EasyJet 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

21

www.easyJet.com

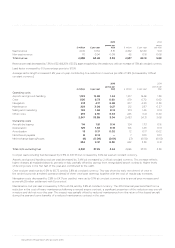

Other costs per seat increased by 8.2% to £3.70 per seat, and by 9.6% at constant currency. There were increased disruption costs

during the year due to the French ATC strikes in April and the two fires at Rome Fiumicino airport. Investment in the development

of our digital customer proposition also contributed to the increased cost per seat.

Aircraft dry leasing cost per seat fell by 12.6% to £1.51 and by 9.7% at constant currency due to the return of five leased aircraft

during the year and the extension of 12 aircraft leases at lower monthly rentals.

Depreciation costs have increased by 11.8% on a per seat basis. The increase is principally driven by the acquisition of 20 new

A320 aircraft, which increased the average number of owned fleet by 9.7% from 150 in 2014 to 164 in 2015.

Fuel

2015 2014

£ million £ per seat

pence per

ASK £ million £ per seat

pence per

ASK

Fuel 1,199 15.98 1.43 1,251 17.49 1.57

Fuel cost per seat decreased by 8.6% and by 9.1% at constant currency.

During the period the average market Jet fuel price fell by 36.4% to $619 per tonne from $973 per tonne in the previous year.

The operation of easyJet’s fuel hedging policy meant that the average effective fuel price movement only saw a decrease of

10.7% to $872 per tonne from $977 per tonne in the previous year.

Cost per seat including fuel decreased by 3.4% to £53.33 and decreased by 0.4% per seat at constant currency.

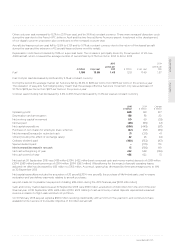

NET CASH AND FINANCIAL POSITION

Summary net cash reconciliation

2015

£ million

2014

£ million

Change

£ million

Operating profit 688 581 107

Depreciation and amortisation 138 118 20

Net working capital movement 50 69 (19)

Net tax paid (98) (96) (2)

Net capital expenditure (536) (449) (87)

Purchase of own shares for employee share schemes (92) (57) (35)

Net decrease/(increase) in restricted cash 21 (20) 41

Other (including the effect of exchange rates) 22 26 (4)

Ordinary dividend paid (180) (133) (47)

Special dividend paid –(175) 175

Net increase/(decrease) in net cash 13 (136) 149

Net cash at beginning of year 422 558 (136)

Net cash at end of year 435 422 13

Net cash at 30 September 2015 was £435 million (2014: £422 million) and comprised cash and money market deposits of £939 million

(2014: £985 million) and borrowings of £504 million (2014: £563 million). After allowing for the impact of aircraft operating leases,

adjusted net debt has decreased by £83 million to £363 million. As a result, gearing has decreased by three percentage points to 14%

at 30 September 2015.

Net capital expenditure includes the acquisition of 20 aircraft (2014: nine aircraft), the purchase of life-limited parts used in engine

restoration and pre-delivery payments relating to aircraft purchases.

easyJet made net corporation tax payments totalling £98 million during the 2015 financial year (2014: £96 million).

Cash and money market deposits as at 30 September 2015 were £939 million, a reduction of £46 million from the end of the prior

financial year. At 30 September 2015, £619 million (2014: £572 million) of cash and money market deposits represented unearned

revenue in relation to flight seats sold but not yet flown.

On 10 February 2015 easyJet signed a $500 million revolving credit facility with a minimum five-year term, and continues to have

available funds in excess of its liquidity objective of £4 million per aircraft.