EasyJet 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 easyJet plc Annual report and accounts 2015

Notes to the accounts continued

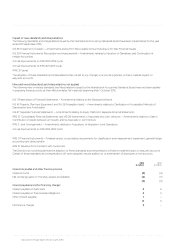

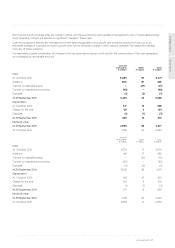

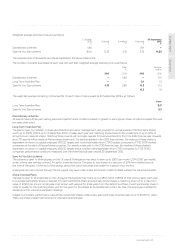

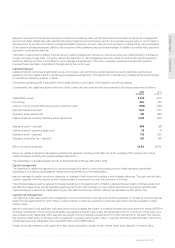

9. Property, plant and equipment continued

The net book value of aircraft includes £275 million (2014: £322 million) relating to advance and option payments for future deliveries.

This amount is not depreciated.

Aircraft with a net book value of £583 million (2014: £597 million) are mortgaged to lenders as loan security.

Aircraft with a net book value of £149 million (2014: £142 million) are held under finance leases.

easyJet is contractually committed to the acquisition of 150 (2014: 170) Airbus A320 family aircraft, with a total list price of US$13.0 billion

(2014: US$14.6 billion) before escalations and discounts for delivery in 2016 (20 aircraft), between 2017 and 2018 (30 aircraft) and between

2017 and 2022 (100 new generation aircraft).

On 16 November 2015, easyJet secured an agreement with Airbus to take delivery of an additional 36 aircraft (of which 30 are new

generation) with a total list price of $3.2 billion, based on January 2012 list prices.

The ‘other’ category mainly comprises leasehold improvements, computer hardware, and fixtures, fittings and equipment.

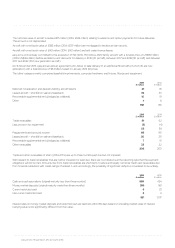

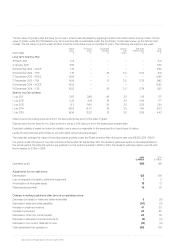

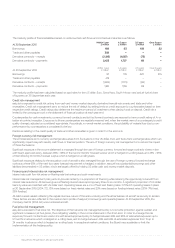

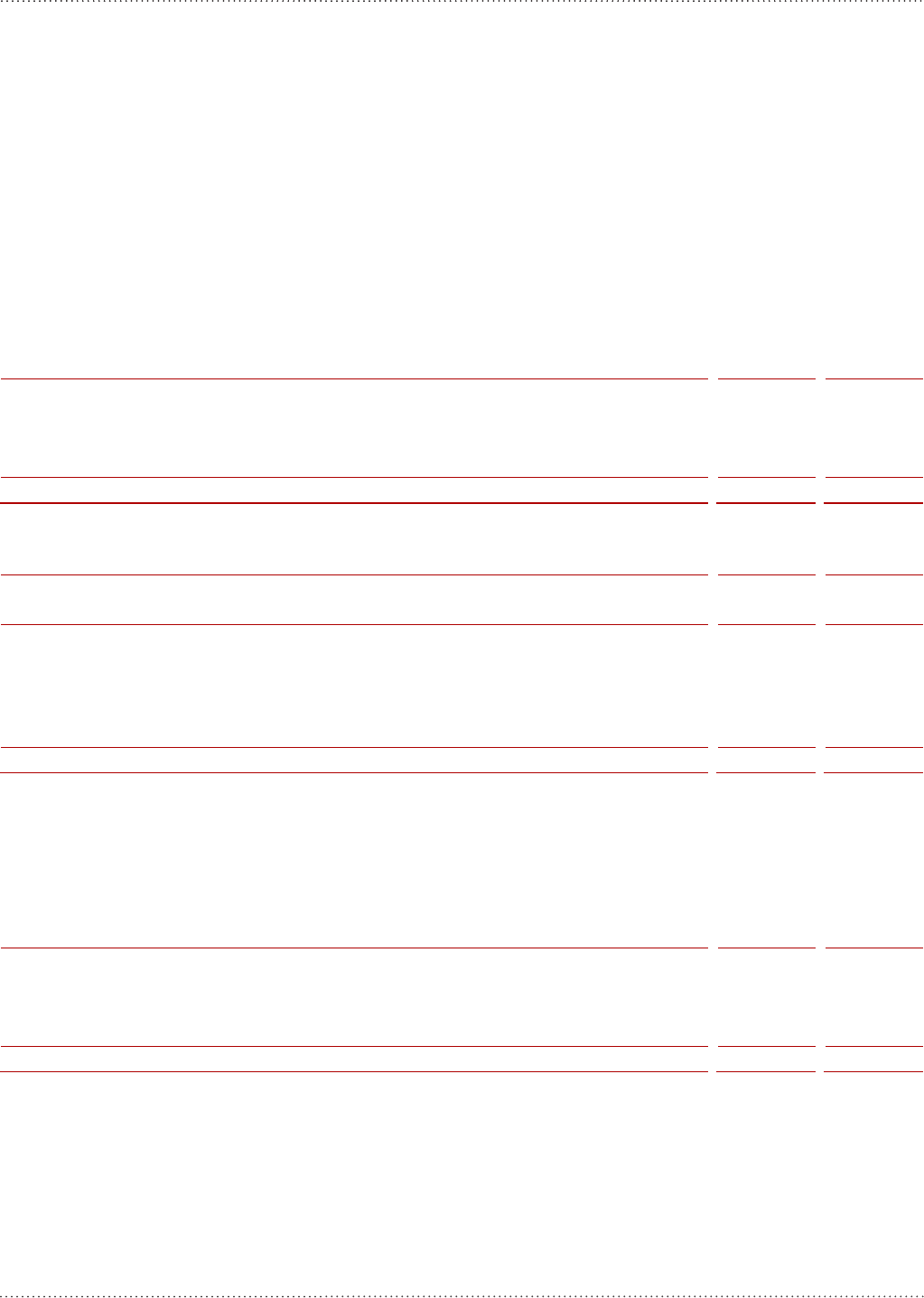

10. Other non-current assets

2015

£ million 2014

£ million

Deferred consideration and deposits held by aircraft lessors 81 76

Leased aircraft – shortfall on sale and leaseback 35 55

Recoverable supplemental rent (pledged as collateral) 10 19

Other 4 6

130 156

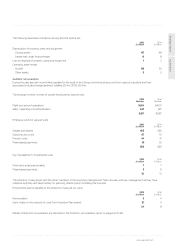

11. Trade and other receivables

2015

£ million 2014

£ million

Trade receivables 61 62

Less provision for impairment (3) (4)

58 58

Prepayments and accrued income 86 90

Leased aircraft – shortfall on sale and leaseback 20 20

Recoverable supplemental rent (pledged as collateral) 7 10

Other receivables 35 22

206 200

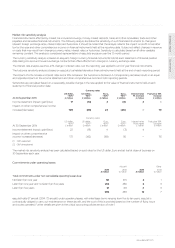

Trade and other receivables of £14m (2014: £17m) are up to three months past due but not impaired.

With respect to trade receivables that are neither impaired nor past due, there are no indications at the reporting date that the payment

obligations will not be met. Amounts due from trade receivables are short-term in nature and largely comprise credit card receivables due

from financial institutions with credit ratings of at least A and, accordingly, the possibility of significant default is considered to be unlikely.

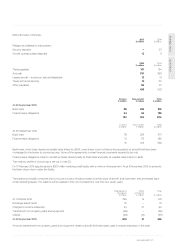

12. Cash and money market deposits

2015

£ million 2014

£ million

Cash and cash equivalents (original maturity less than three months) 650 424

Money market deposits (original maturity more than three months) 289 561

Current restricted cash 6 23

Non-current restricted cash 6 9

951 1,017

Interest rates on money market deposits and restricted cash are repriced within 185 days based on prevailing market rates of interest.

Carrying value is not significantly different from fair value.