EasyJet 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 easyJet plc Annual report and accounts 2015

Directors’ remuneration report

Annual statement by the

chair of the remuneration committee

CHARLES GURASSA,

CHAIR OF THE REMUNERATION COMMITTEE

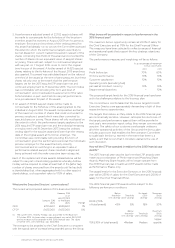

Performance of the Group in the 2015 financial year

easyJet has continued to deliver sustainable returns and growth

for its shareholders. The key highlights are as follows:

• profit before tax up by 18% to £686 million;

• 1.7 percentage point growth in return on capital employed

(ROCE) (including lease adjustments) from 20.5% in 2014 to

22.2% in 2015;

• increased ordinary dividend with a proposed ordinary dividend

of 55.2 pence per share;

• on-time performance was 80%, marginally above the threshold

for the year; and

• total cost per seat (excluding fuel at constant currency) and

customer satisfaction outcomes for the year were below

bonus thresholds for the year.

Aligning remuneration policy with Company principles

Simple and cost-effective approach – In line with our low-cost

and efficient business model, the Committee has chosen to

set a simple pay package against the market. For example, our

Executive Directors do not receive the Executive benefits that

can be found in most organisations (see page 66).

Support the stated business strategy of growth and returns –

Performance is assessed against a range of financial, operational

and longer-term targets ensuring value is delivered to shareholders,

and Directors are rewarded for the successful delivery of the key

strategic objectives of the Company.

Pay for performance – Remuneration is heavily weighted towards

variable pay, dependent on performance. This ensures that there

is a clear link between the value created for shareholders and the

amount paid to our Executive Directors.

Key pay outcomes in respect of the 2015 financial year – Annual

bonuses are based on profit before tax and key operational and

financial targets. A bonus of 66% of the maximum was awarded

to the Chief Executive in respect of the 2015 financial year. This

reflects the strong results the Group has achieved. One-third of

the bonus earned is subject to compulsory deferral for three

years. In light of the resignation during the year of Chris Kennedy,

the Chief Financial Officer, he is not eligible to receive a bonus

award in respect of the 2015 financial year.

Under the Long Term Incentive Plan (LTIP), Performance Share

Awards made in December 2012 are due to vest in December

2015. These awards are based on a combination of average

ROCE performance (including lease adjustments) and relative

total shareholder return (TSR) compared to FTSE 51-150

companies for the three financial years ended 30 September

2015. The Group achieved average ROCE performance (including

lease adjustments) of 20.0%, and the Company was ranked in the

top decile in terms of TSR relative to FTSE 51-150 companies,

reflecting exceptional performance over the period. This level of

performance, reflecting a return of 236% for investment in easyJet

shares, resulted in 100% of the awards vesting successfully,

subject to continued employment to the vesting date.

Remuneration policy for the 2016 financial year

The Company’s remuneration policy was approved by

shareholders at last year’s AGM in February 2015 and the current

intention is that it will apply until the 2018 AGM. As such, we will

not be asking shareholders to vote on the policy at the 2016

AGM. In reviewing the policy last year, one key conclusion of

the Committee was that the Company’s remuneration policy

should continue to be aligned with easyJet’s principles and the

Committee is of the view that this remains the case. In line

with our principles, and taking full account of the ‘best practice’

expectations of investors, we took the opportunity of simplifying

our arrangements and 2015 was therefore the last time that we

made Matching Share Awards under the LTIP. From 2016, awards

will be made as Performance Shares only. The Committee

remains confident that the policy is appropriate and that it

satisfies our objective to operate a remuneration structure which

successfully promotes the long-term success of the Company.

The Committee has further reviewed the LTIP and has recalibrated

the targets in line with the current key strategic focus and

projected additional capital expenditure within the business. This

has led to a rebalancing of the current performance metric from

an equal split of ROCE and relative TSR to a condition based 70%

on ROCE and 30% on TSR. The target range continues to be set

taking into account internal projections and external views. The

range is the same as last year with a small enhancement to pay

out on achieving target expectations. This has been the subject

of consultation with the Company’s major shareholders and the

leading shareholder advisory bodies. The Committee believe

these to be appropriate and demanding targets.

In summary, our relatively straightforward remuneration consists

of a base salary, pension contribution of 7%, benefit provision

and, subject to stretching performance conditions, an annual

bonus plan, part paid in cash and part deferred into shares,

and shares awarded under an LTIP. Incentive pay is subject to

clawback provisions, a post-vesting holding period operates for

LTIP awards and significant share ownership guidelines apply.

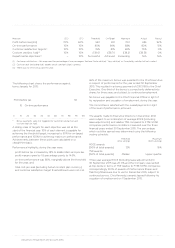

The basic salary of the Chief Executive increased by 1%, in line

with the typical rate of increase being awarded across the

Group. The increase will be effective from 1 January 2016.

Changes to the Board

We announced in January 2015 that our CFO, Chris Kennedy,

would be leaving to take up another role. Chris subsequently

stepped down from the Board and left the Company on 1

September 2015. We are delighted that Andrew Findlay has

joined us as CFO from 2 October 2015.

Chris Kennedy worked the majority of his notice period and will

not receive any payment in lieu of the balance of his notice

period after leaving the Company. In line with the Company’s

remuneration policy, following his resignation, Chris was not

eligible to receive a bonus for the 2015 financial year. Under

the rules of the LTIP, any unvested LTIP awards after the date

of departure lapsed, and all benefits also ceased.