EasyJet 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

11

www.easyJet.com

1BUILD STRONG NUMBER ONE

AND TWO NETWORK POSITIONS

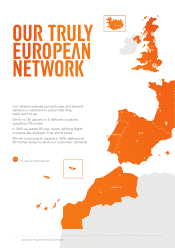

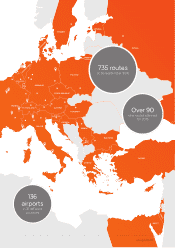

easyJet flies to a network of primary airports and routes that tap

into deep, wealthy markets with populations that have a high

propensity to fly. We have chosen to establish ourselves at the right

airports, serving valuable catchment areas that represent Europe’s

top markets by GDP, driving both leisure and business travel. This is

also where strong markets already exist, built up over a period of

time by legacy carriers. We have the opportunity both to capture

further market share and to grow the overall market.

Driven by strong underlying demand and an attractive customer

proposition, we will continue to invest in growing our network.

We operate more of the top 100 routes in Europe than any other

airline and our route frequencies deliver choice and flexibility for

our customers while increasing returns. Our competitive advantage

is reinforced by the overall portfolio of peak time slots at airports

where either total slot availability or availability at customer-friendly

times is constrained.

We regularly review the route network in order to maximise returns

and exploit demand opportunities in the market. During the year we

added a net 60 routes to the network, slightly more than last year.

These were allocated to new bases, such as Amsterdam, Hamburg,

Naples and Oporto, and to markets where we want to consolidate

our position and grow our share, such as Switzerland and Italy.

We have recently announced new base openings in Venice and

Barcelona. Our plans for fleet expansion will help us to capitalise

on expected demand in markets that we understand.

Over time, increased route maturity and greater numbers of

frequencies have contributed to increasing profitability and returns.

We continue to establish stronger leadership positions in all of our

markets, to achieve the aim of holding the position of number

one or number two in each market. We currently have 52% of

our capacity in airports where we have the number one position

by share and 83% as one of the top two.

Progress in our main markets is as follows:

United Kingdom

easyJet is the UK’s largest short-haul airline, where we have a

20% market share(2). At year end the UK had 134 based aircraft.

We are continuing to reinforce our already strong position in the

UK market, both London-based and regional. easyJet remains the

number one carrier by market share at almost all of its UK bases,

including its major bases of London Gatwick, London Luton, Bristol,

Belfast and Edinburgh. Our positioning, market share and airport

bases are driving both leisure and business passengers. We

increased capacity by 3% in the twelve months to 30 September

2015, launching new routes such as London Gatwick to Stuttgart

and London Luton to Essaouira, while continuing to increase

frequencies on selected routes. Our competitors increased their

capacity on our markets by 9%.

France

easyJet is France’s second largest short-haul airline with a 14%

market share. At year end France had 26 based aircraft.

We see opportunities to grow our market share in France, leveraging

our competitive market position, adding capacity at Charles de

Gaulle through up-gauging and strengthening our domestic network

(we are the number one or two carrier after Air France in most of the

airports where we operate). We increased capacity in France by 6%

in the year, against competitor growth on our markets of 5%,

launching eight new routes in the year such as Toulouse to Seville

and Paris Orly to Split.

Italy

easyJet has a 12% market share in Italy. At year end Italy had

29 based aircraft.

We continue to target increasing market share in Italy, by

reinforcing our existing strong positions and investing more in the

higher value catchment areas. We are the biggest operator at Milan

Malpensa with 22 touching aircraft, have recently opened a new

base at Naples and will open a base in Venice early in 2016 (and we

are already the number one airline at both). We are supporting this

by redeploying aircraft and crew from Rome Fiumicino, which still

remains an important part of our network with an expected two

million passengers a year. During 2015 we increased capacity in

Italy by 7% launching 23 new routes in the year, including Milan

Malpensa to Munich, Milan Linate to Paris Charles de Gaulle and

Milan Linate to Amsterdam.

Switzerland

easyJet is Switzerland’s second largest airline with a 23% total

market share. At year end Switzerland had 23 based aircraft.

easyJet is the number one operator at both Geneva and Basel

airports, with the latter also part of the Zurich catchment area.

We increased capacity by 9% in the twelve months to 30

September 2015, building and reinforcing our leading positions

at both airports. As the leading airline brand in Geneva and Basel

easyJet’s strategy is to continue to build customer preference in

the market. Competitor capacity growth on our markets was

also 9%. easyJet launched eleven new routes in the year such

as Geneva to Menorca and Basel to London Luton.

Germany

easyJet has 4% market share in Germany. At the year end Germany

had 12 based aircraft.

Germany is a large and attractive market, although with a more

regional, federal structure than other European countries. easyJet

is focused on its two bases at Berlin Schoenefeld, where it is the

number one airline, and Hamburg, which opened in 2014. We target

continued growth in Germany, taking share from the incumbent

operators. We have increased capacity by 15% during the year.

Competitor growth on our markets was 6%. We launched sixteen

new routes in the year such as Hamburg to Lanzarote and

Hamburg to Paris Orly.

Portugal/Spain

easyJet has 13% market share in Portugal and 8% market share in

Spain. At year end Portugal had six based aircraft.

Portugal and Spain are principally an in-bound market for easyJet,

with strong demand on key flows to the region from the rest of

Europe. We increased capacity by 8% and 2% in Portugal and Spain

respectively, reflecting in particular the investment in a new base in

Oporto from where we launched six new routes to Luxembourg,

Nantes, Stuttgart, Manchester, Bristol and London Luton airports.

We also announced that a new base at Barcelona would be

opening in February 2016. Competitor market growth on our

markets was 10% in Portugal and 7% in Spain.

Netherlands

easyJet is the Netherlands’ second largest short-haul airline

with a 9% market share. At year end the Netherlands had three

based aircraft.

The Netherlands is a significant opportunity for easyJet, where

we currently carry four million passengers a year. In March 2015

we opened a new base at Schipol Airport, Amsterdam (where

we are now the second biggest operator) and we are continuing

to invest in growth of our market share. As a result we have

increased capacity by 17% during the year against competitor

growth on our markets of 9%. easyJet launched nine new routes

in the year, such as Amsterdam to Nice.