EasyJet 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 easyJet plc Annual report and accounts 2015

Chief Executive’s review continued

EXTERNAL ENVIRONMENT

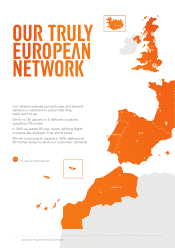

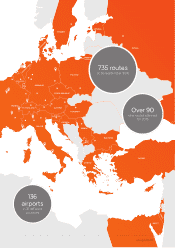

easyJet operates in the short-haul European aviation market,

which has seen strong underlying demand throughout the year.

easyJet’s focus is primarily in Western and Northern Europe,

where there is a high propensity to travel and deep, rich markets.

Economic trends are currently favourable, with GDP growth in

our main markets. The UK is the strongest country in terms

of absolute GDP performance in 2015 and we continue to see

an improving outlook across all of our other major regions. In

addition, consumer confidence is growing in those markets,

which we expect to support growth in economic activity.

These positive trends, combined with our market positioning,

are reflected in strong demand for our services.

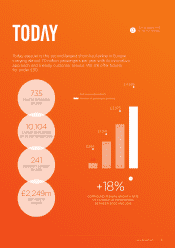

The total European short-haul market(2) grew by 5% year-on-year

in the 12 months to 30 September 2015, sustained in part by a

continued low fuel price. Low cost carrier share of the short-haul

market increased by around one percentage point to 42%. In the

same period, easyJet’s competitors increased capacity by 7%

in its markets, with particularly strong growth in the UK market.

Over its financial year, easyJet increased capacity by 5%, with

growth of 4% in the first half increasing to 6% in the second half.

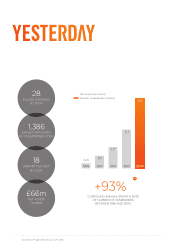

Whilst the overall short-haul market has grown over the last 10

years, the low-cost carriers have taken significant market share,

as the legacy carriers have cut mainline capacity across their

networks in order to address their lack of competitiveness.

At the same time the legacy carriers are transferring capacity

from their flag airlines to lower-cost subsidiaries such as Vueling,

Eurowings and Transavia. In its 20 years of existence, easyJet has

grown its own market share as part of that low cost growth and

now has an estimated 8% of the European short-haul market.

We see a number of opportunities to increase our market share.

easyJet has delivered a strong performance against this

competitive backdrop, demonstrating the strength of its model

and implementation of its strategy. With a track record of high

growth across economic cycles, strong underlying demand,

as well as our relatively low current market share, we continue to

see opportunities to deliver further growth over the medium term.

Our strategy

1.

BUILD STRONG

NUMBER ONE AND

TWO NETWORK

POSITIONS

5.

CULTURE,

PEOPLE AND

PLATFORM

2.

DRIVE DEMAND,

CONVERSION

AND YIELDS

4.

DISCIPLINED

USE OF

CAPITAL

3.

MAINTAIN

COST

ADVANTAGE

S

A

F

E

T

Y

S

A

F

E

T

Y

S

A

F

E

T

Y

S

A

F

E

T

Y

easyJet is confident that through its strategy it will deliver

sustainable growth and returns for shareholders.

(2) Capacity and market share figures from OAG. Size of European market based on internal easyJet definition. Historical data based on 12 month period

from October 2014 to September 2015.