EasyJet 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

105

www.easyJet.com

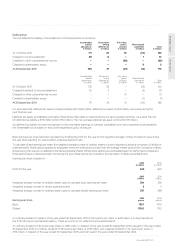

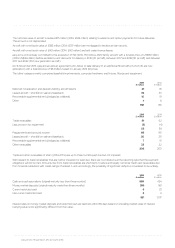

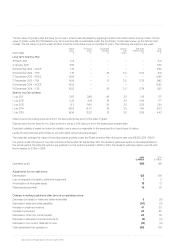

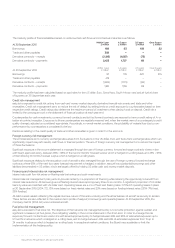

Both fuel price and exchange rates are volatile in nature, and the assumptions used represent management’s view of reasonable average

rates. Operating margins are sensitive to significant changes in these rates.

Cash flow projections beyond the forecast period have been extrapolated using growth rate scenarios ranging from zero up to an

estimated average of long-term economic growth rates for the principal countries in which easyJet operates. No impairment resulted

from any of these scenarios.

No reasonably possible combination of changes to the key assumptions above would result in the carrying value of the cash-generating

unit exceeding its recoverable amount.

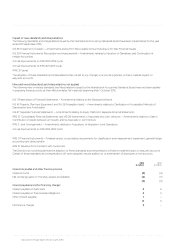

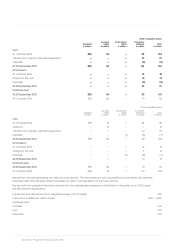

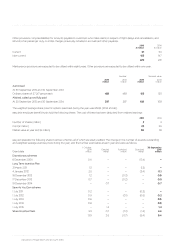

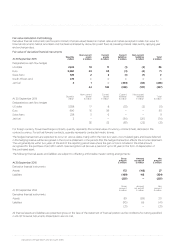

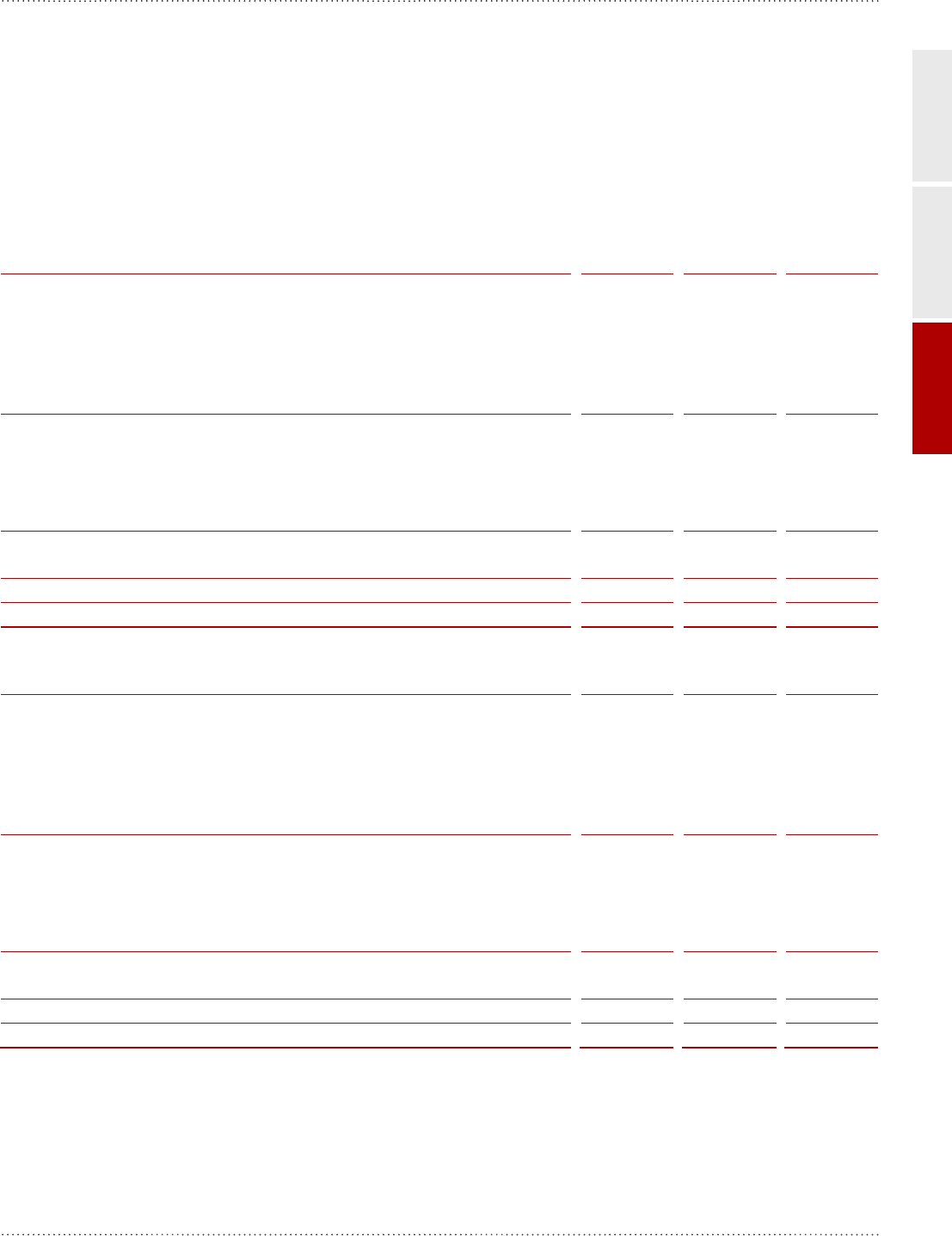

9. Property, plant and equipment

Aircraft

and spares

£ million

Other

£ million

Total

£ million

Cost

At 1 October 2014 3,035 36 3,071

Additions 500 36 536

Transfer to intangible assets – (27) (27)

Transfer to maintenance provisions (48) – (48)

Disposals (2) (2) (4)

At 30 September 2015 3,485 43 3,528

Depreciation

At 1 October 2014 517 12 529

Charge for the year 121 4 125

Disposals (2) (1) (3)

At 30 September 2015 636 15 651

Net book value

At 30 September 2015 2,849 28 2,877

At 1 October 2014 2,518 24 2,542

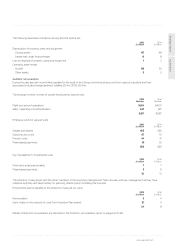

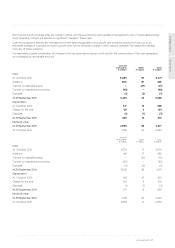

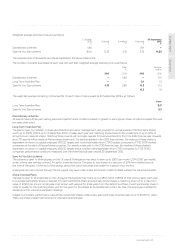

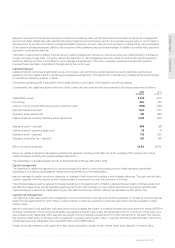

Aircraft

and spares

£ million Other

£ million

Total

£ million

Cost

At 1 October 2013 2,674 31 2,705

Additions 419 17 436

Transfer to intangible assets – (10) (10)

Transfer to maintenance provisions (55) – (55)

Disposals (3) (2) (5)

At 30 September 2014 3,035 36 3,071

Depreciation

At 1 October 2013 415 10 425

Charge for the year 103 3 106

Disposals (1) (1) (2)

At 30 September 2014 517 12 529

Net book value

At 30 September 2014 2,518 24 2,542

At 1 October 2013 2,259 21 2,280