EasyJet 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 easyJet plc Annual report and accounts 2015

Notes to the accounts continued

1. Significant accounting policies continued

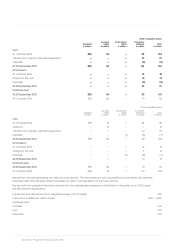

Basis of consolidation

The consolidated accounts incorporate those of easyJet plc and its subsidiaries for the years ended 30 September 2014 and 2015.

A full list of subsidiaries can be found in the notes to the Company accounts on page 121.

A subsidiary is an entity controlled by easyJet. Control is achieved when easyJet is exposed, or has rights, to variable returns from its

involvement with the investee and has the ability to affect those returns through its power, directly or indirectly, over the investee.

Intragroup balances, transactions and any unrealised gains and losses arising from intragroup transactions are eliminated in preparing the

consolidated accounts.

Foreign currencies

The primary economic environment in which a subsidiary operates determines its functional currency. The consolidated accounts of easyJet

are presented in sterling, rounded to the nearest £million, which is the Company’s functional currency and the Group’s presentation

currency. Certain subsidiaries have operations that are primarily influenced by a currency other than sterling. Exchange differences arising

on the translation of these foreign operations are taken to shareholders’ equity until all or part of the interest is sold, when the relevant

portion of the accumulated exchange gains or losses is recognised in the income statement. Profits and losses of foreign operations are

translated into sterling at average rates of exchange during the year, since this approximates the rates on the dates of the transactions.

Transactions arising in foreign currencies are recorded using the rate of exchange ruling at the date of the transaction. Monetary assets

and liabilities denominated in foreign currencies are translated into sterling using the rate of exchange ruling at the balance sheet date

and (except where the asset or liability is designated as a cash flow hedge) the gains or losses on translation are included in the income

statement. Non-monetary assets and liabilities denominated in foreign currencies are translated into sterling at foreign exchange rates

ruling at the dates the transactions were effected.

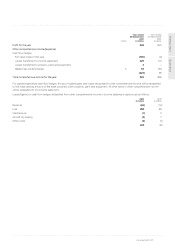

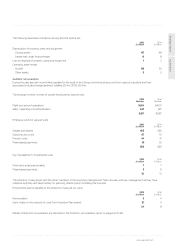

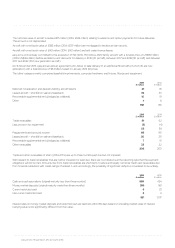

Revenue recognition

Revenue comprises seat revenue, being the value of airline services (net of air passenger duty and similar charges, VAT and discounts),

and non-seat revenue.

Seat revenue arises from the sale of flight seats, including the provision of checked baggage, allocated seating, administration, credit card

and change fees. Seat revenue is recognised when the service is provided. This is generally when the flight takes place, but in the following

cases, this is at the time of booking:

administration and credit card fees as they are contractually non-refundable; and

change fees as the service provided is that of allowing customers to change bookings.

Amounts paid by ‘no-show’ customers are recognised as seat revenue when the booked service is provided as such customers are not

generally entitled to change flights or seek refunds once a flight has departed.

Unearned revenue represents flight seats, including the provision of checked baggage and allocated seating, sold but not yet flown and

is held in the statement of financial position until it is realised in the income statement when the service is provided.

Non-seat revenue arises from commissions earned from services sold on behalf of partners and is recognised when the service is provided.

This is generally when the related flight takes place. In the case of commission earned from travel insurance, revenue is recognised at the

time of booking as easyJet acts solely as appointed representative of the insurance company.

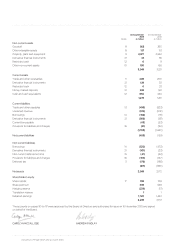

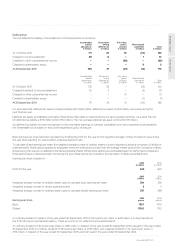

Business combinations

Business combinations in prior years were accounted for by applying the purchase method. The cost of the acquisition is measured at the

aggregate of the fair values, at the date of exchange, of assets given and liabilities incurred or assumed plus any costs directly attributable

to the business combination. The acquiree’s identifiable assets and liabilities are recognised at their fair values at the acquisition date.

There have been no business combinations since the effective date of IFRS 3 Business Combinations (Revised).

Goodwill arising on acquisition is recognised as an asset and initially measured at cost, being the excess of the cost of the business

combination over easyJet’s interest in the net fair value of the identifiable assets, liabilities and contingent liabilities recognised.

Goodwill and other intangible assets

Goodwill is stated at cost less any accumulated impairment losses. It has an indefinite expected useful life and is tested for impairment

at least annually or where there is any indication of impairment.

Landing rights are stated at cost less any accumulated impairment losses. They are considered to have an indefinite useful life as they will

remain available for use for the foreseeable future provided minimum utilisation requirements are observed, and are tested for impairment

at least annually or where there is any indication of impairment.

Other intangible assets are stated at cost less accumulated amortisation, which is calculated to write off their cost, less estimated residual

value, on a straight-line basis over their expected useful lives. Expected useful lives and residual values are reviewed annually.

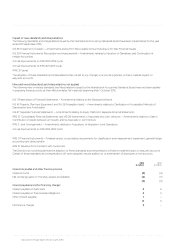

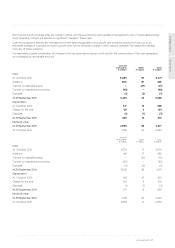

Expected useful life

Computer software 3 years

Contractual rights Over the length of the related contracts