EasyJet 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 easyJet plc Annual report and accounts 2015

Risk continued

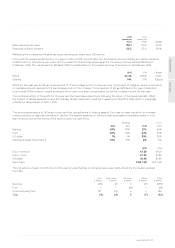

STRONG BALANCE SHEET

Risk description Mitigation

Financial risk

easyJet is exposed to a variety of financial risks

which could give rise to adverse pressure on

the financial performance of the Company,

e.g. costs, revenue.

• Market risks – significant/sudden increases in

jet fuel prices, currency fluctuations or interest

rates which have not been adequately

protected through hedging

• Counterparty risk – non-performance of

counterparties used for depositing surplus

funds (e.g. money market funds,

bank deposits)

• Liquidity risk – misjudgement in the level

of liquidity resulting in inability to meet

contractual/contingent financial obligations

or the inability to fund the business

when needed.

Link to strategy:

3 4

The Finance Committee (a committee of the Board) oversees the Group's

treasury and funding policies and activities.

Turn to page: 59

for further details

This includes:

• a treasury policy setting out Board approved strategies for foreign exchange

and fuel hedging, along with liquidity, interest rate management, counterparties

and cash deposit limits; and

• reviewing and reporting on compliance with Board treasury policies.

The policy is to hedge within a percentage band for a rolling 24-month period.

Board policy is to maintain target liquidity at £4 million per aircraft, which is

supported by a $500 million (five-year) revolving credit facility provided by

a group of 12 relationship banks. This allows the Group to better manage

the impact of downturns in business or temporary curtailment of activities.

A strong balance sheet supports the business through fluctuations in

economic conditions.

Risk description Mitigation

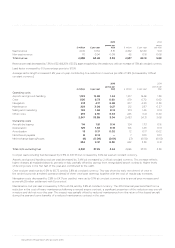

Major shareholder and brand

owner relationship

easyJet has two major shareholders (easyGroup

Holdings Limited and Polys Holding Limited)

which, as a concert party, control 33.73% of

its ordinary shares. Shareholder activism could

adversely impact the reputation of easyJet

and cause a distraction to management.

easyJet does not own its Company name or

branding, which is licensed from easyGroup Ltd.

The licence includes certain minimum service

levels that easyJet must meet in order to retain

the right to use the name and brand. The easyJet

brand could also be impacted through the actions

of easyGroup or other easyGroup licensees.

Link to strategy:

4

easyJet has an active shareholder engagement programme led by its investor

relations team. As part of that programme easyJet engages with easyGroup

Holdings Limited on a regular basis alongside its other major shareholders.

In addition to engaging with easyGroup as part of the shareholder engagement

programme, the Company has a relationship agreement with easyGroup and

Polys Holdings in line with the controlling shareholder regime as set out in the

Financial Conduct Authority's Listing Rules.

Turn to page: 83

for further details

Representatives from the Board and senior management take collective

responsibility for addressing issues arising from any activist approach adopted

by the major shareholder. The objective is to proactively address issues before

they arise and anticipate and plan for potential future activism.

The brand licence agreement with easyGroup Ltd provides for the regular

meeting of senior representatives from both sides to actively manage brand-

related issues as they arise. Such meetings occur on a quarterly basis and have

proven effective. easyJet also monitors compliance with brand licence service

levels and has a right to take steps to remedy any instance of non-compliance.

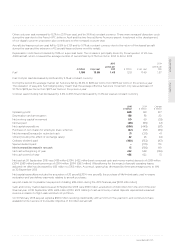

REPUTATIONAL RISKS