EasyJet 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

67

www.easyJet.com

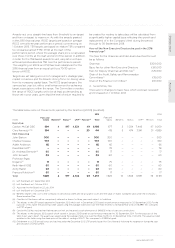

Element, purpose

and link to strategy Operation (including maximum levels where applicable)

Framework used to assess performance and provisions

for the recovery of sums paid

Annual bonus

To incentivise and

recognise execution of

the business strategy

on an annual basis.

Rewards the achievement

of annual financial and

operational goals.

Compulsory deferral

provides alignment

with shareholders.

Maximum opportunity of 200% of salary for

Chief Executive and 175% of salary for other

Executive Directors.

One-third of the bonus earned is subject to

compulsory deferral into shares (or equivalent)

in a Deferred Annual Bonus Plan (DABP),

typically for a period of three years, and is

normally subject to continued employment.

The remainder of the bonus is paid in cash.

Dividend equivalent payments may be made

(in cash or shares) under the DABP, at the time

of vesting and may assume the reinvestment

of dividends.

All bonus payments are at the discretion of

the Committee, as shown following this table.

Bonuses are based on stretching financial,

operational and, in some cases, personal/

departmental performance measures, as set and

assessed by the Committee in its discretion. Financial

measures (e.g. profit before tax) will represent the

majority of bonus, with other measures representing

the balance. A graduated scale of targets is set for

each measure, with 10% of each element being

payable for achieving the relevant threshold hurdle.

Safety underpins all of the operational activities

of the Group and the bonus plan includes provision

that enables the Remuneration Committee to scale

back the bonus earned in the event that there is a

safety event which it considers warrants the use

of such discretion.

The cash and deferred elements of bonuses are

subject to provisions which enable the Committee

to recover the cash paid (clawback) or to lapse the

associated deferred shares (malus) in the event of

a misstatement of results for the financial year to

which the bonus relates, or an error in determining

the cash bonus or the number of shares comprising

a deferred share award, within three years of the

payment of the cash bonus.

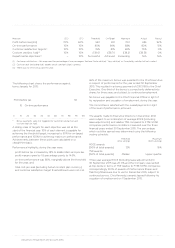

LTIP Performance Share

Award

To incentivise and

recognise execution of

the business strategy

over the longer term.

Rewards strong financial

performance and

sustained increase in

shareholder value.

Each year LTIP awards may be granted subject

to the achievement of performance targets.

Awards normally vest over a three-year period.

The maximum opportunity contained within

the plan rules for Performance Share Awards

is 250% of salary (with awards up to 300%

of salary eligible to be made in exceptional

circumstances, such as recruitment).

The normal maximum face value of annual

awards will be 250% of salary for the Chief

Executive and 200% of salary for other

Executive Directors.

A dividend equivalent provision exists which

allows the Committee to pay dividends on

vested shares (in cash or shares) at the time of

vesting and may assume the reinvestment of

dividends. A holding period applies to share

awards granted in the financial year ended

30 September 2015 and beyond. The holding

period will require the Executive Directors

to retain the after-tax value of shares for

24 months from the vesting date.

LTIP awards vest based on three-year performance

against a stretching range of financial targets and

relative TSR performance set and assessed by the

Committee in its discretion. Financial targets will

determine vesting in relation to at least 50%

of awards.

In order for the TSR portion of the award to be

earned, the Company’s absolute TSR performance

must also be positive over the performance period.

25% of each element vests for achieving the

threshold performance target with 100% of the

awards being earned for maximum performance.

(There is straight-line vesting between these points).

The LTIP includes provisions which enable the

Committee to recover value in the event of a

misstatement of results for the financial year to

which the vesting of awards related, or an error in

calculation when determining the vesting result

within three years of the vesting (i.e. clawback

provisions apply). The mechanism through which

the clawback can be implemented enables the

Committee to: (i) reduce the outstanding LTIP share

awards (i.e. malus provisions may be used to effect

a clawback), or (ii) for the Committee to require that

a net of tax balancing cash payment be made.

Share ownership

To ensure alignment

between the interests of

Executive Directors and

shareholders.

200% of salary holding required for the Chief

Executive and 175% of salary for the Chief

Financial Officer which is expected to be

reached within five years of appointment.

Executive Directors are required to retain half

of the post-tax shares vesting under the LTIP

until the guideline is met.

Not applicable.