EasyJet 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

79

www.easyJet.com

Review of past performance

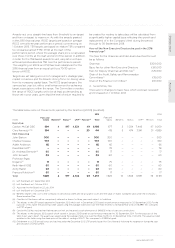

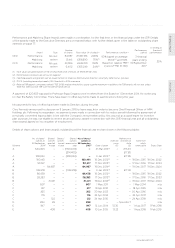

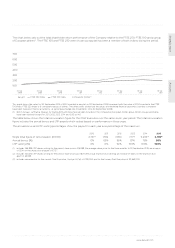

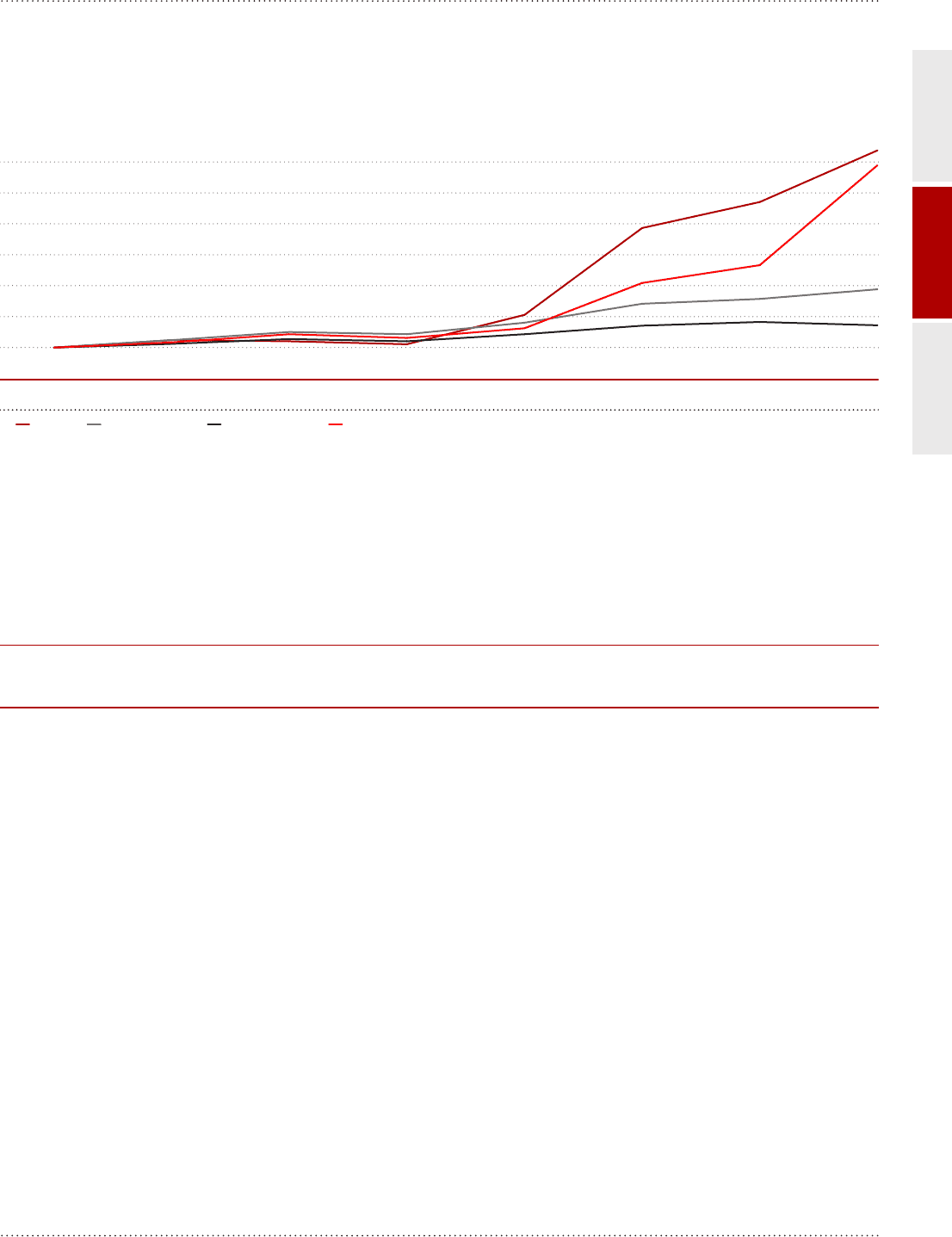

The chart below sets out the total shareholder return performance of the Company relative to the FTSE 250, FTSE 100 and a group

of European airlines(1). The FTSE 100 and FTSE 250 were chosen as easyJet has been a member of both indices during the period.

TOTAL SHAREHOLDER RETURN

VALUE (LOCAL CURRENCY)

100

30 Sep

2015

30 Sep

2014

30 Sep

2013

30 Sep

2012

30 Sep

2011

30 Sep

2010

30 Sep

2009

30 Sep

2008

easyjet FTSE 250 Index FTSE 100 Index Comparator Airlines(1)

200

300

400

500

600

700

This graph shows the value, by 30 September 2015 of £100 invested in easyJet on 30 September 2008 compared with the value of £100 invested in the FTSE

100 Index, FTSE 250 Index or a comparator group of airlines. The other points plotted are the values at intervening financial year ends (overseas companies

have been tracked in their local currency, i.e. ignoring exchange rate movements since 30 September 2008).

(1) British Airways, Lufthansa, Ryanair, Air France-KLM and Iberia have all been included in the comparative European Airlines group. British Airways and Iberia

have been tracked forward for 2011, 2012, 2013, 2014 and 2015 as IAG.

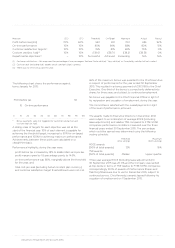

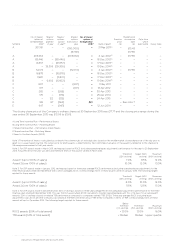

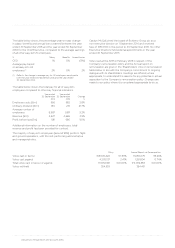

The table below shows the total remuneration figure for the Chief Executive over the same seven year period. The total remuneration

figure includes the annual bonus and LTIP awards which vested based on performance in those years.

The annual bonus and LTIP vesting percentages show the payout for each year as a percentage of the maximum.

2010 2011 2012 2013 2014 2015

Single total figure of remuneration (£’000) 2,741(3) 1,552 3,694 7,777 9,209(2) 6,198(1)

Annual bonus (%) 0% 63% 96% 87% 76% 66%

LTIP vesting (%) 0% 0% 92% 100% 100% 100%

(1) Includes 266,899 LTIP shares vesting for the period, share price is £16.988 (the average share price for the three months to 30 September 2015) an increase

of 130% on the share price at grant of £7.37.

(2) Includes 445,575 LTIP shares vesting for the period, share price was £16.71 (the actual share price at vesting) an increase of 325% on the share price at

grant of £3.928.

(3) Includes remuneration for the current Chief Executive, Carolyn McCall, of £178,000 and for the former Chief Executive of £2,563,000.