EasyJet 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 easyJet plc Annual report and accounts 2015

Notes to the accounts continued

21. Financial instruments continued

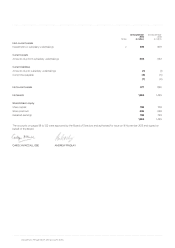

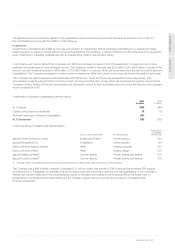

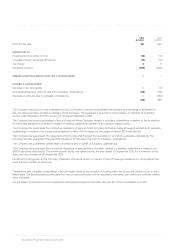

Fair value calculation methodology

Derivative financial instruments are forward contracts that are valued based on market rates and market-accepted models. Fair value for

financial instruments held at amortised cost has been estimated by discounting cash flows at prevailing interest rates and by applying year

end exchange rates.

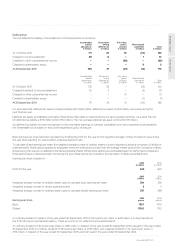

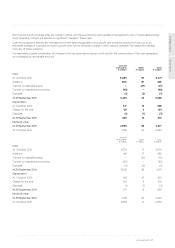

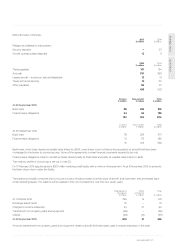

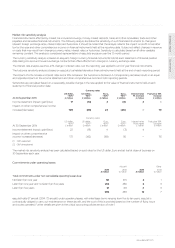

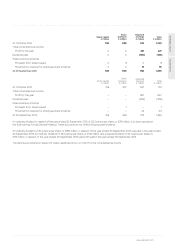

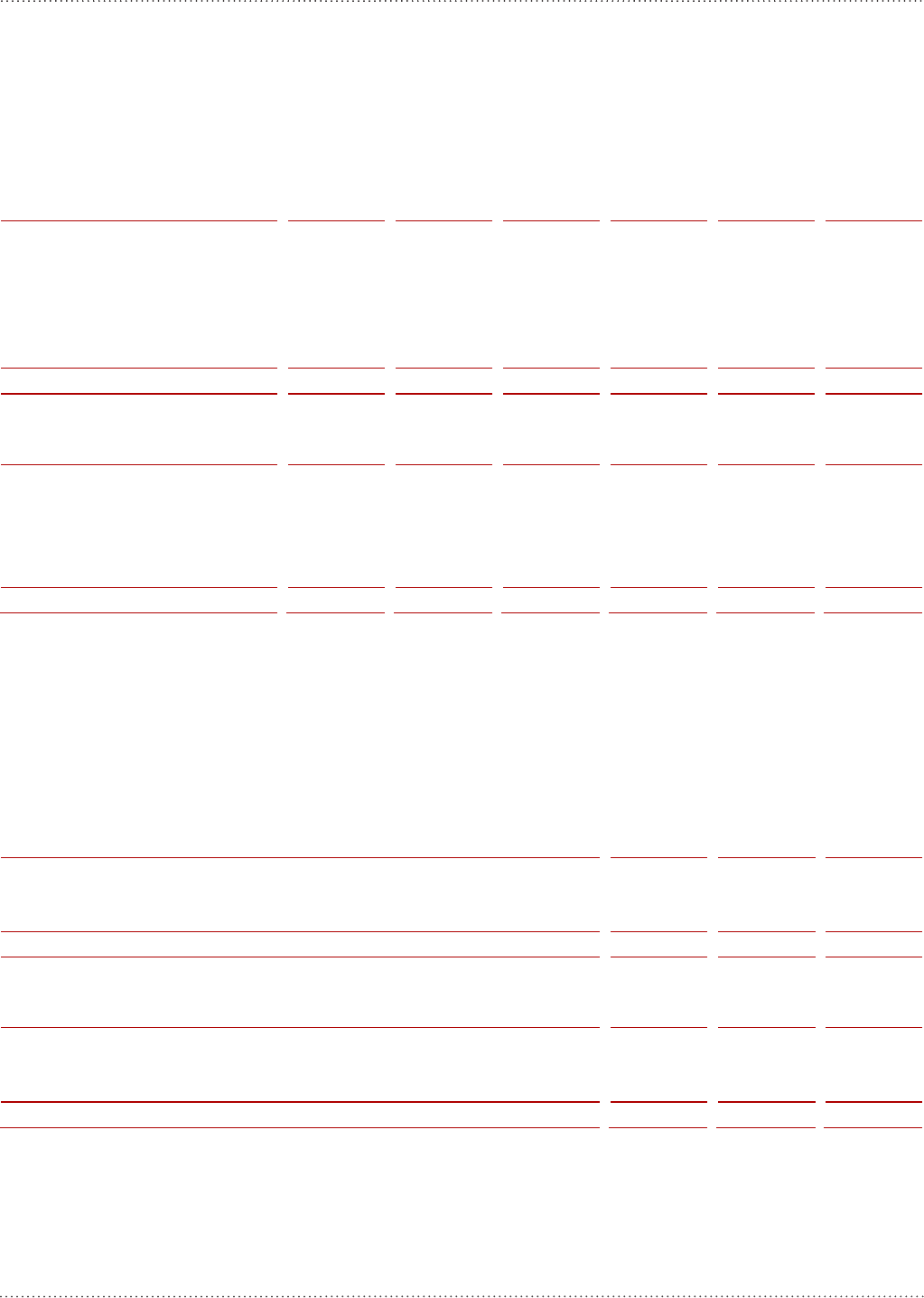

Fair value of derivative financial instruments

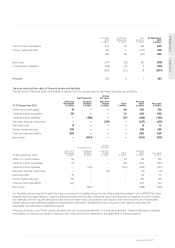

At 30 September 2015

Quantity

million

Non-current

assets

£ million

Current

assets

£ million

Current

liabilities

£ million

Non-current

liabilities

£ million

Total

£ million

Designated as cash flow hedges

US dollar 2,614 18 71 (1) (2) 86

Euro 2,360 23 55 (3) (4) 71

Swiss franc

329 2 2 (1) (1) 2

South African rand

479 – – – – –

Jet fuel 3 1 – (363) (94) (456)

44 128 (368) (101) (297)

At 30 September 2014

Quantity

million

Non-current

assets

£ million

Current

assets

£ million

Current

liabilities

£ million

Non-current

liabilities

£ million

Total

£ million

Designated as cash flow hedges

US dollar 3,358 17 8 (33) (3) (11)

Euro 990 16 39 – – 55

Swiss franc 238 3 6 – – 9

Jet fuel 3 – – (54) (20) (74)

36 53 (87) (23) (21)

For foreign currency forward exchange contracts, quantity represents the nominal value of currency contracts held, disclosed in the

contract currency. For jet fuel forward contracts, quantity represents contracted metric tonnes.

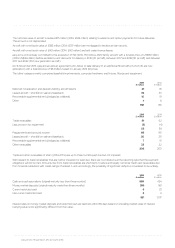

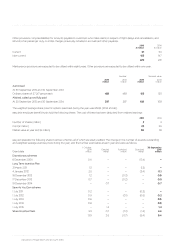

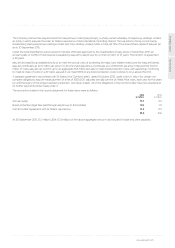

The hedged transactions are expected to occur on various dates mainly within the next two years. Accumulated gains and losses deferred

in the hedging reserve will be recognised in the income statement in the periods that the hedged transaction affects the income statement.

This will generally be within two years of the end of the reporting period save where the gain or loss is included in the initial amount

recognised for the purchase of aircraft in which case recognition will be over a period of up to 23 years in the form of depreciation of

the purchased asset.

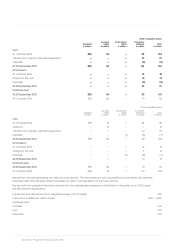

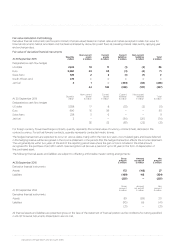

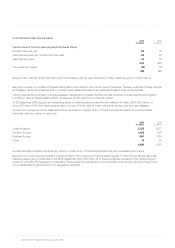

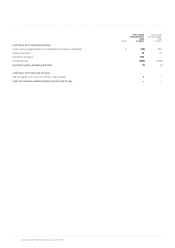

The following financial assets and liabilities are subject to offsetting, enforceable master netting arrangements:

At 30 September 2015

Gross

amount

£ million

Amount

not set off

£ million

Net

amount

£ million

Derivative financial instruments

Assets 172 (145) 27

Liabilities (469) 145 (324)

(297) – (297)

At 30 September 2014

Gross

amount

£ million

Amount

not set off

£ million

Net

amount

£ million

Derivative financial instruments

Assets 89 (69) 20

Liabilities (110) 69 (41)

(21) – (21)

All financial assets and liabilities are presented gross on the face of the statement of financial position as the conditions for netting specified

in IAS 32 ‘Financial Instruments Presentation’ are not met.