EasyJet 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

69

www.easyJet.com

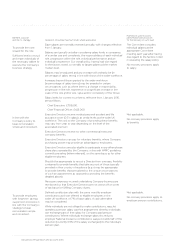

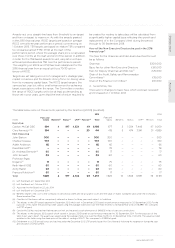

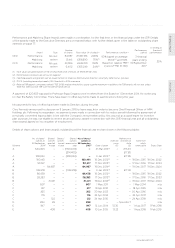

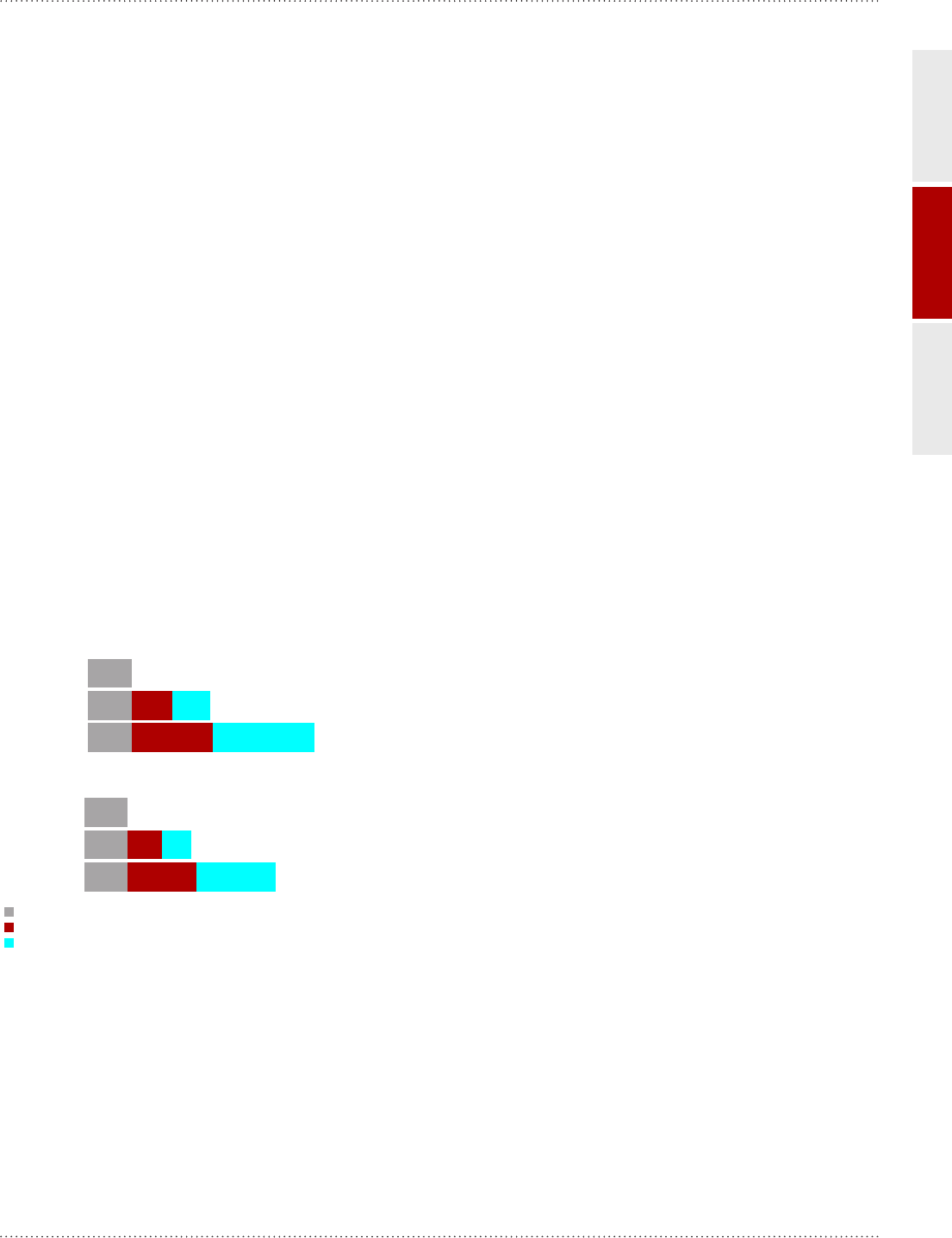

How much could the Executive Directors earn under the

remuneration policy?

A significant proportion of remuneration is linked to performance,

particularly at maximum performance levels. The charts below show

how much the Chief Executive and Chief Financial Officer could earn

under easyJet’s remuneration policy (as detailed above) under

different performance scenarios (based on their salaries as at 2

October 2015 – Chief Financial Officer’s date of joining). The following

assumptions have been made:

Minimum (performance below threshold) – Fixed pay only with

no vesting under any of easyJet’s incentive plans.

In line with expectations – Fixed pay plus a bonus at the mid-point

of the range (giving 50% of the maximum opportunity) and vesting

of 37.5% of the maximum under the LTIP.

Maximum (performance meets or exceeds maximum) – Fixed pay

plus maximum bonus and maximum vesting under the LTIP.

Fixed pay comprises:

• salaries – salary effective as at 2 October 2015;

• benefits – amount received by each Executive Director in

the 2015 financial year;

• pension – employer contributions or cash-equivalent payments

received by each Executive Director in the 2015 financial year;

and

• Free and Matching Shares under the all-employee share

incentive plan.

The scenarios do not include any share price growth or

dividend assumptions.

Below

threshold

£752,000

£2,106,000

£460,000

£1,150,000

£2,053,000

£3,896,000

In line with

expectations

Exceeds

target

Exceeds

target

Below

threshold

In line with

expectations

Fixed pay

Annual Bonus

LTIP (Performance)

100%

36%

19%

100%

40%

22%

32% 28%

36% 42%

33% 31%

45%36%

CHIEF FINANCIAL OFFICER

CHIEF EXECUTIVE

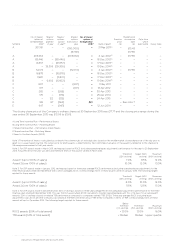

It should be noted that since the analysis above shows what

could be earned by the Executive Directors based on the

remuneration policy described above (ignoring the potential

impact of share price growth), the numbers will be different

to the values included in the table on page 73 detailing what

was actually earned by the Executive Directors in relation to

the financial year ended 30 September 2015, since these values

are based on the actual levels of performance achieved to

30 September 2015 and include the impact of share price

growth in relation to share awards.

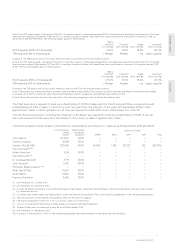

What are the Executive Directors’ terms of employment?

Under the Executive Directors’ service contracts both parties are

required to give 12 months’ notice of termination of employment.

For Executive Directors, if notice is served by either party, the

Executive Director can continue to receive basic salary, benefits

and pension for the duration of their notice period during which

time the Company may require the individual to continue to fulfil

their current duties or may assign a period of garden leave.

The policy for a new hire would be based on similar terms and

will also include the ability for easyJet to make a payment in lieu

of notice of up to 12 monthly instalments which would be

reduced if alternative employment was taken up.

Under the current Chief Executive’s contract, the Company, by

mutual consent, may elect to make a payment in lieu of notice

equivalent in value to 12 months’ basic salary, payable in monthly

instalments which would be subject to mitigation if alternative

employment is taken up during this time. Alternatively, this

payment may be paid as a lump sum. Bonus payments may be

made, payable in cash, on a pro-rata basis, but only for the

period of time served from the start of the financial year to the

date of termination and not for any period in lieu of notice. Any

bonus paid would be subject to the normal bonus targets, tested

at the end of the financial year. The current Chief Executive has

a contractual entitlement to such a pro-rated payment under

her service contract, other than in the cases of resignation or

termination resulting from gross misconduct. These provisions

do not apply to the Chief Financial Officer.

In relation to a termination of employment, the Committee

may make any statutory entitlements or payments to settle

or compromise claims in connection with a termination of

any existing or future Executive Director as necessary. The

Committee also retains the discretion to reimburse reasonable

legal expenses incurred in relation to a termination of employment

and to meet any outplacement costs if deemed necessary.

The Executive Directors’ service contracts and the Non-

Executive Directors’ letters of appointment are available for

inspection by shareholders at the Company’s registered office.

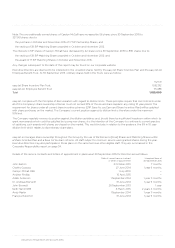

What is the policy when an Executive Director leaves or there

is a takeover?

The rules of both schemes (LTIP and Deferred Annual Bonus

Plan) set out what happens to awards if a participant ceases

to be an employee or Director of easyJet before the end of the

vesting period. Generally, any outstanding share awards will lapse

on such cessation, except in certain circumstances.

If an Executive Director ceases to be an employee or Director

of easyJet as a result of death, injury, retirement, the sale of the

business or company that employs the individual, or any other

reason at the discretion of the Committee, then they will be

treated as a ‘good leaver’ under the relevant plan’s rules. Under

the Deferred Annual Bonus Plan, the shares for a good leaver will

normally vest in full on the normal vesting date (or on cessation

of employment in the case of death) and if the award is in the

form of an option, there is a 12-month window in which the

award can be exercised. Awards structured as options which

have vested prior to cessation can be exercised within 12 months

of cessation of office or employment.