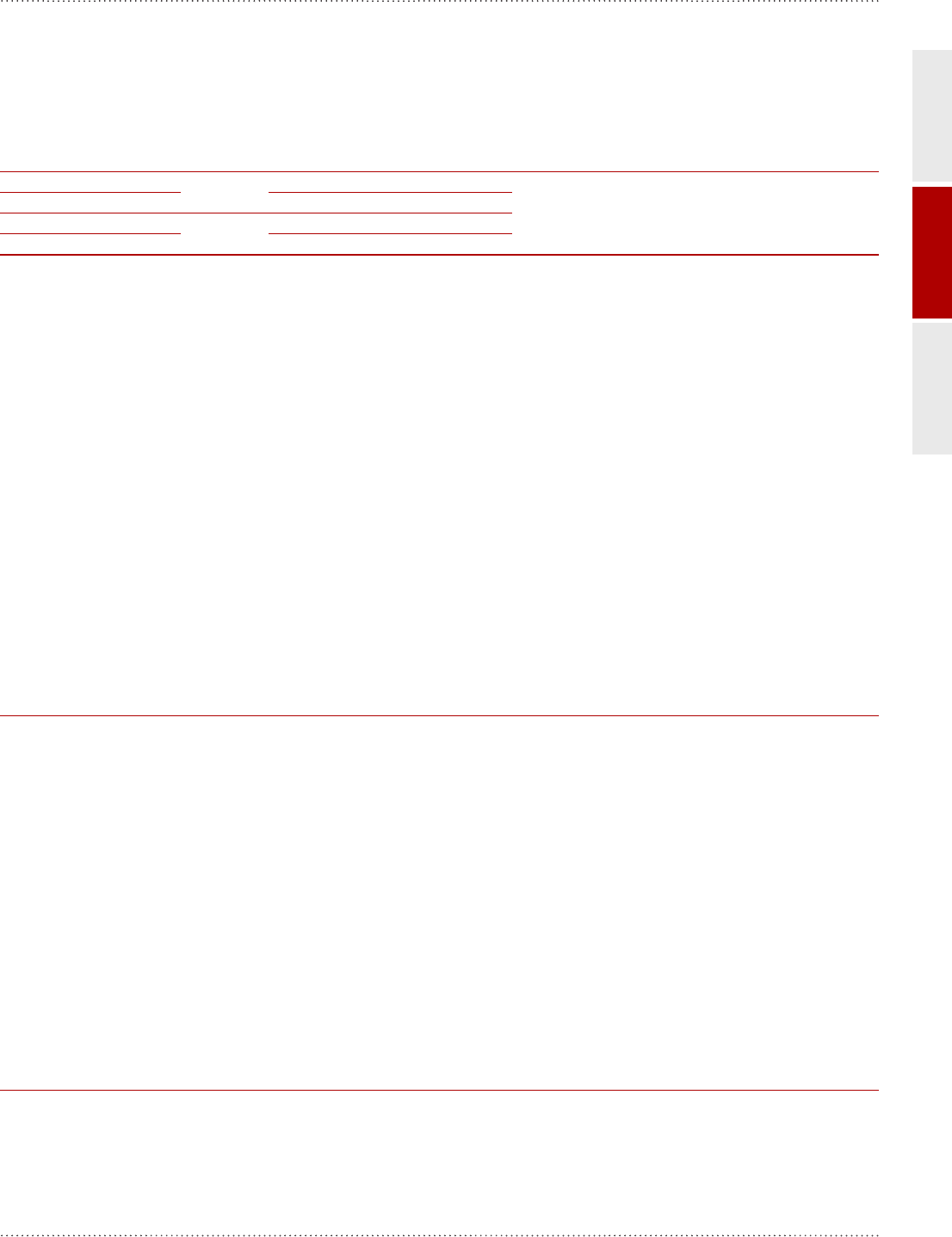

What share awards do the Executive Directors have outstanding at the financial year end? (Audited)

Details of share options and share awards outstanding at the financial year end are shown in the following tables:

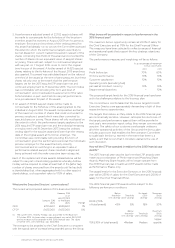

Carolyn McCall OBE

Scheme

No. of shares/

options at

30 September

2014(1)

Shares/

options

granted

in year

Shares/

options

lapsed

in year

Shares/

options

exercised in

year

No. of shares/

options at

30 September

2015(1) Date of grant

Exercise

price

(£)

Market price

on exercise

date

(£)

Date from

which

exercisable Expiry Date

A 344,405 – – (130,000) –31 Mar 2011(2) – £15.43 – –

(214,405) £17.85

A 338,594 – – (338,594) –4 Jan 2012(3) – £17.85 – –

A 180,461 – – – 180,461 18 Dec 2012(4) – – 18 Dec 2015 18 Dec 2022

A 90,517 – – – 90,517 17 Dec 2013(5) – – 17 Dec 2016 17 Dec 2023

A – 84,987 – – 84,987 19 Dec 2014(6) – – 19 Dec 2017 19 Dec 2024

B 106,978 – – (106,978) –4 Jan 2012(3) – £17.93 – –

B 86,438 – – – 86,438 18 Dec 2012(4) – – 18 Dec 2015 18 Dec 2022

B 38,283 – – – 38,283 17 Dec 2013(5) – – 17 Dec 2016 17 Dec 2023

B – 31,441 – – 31,441 19 Dec 2014(6) – – 19 Dec 2017 19 Dec 2024

C 807 – – – 807 1 May 2011 – – 1 May 2014 n/a

C 617 – – – 617 18 Apr 2012 – – 18 Apr 2015 n/a

C 265 – – – 265 30 Apr 2013 – – 30 Apr 2016 n/a

C 176 – – – 176 25 Apr 2014 – – 25 Apr 2017 n/a

C – 122 – – 122 24 Apr 2015 – – 24 Apr 2018 n/a

D 894 95 – – 989 – – See note 7 – n/a

E 947 – – – 947 12 Jun 2014 13.30 – 1 Aug 2017 1 Feb 2018

E – 408 – – 408 10 Jun 2015 13.23 – 1 Aug 2018 1 Feb 2019