EasyJet 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

99

www.easyJet.com

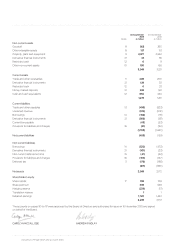

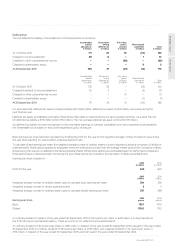

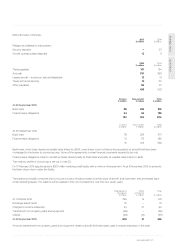

Deferred tax liabilities represent the amount of income taxes payable in future periods in respect of taxable temporary differences.

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities

and it is the intention to settle these on a net basis.

Aircraft maintenance provisions

The accounting for the cost of providing major airframe and certain engine maintenance checks for owned and finance-leased aircraft is

described in the accounting policy for property, plant and equipment.

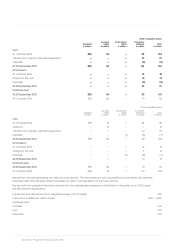

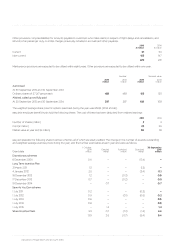

easyJet has contractual obligations to maintain aircraft held under operating leases. Provisions are created over the term of the lease based

on the estimated future costs of major airframe checks, engine shop visits and end of lease liabilities. These costs are discounted to present

value where the amount of the discount is considered material.

Where an aircraft is sold and leased back, other than when first delivered to easyJet, a liability to undertake future maintenance activities,

resulting from past flying activity, arises at the point the lease agreement is signed. This liability is treated as part of the surplus or shortfall

arising on the sale and leaseback, the accounting treatment of which is described in the leases accounting policy.

A number of leases also require easyJet to pay recoverable supplemental rent to the lessor. The purpose of these payments is to provide

the lessor with collateral should an aircraft be returned in a condition that does not meet the requirements of the lease. This recoverable

supplemental rent is included in trade and other receivables within current assets and other non-current assets, as applicable, and is

refunded when qualifying heavy maintenance is performed, or is offset against the costs incurred at the end of the lease.

Employee benefits

easyJet contributes to defined contribution pension schemes for the benefit of employees. easyJet has no further payment obligations

once the contributions have been paid. The assets of the schemes are held separately from those of easyJet in independently administered

funds. easyJet’s contributions are charged to the income statement in the year in which they are incurred.

The expected cost of compensated holidays is recognised at the time that the related employees’ services are provided.

Share capital and dividend distribution

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new ordinary shares or options are shown in

equity as a deduction, net of tax, from the proceeds.

Where any Group company or employee benefit trust purchases the Company’s equity shares, the consideration paid and any directly

attributable incremental costs are deducted from retained earnings until the shares are cancelled or reissued. Proceeds from re-issue are

shown as a credit to retained earnings.

easyJet settles share awards under the Long Term Incentive Plan, the Save As You Earn scheme and the Share Incentive Plans by

purchasing its own shares on the market through employee benefit trusts. The cost of such purchases is deducted from retained earnings

in the period that the transaction occurs.

Dividend distributions to the Company’s shareholders are recognised as a liability in the period in which the dividends are approved by the

Company’s shareholders.

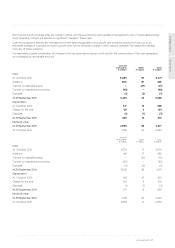

Share-based payments

easyJet has a number of equity-settled share incentive schemes. The fair value of share options granted under the Save As You Earn

scheme is measured at the date of grant using the Binomial Lattice option pricing model. The fair value of grants under the Long Term

Incentive Plan is measured at the date of grant using the Black-Scholes model for awards based on ROCE performance targets, and the

Stochastic model (also known as the Monte Carlo model) for awards based on TSR performance targets. The fair value of all other awards

is the share price at the date of grant.

The fair value of the estimated number of options and awards that are expected to vest is expensed to the income statement on a

straight-line basis over the period that employees’ services are rendered, with a corresponding increase in shareholders’ equity. Where non-

market performance criteria (such as ROCE) attached to the share options and awards are not met, any cumulative expense previously

recognised is reversed. For awards with market-related performance criteria (such as TSR), an expense is recognised irrespective of whether

the market condition is satisfied.

The social security obligations payable in connection with grant of the share options are an integral part of the grant itself and the charge is

treated as a cash-settled transaction.

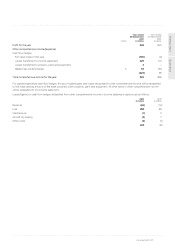

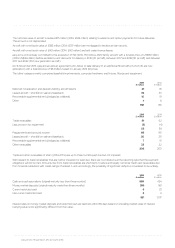

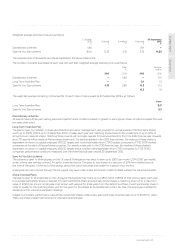

Segmental disclosures

easyJet has one operating segment, being its route network, based on management information provided to the Executive Management

Team, which is easyJet’s Chief Operating Decision Maker. Resource allocation decisions are made for the benefit of the route network as a

whole, rather than for individual routes within the network. Performance of the network is assessed based on the consolidated profit or loss

before tax for the year.

Revenue is allocated to geographic segments on the following bases:

revenue earned from passengers is allocated according to the location of the first departure airport on each booking; and

commission revenue earned from partners is allocated according to the domicile of each partner.