EasyJet 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

103

www.easyJet.com

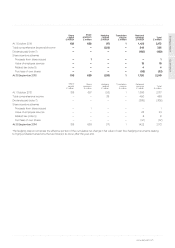

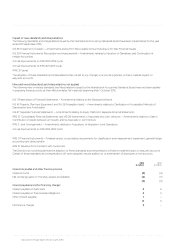

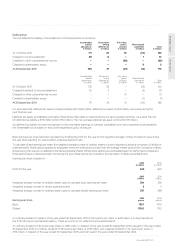

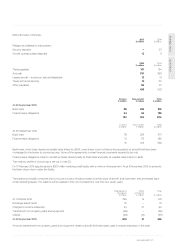

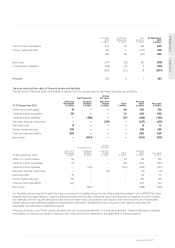

Deferred tax

The net deferred tax liability in the statement of financial position is as follows:

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains/

(losses)

£ million

Share-based

payments

£ million Total

£ million

At 1 October 2014 171 29 10 (24) 186

Charged to income statement 28 8 – 1 37

Credited to other comprehensive income – – (56) – (56)

Charged to shareholders’ equity – – – 9 9

At 30 September 2015 199 37 (46) (14) 176

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains/

(losses)

£ million

Share-based

payments

£ million Total

£ million

At 1 October 2013 139 26 – (21) 144

Charged/(credited) to income statement 32 3 – (2) 33

Charged to other comprehensive income – – 10 – 10

Credited to shareholders’ equity – – – (1) (1)

At 30 September 2014 171 29 10 (24) 186

It is estimated that deferred tax assets of approximately £50 million (2014: deferred tax assets of £24 million) will reverse during the

next financial year.

Deferred tax assets and liabilities have been offset where they relate to taxes levied by the same taxation authority. As a result the net

UK deferred tax liability is £176 million (2014: £194 million). The net overseas deferred tax asset is £nil (2014: £8 million).

No deferred tax liability has been recognised on the unremitted earnings of overseas subsidiaries as no tax is expected to be payable in

the foreseeable future based on the current repatriation policy of easyJet.

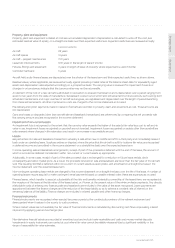

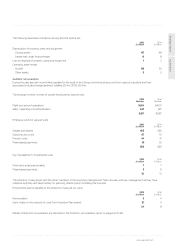

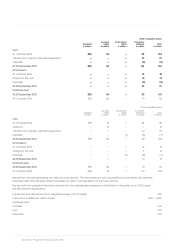

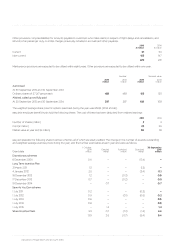

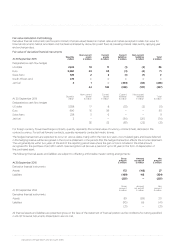

6. Earnings per share

Basic earnings per share has been calculated by dividing the profit for the year by the weighted average number of shares in issue during

the year after adjusting for shares held in employee benefit trusts.

To calculate diluted earnings per share, the weighted average number of ordinary shares in issue is adjusted to assume conversion of all dilutive

potential shares. Share options granted to employees where the exercise price is less than the average market price of the Company’s ordinary

shares during the year are considered to be dilutive potential shares. Where share options are exercisable based on performance criteria and

those performance criteria have been met during the year, these options are included in the calculation of dilutive potential shares.

Earnings per share is based on:

2015

£ million 2014

£ million

Profit for the year 548 450

2015

million 2014

million

Weighted average number of ordinary shares used to calculate basic earnings per share 394 393

Weighted average number of dilutive potential shares 3 5

Weighted average number of ordinary shares used to calculate diluted earnings per share 397 398

Earnings per share 2015

pence 2014

pence

Basic 139.1 114.5

Diluted 138.0 113.2

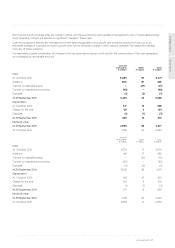

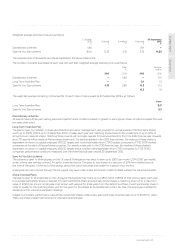

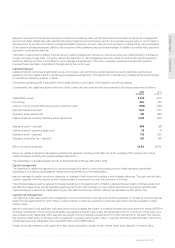

7. Dividends

An ordinary dividend in respect of the year ended 30 September 2015 of 55.2 pence per share, or £219 million, is to be proposed at

the forthcoming Annual General Meeting. These accounts do not reflect this proposed dividend.

An ordinary dividend of 45.4 pence per share, or £180 million, in respect of the year ended 30 September 2014 was paid in the year ended

30 September 2015. An ordinary dividend of 33.5 pence per share, or £133 million, and a special dividend of 44.1 pence per share, or

£175 million, in respect of the year ended 30 September 2013 were both paid in the year ended 30 September 2014.