EasyJet 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

111

www.easyJet.com

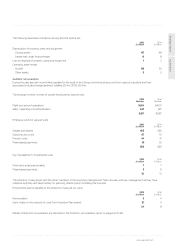

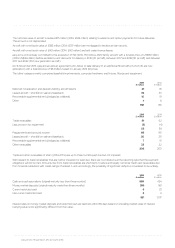

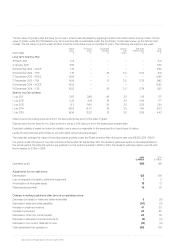

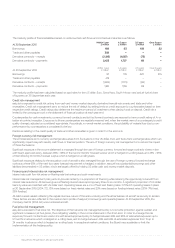

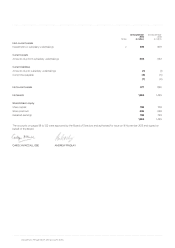

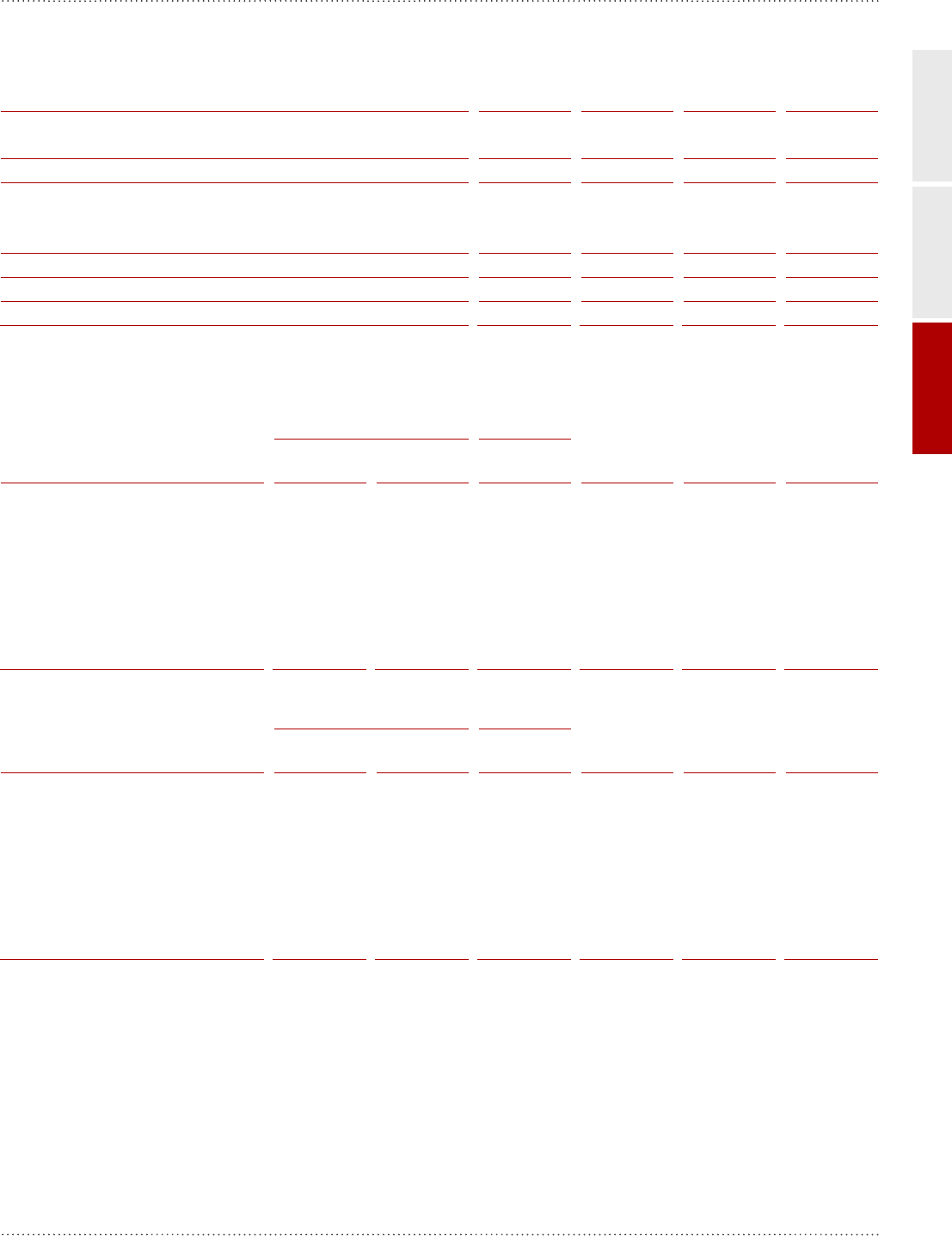

20. Reconciliation of net cash flow to movement in net cash

1 October

2014

£ million

Exchange

differences

£ million

Net

cash flow

£ million

30 September

2015

£ million

Cash and cash equivalents 424 33 193 650

Money market deposits 561 5 (277) 289

985 38 (84) 939

Bank loans (377) (19) 80 (316)

Finance lease obligations (186) (13) 11 (188)

(563) (32) 91 (504)

Net cash 422 6 7 435

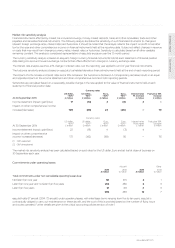

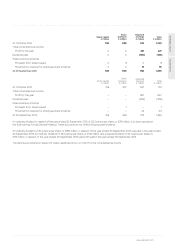

21. Financial instruments

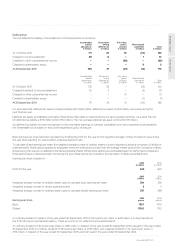

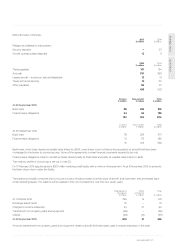

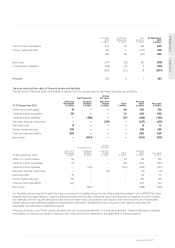

Carrying value and fair value of financial assets and liabilities

The fair values of financial assets and liabilities, together with the carrying value at each reporting date, are as follows:

Amortised cost

Held at

fair value

At 30 September 2015

Loans and

receivables

£ million

Financial

liabilities

£ million

Cash flow

hedges

£ million

Other

£ million

Carrying

value

£ million

Fair value

£ million

Other non-current assets 91 – – 39 130 130

Trade and other receivables 136 – – 70 206 206

Trade and other payables – (398) – (97) (495) (495)

Derivative financial instruments – – (297) – (297) (297)

Restricted cash 12 – – – 12 12

Money market deposits 289 – – – 289 289

Cash and cash equivalents 650 – – – 650 650

Borrowings – (504) – – (504) (510)

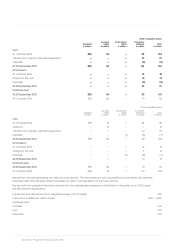

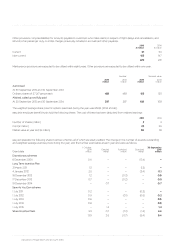

Amortised cost

Held at

fair value

At 30 September 2014

Loans and

receivables

£ million

Financial

liabilities

£ million

Cash flow

hedges

£ million

Other

£ million

Carrying

value

£ million

Fair value

£ million

Other non-current assets 99 – – 57 156 156

Trade and other receivables 112 – – 88 200 200

Trade and other payables – (419) – (104) (523) (523)

Derivative financial instruments – – (21) – (21) (21)

Restricted cash 32 – – – 32 32

Money market deposits 561 – – – 561 561

Cash and cash equivalents 424 – – – 424 424

Borrowings – (563) – – (563) (568)

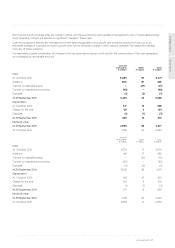

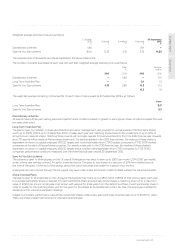

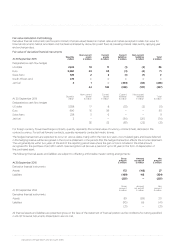

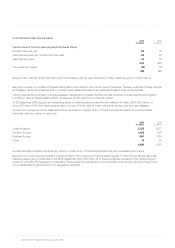

For the financial instruments for which fair value is disclosed in the tables above, the fair value is classified as level 2 of the IFRS13 ‘Fair Value

Measurement’ fair value hierarchy. Level 2 is defined as being the fair value of financial instruments that are not traded in an active market

(for example, over-the-counter derivatives) and which are determined using valuation techniques which maximise the use of observable

market data and rely as little as possible on entity-specific estimates. If all significant inputs required to fair value an instrument are

observable, the instrument is classified as level 2.

Amounts disclosed in the ‘Other’ column are items that do not meet the definition of a financial instrument. They are disclosed to facilitate

reconciliation of the carrying values of financial instruments to line items presented in the statement of financial position.